Security appliance market growing, report says

Shipments and factory revenue for security appliances were up in the first quarter of 2012, according to an IDC report, demonstrating increased interest by organizations who want to keep undesired users off their networks.

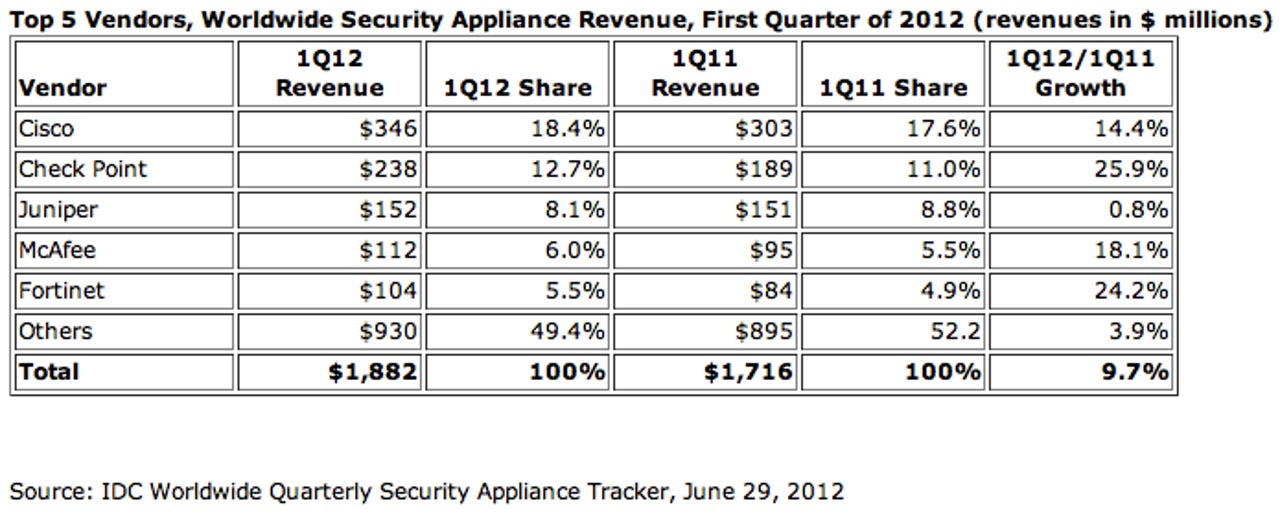

According to the survey, worldwide factory revenues were up 9.7 percent, year over year, to $1.9 billion. Shipments increased 12.9 percent, to more than 500,000 units.

All of the world's regions save for Asia-Pacific -- which excludes Japan -- saw double-digit growth in shipments. The biggest increase came from Central and Eastern Europe: an astounding 39.3 percent increase over the same time last year.

Meanwhile, the U.S. posted the biggest gains in factory revenue -- 16.2 percent -- thanks to demand for high-end firewalls and intrusion protection systems. Firewall/VPNs saw the biggest year-over-year revenue growth, and now account for 28.3 percent of the overall security appliance market. Of all the kinds of appliances available -- unified threat management, content management -- only standalone VPNs saw a decline, down 10 percent year over year.

As per usual, Cisco led the way, with Check Point and Juniper rounding out the top three:

There's also a bit of consolidation going on; the top 5 vendors increased their share of the total market to 50.7 percent.

IDC says it expects to see more growth in unified threat management as organizations pursue cheaper, more streamlined offerings. The bottom line: threats are increasing, sensitive data remains at risk and there's nowhere left to hide -- not even for the smallest businesses.