Sage on the road to nowhere

The last few days, my accounting buddies have been all a-Twitter about Sage Software's plans to take the company forward. Prior to the investor day, I posited that whatever those plans may be, its fundamental issue lies in the boardroom. I said:

The real problem lies in the boardroom. When Paul Walker stepped down as CEO, the company had a golden opportunity to usher in a fresh set of eyes. Instead, it opted for a more refined version of what went before. How that decision was reached remains a mystery but you can bet that institutional investors didn't have faith in the management team to make radical changes. You can also bet that the existing management didn't have the stomach or vision to make change.

Now it is becoming apparent that its core European markets are vulnerable, Sage is once again trying to buy its way out of trouble. This time in Brazil with a £125 majority stake in that SME market. It is at best a stop gap.

If the powerful institutional investors were prepared to step back and see how Sage could once again find sustainable growth – and that has to come via a change in the business model – then it is conceivable that Sage could once again become relevant. Acquisition will not do it now or in the long term.

Nothing I saw in the presentations (UPDATE: webcasts have been pulled from the Sage site) leads me to substantially change that view.

Sage has been bumping along for a number of years, at times struggling to make its Emdeon acquisition pay its way, at other times appearing to have a management team that was standing next to a revolving door and at yet other times having no discernible cloud strategy. The current management team hopes to fix all those problems but it is hard to see how that can work without considerable pain along the way. Guy Berruyer, CEO said as much in his opening remarks, noting that 'more of the same [past strategies] will not deliver' on the company's mid term growth target of plus 6%. The fact Sage is targeting such modest growth rates should send alarm bells to both customers and investors. Why?

Sage has spent the last 20 plus years growing by acquisition. Most of those acquisitions have been in relatively mature markets. Over time, Sage could exercise its group financial and marketing muscle to outplay any competitor while trimming costs and so delivering high rates of return to investors. Unfortunately, the wheels fell off that strategy around five years ago. Management fell asleep at the wheel, content to milk the large customer base for maintenance fees while the cloud players got stuck into its core SME customer base. In the last couple of years, I estimate the combined three large UK based SaaS/cloud players have eaten all of Sage's true organic growth and are now dining on those Sage customers who are ready for change. Add in the myriad other cloud players and Sage is being taken out by death of a thousand cuts. The same goes for the mid-range where Sage has had extraoridinary difficulty in upgrading customers.

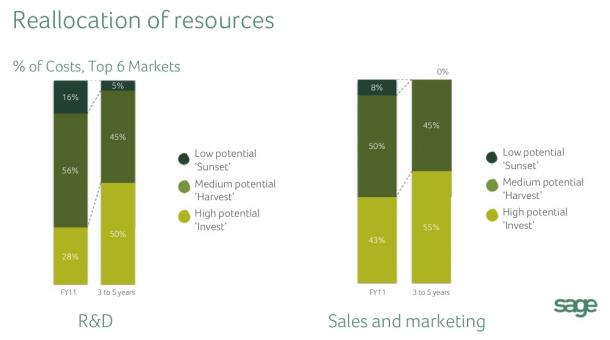

The meat of the issue comes in the CFO's presentation where he says that Sage has identified three product types: invest, harvest and sunset. See the illustration below to get an idea how Sage plans to tackle the problem:

Paul Harrison, CFO says there will be no expansion of spend but merely a reallocation. On its face that sounds like a strategy designed to win over existing institutional investors but it doesn't realistically get Sage out of the hole it is in. Why?

In the UK (as an example), Sage has only been spending around 6.75% of total revenue on R&D. That market is dominated by Sage 50, a mature solution. Globally, the company allocated around 11% of total revenue on R&D. That amounts to around $249 million at today's exchange rate. Looking at the above graphic you'd think that an R&D uplift from some $70 million to $124 million in high growth products would be a good thing. However, Sage has 270 products on 70 platforms. That means in reality, Sage has to undergo a huge amount of rationalisation in order to get anything meaningful out of its R&D spend. The company says that is a core part of its strategy as it seeks to reach a position where it has global software assets that are localised.

