Oracle's customers a bit baffled by Fusion strategy, says report

Oracle customers are generally confused by the company's strategy for Fusion applications, see no strong business reasons to upgrade and are taking advantage of an "Applications Unlimited" program from 2006 to stay put for an indefinite period of time, according to a report from Forrester Research.

Forrester's advice for IT buyers:

- Stay put, but make sure you have Fusion-compatible middleware.

- Adopt a few Fusion modules to try out with existing applications.

- Decouple some applications and move them to another SaaS vendor.

Forrester's report noted:

Despite Oracle’s extensive marketing efforts, our survey results and our daily inquiries with Oracle customers suggest that Oracle’s strategy and road map for Oracle Fusion Applications isn’t getting through. Encouraged to provide multiple responses to why their firm doesn’t plan to use Oracle Fusion Applications, 60% of survey respondents said that Oracle’s app strategy was unclear, 54% said Oracle Fusion Applications weren’t mature enough, 36% cited high licensing costs, and 30% said Oracle lacks good customer references for Oracle Fusion Applications. When asked if Oracle had presented their firms with a credible plan to transition to Oracle Fusion Applications, 60% of our respondents said no, 4% said yes, 17% said they didn’t know, and 19% said they don’t plan to transition to Oracle Fusion Applications.

That confusion over Fusion is the crux of Forrester's argument that Oracle will have trouble growing application revenue. To wit:

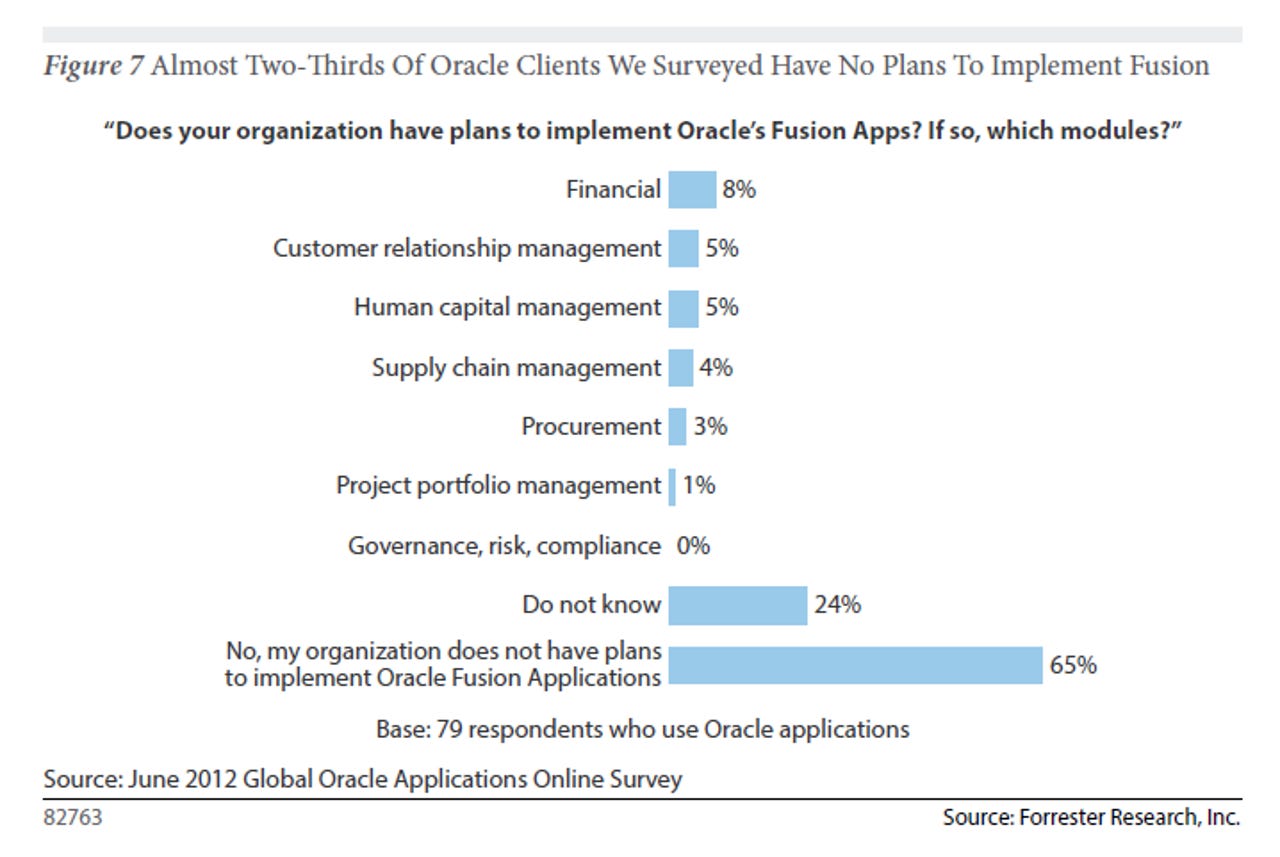

- 65 percent of Oracle customers in a survey with 79 respondents indicated they had no plans to upgrade to Fusion.

- The company's application revenues have hit weak spots over the last two years for various reasons, but the weakness has been masked by acquisitions. The bottom line is that Oracle will need to jump start Fusion demand to restore application sales. What's next for Oracle? "The current middle path of talking about Fusion while providing no disincentives against clients staying on existing apps will lead to mediocre growth. Our bet is that Oracle will push Oracle Fusion Applications," said Forrester's band of analysts.

- Oracle's decision to offer Applications Unlimited, a program that allows customers to upgrade software running on their timelines, was a good decision in 2006 because it reassured customers. Today, that program means that few customers are on the Fusion upgrade bandwagon.

- Oracle isn't seeing mass defections, but faces little upgrade enthusiasm. As a result, application growth is hampered going forward (unless it's masked by acquisitions).

- Customers are generally confused by Oracle's Fusion strategy.

Here are my takeaways from the report and a few thoughts for IT buyers:

- Oracle is likely to blast the Forrester report due to its sample size. I'd argue the surveys based on more than 100 respondents in the report are valuable.

- The argument that Applications Unlimited hampers Fusion adoption makes a lot of sense. However, Oracle's game plan isn't necessarily to sell you a lot of applications as much as it is to collect the maintenance revenue. In that revenue model, customers staying put aren’t so bad.

- Fifty three percent of 114 respondents in the Oracle survey used PeopleSoft followed by 45 percent with Hyperion, 41 percent with E-Business Suite and 39 percent with Oracle Siebel. We know all about Salesforce.com's business and how it was practically built on Siebel defections. The PeopleSoft percentage, however, indicates how Workday is so critical to the human capital management market. If Workday swoops in when PeopleSoft customers are eyeing Fusion or software as a service, Oracle's life gets much harder. Oracle is savvy though---it bought Taleo and has its own cloud plays. And by the way SAP bought SuccessFactors too.

- The end game for Oracle's application revenue growth is closer than we think. Don't dismiss Forrester's take that Oracle will step up its Fusion sales approach in attempt to push upgrades. That outcome, which is likely at some point, will accelerate customers' decision to move to Fusion or another vendor entirely.