Splunk's Q4 expenses run hot as it adds salespeople

Splunk's bottom line suffered in the fourth quarter as its expenses swelled as the company adds salespeople to meet demand.

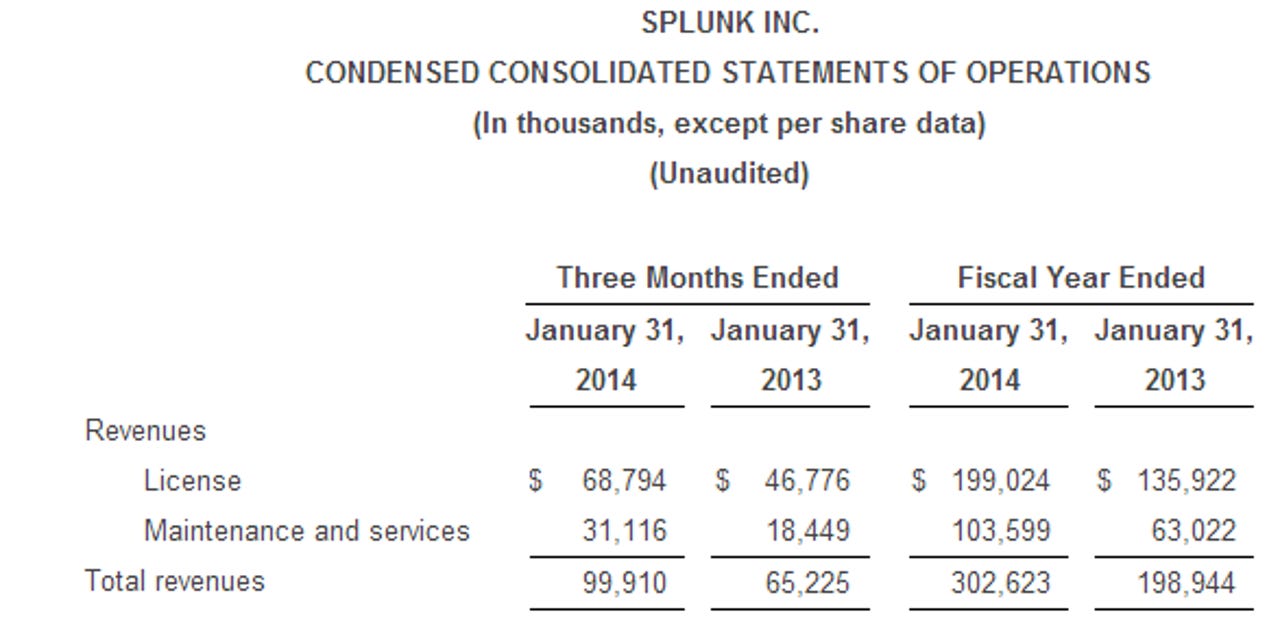

The company reported a fourth quarter loss of $32.5 million, or 30 cents a share, on revenue of $99.9 million, up 52 percent from a year ago. Splunk's fourth quarter non-GAAP earnings were 3 cents a share.

Wall Street was looking for a non-GAAP fourth quarter profit of 5 cents a share on revenue of $90.5 million.

For fiscal 2014, Splunk reported a net loss of $79 million, or 75 cents a share, on revenue of $302.6 million.

Splunk spent $76.3 million in the fourth quarter on sales and marketing, up from $40.3 million a year ago. For 2014, Splunk spent $215 million on sales and marketing, up from $125 million a year ago.

As for the outlook, Splunk said it expected first quarter sales to be between $78 million and $80 million and fiscal 2015 revenue about $400 million. Those ranges were in line with estimates.

The company is clearly in land grab mode when it comes to growing the customer base. Splunk said it added more than 500 new customers in the quarter for 7,000 total. One of the biggest worries for Splunk is sales capacity and whether it can bring on enough salespeople to meet demand.

Part of the reasons expenses in the fourth quarter ran high is that Splunk had to pay more sales commissions.

On a conference call with analysts, Splunk CEO Godfrey Sullivan said the company is landing new customers and expanding business with existing clients. Security and IT monitoring remain Splunk's largest markets. For the year ahead, Sullivan said Splunk will see a year of greater enterprise adoption. "We laid the ground work for this over the last year by making customer expansion easier through enterprise adoption agreements," he said.