Anyone who has lived through that exercise already knows that this is a Herculean task. In fact this is not a new strategy. I recall listening to the company's CTO many years ago (maybe 10 years ago?) when he said they had rationalised something like 25% of the code base. Since then Sage has added many more softwares to its portfolio and its strategy continues to include a significant acquisition element. In other words, it isn't likely that its rationalisation efforts will yield a great deal because no sooner does it pay down technical debt but it acquires more. And just how do you do slash platforms without spending an enormous amount of money that doesn't yield short/mid-term benefit? If SAP and Oracle represent good proxies then this isn't a three year project but at least a five year effort.

Sage's cloud play, Sage One, a key pillar of future growth is only expected to yield some $47 million in incremental revenue over the next three'ish years. The near term is much worse.

From figures given, Sage said it had 2,000 customers on Sage One at December 2011. The update says it now has 5,000 customers. That includes those from its relationship with Barclays Bank in the UK and presumably a number from its bundled online payroll offering. I know from other sources that the Barclays relationship will only be yielding a tiny amount per customer but it does hold the potential to provide fast volume growth. Meanwhile, the combined growth of the top three UK cloud players in Sage's space are all at rates of at least three to four times that of Sage One but with minimal marketing spend at their disposal. The good news is that 80% of the Sage One code is global in nature so once Sage ramps in the US, it should achieve better returns.

That has to be offset by the marketing effort Sage is putting into the solution. My estimates suggest the group is pouring roughly $1 billion into marketing and sales. The company claims brand leadership in many territories but as it is discovering, that counts for nothing when you are being out played by more nimble competitors.

Xero, [Disclosure: Xero sponsors my personal website] one of the larger cloud accounting players provides a good comparison. In the year to 31st March 2012, Xero spent 15% of total revenue on marketing and advertising (PDF) while more than doubling its revenue and allocating 35% of revenue to R&D. the numbers are not comparable to previous years because Xero is still in early high growth stage. To put this into perspective, Xero more than doubled up paying customers to 78,000 as at 3/31/2012. Some reports suggest Xero is edging towards 100,000 customers in 50 countries.

So while Sage may talk a good game, the numbers make less sense than the explanations suggest.

Some think that Sage should make a big acquisition in the cloud space with Xero being the one most often tipped. Rod Drury, CEO Xero quipped in response.

It doesn't make sense to me either. Acquiring IP in the cloud space is the easy part. Making it play profitably when set against the backdrop of an ingrained acquiring culture is another thing altogether. Sage is a timid technology investor in the sense that it rarely puts money into something that is an unknown or where it cannot see near term profit. The cloud is the antithesis of its current strategy yet others are eating its lunch. That has to hurt.

Then there is the partner strategy. Sage relies very heavily on its 28,000 strong partner network. The last year has seen a grumbling around rebranding in the US when those same partners want to see investment in the solutions. Sage's response is to talk about focussing on the larger partners. That means many of the smaller players will need to get themselves affiliated to larger organisations in double quick time. Also, the notion that some software is in the 'sunset' group (and especially not for profit and construction) sees any deals that are floating around drop straight off the table.

Sage's problems run long and deep but at least management recognises those issues. The only thing I can think that's holding up the company is the relatively conservative nature of accounting types. While the cloud space for finance solutions has many players, the market at all levels is still dominated by the on-premise vendors. That is changing much faster than Sage may recognise and especially in the SME space. Growth there is far faster than in any other segment.

Sage may have the financial bulk to rebuild even modest growth but its strategy is one that plays safe and heavily relies on milking the maintenance machine to keep investors onside while it attempts to wriggle out of core difficulties. Anecdotal reports say that while analysts were not shocked by the strategy, they were not exactly enthralled. The share price barely registered a blip.

As always, I'll follow this story and see how it develops.