Sprint announces 70 percent stake sell to Japan's Softbank

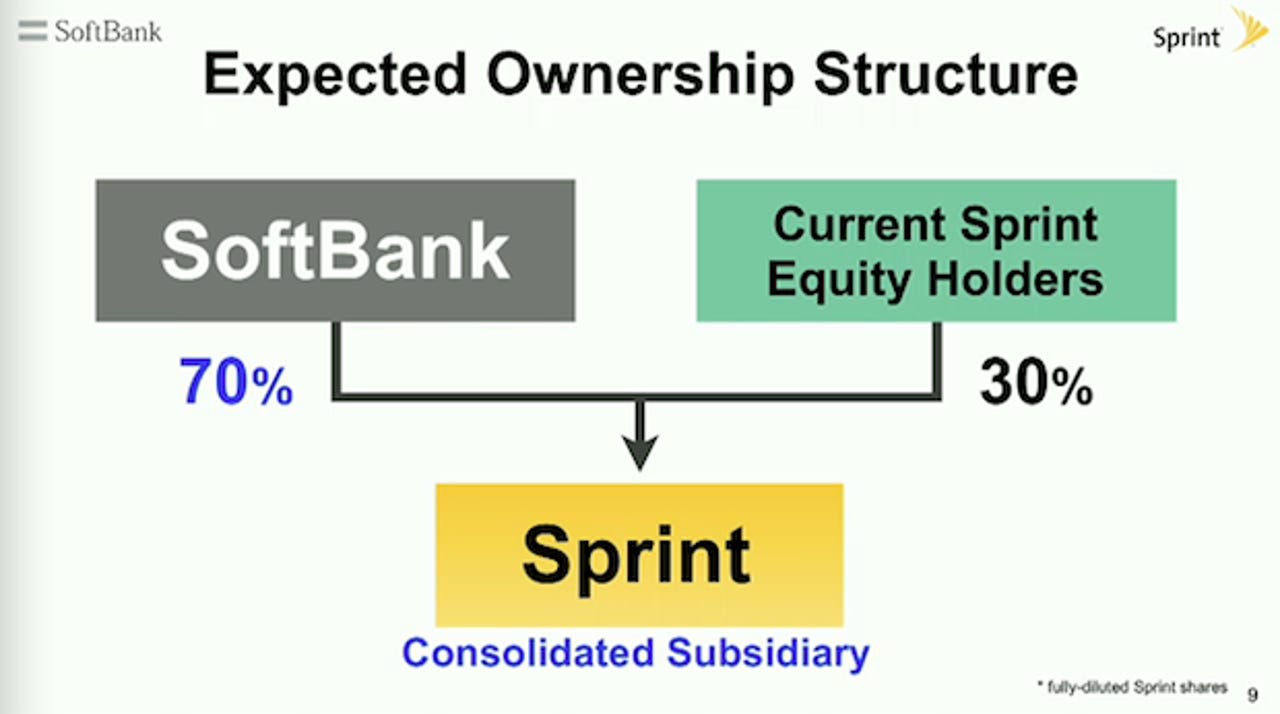

Japanese cellular giant Softbank has bought a 70 percent stake in U.S. network Sprint for $20.1 billion, the two companies announced on early Monday morning.

The deal will include $8 billion in new shares and another $12.1 billion from existing holders. The 70 percent stake will be bought at $7.30 per share -- more than 27 percent than Sprint's closing price on Friday.

A press release issued by Sprint confirms earlier reports by CNBC published yesterday. The deal is expected to close subject to regulatory approval by mid-2013.

The stake sell-off enables Softbank to acquire a huge subscriber base -- one of the largest between the U.S. and Japan -- allowing the firm to rank in third place amongst global operators. Softbank will receive the ability to acquire much-wanted smartphones quicker and receive an investment in the 4G LTE space.

Sprint will receive $8 billion of new capital for investment back into its mobile network.

Softbank has more than 30 million subscribers across Japan, taking just shy of a quarter of the country's population under its cellular wing. Sprint, also the third largest mobile network in its respective U.S. market, has 48 million customers (33 million postpaid with more than 90 percent of revenue; 15 million prepaid subscribers), but figures remain stagnant quarter-on-quarter as ZDNet's Larry Dignan explains, the firm is "surviving not thriving."

Softbank's chief executive highlighted the share price plummet that the company suffered since the talks were confirmed by Sprint earlier this week. Since October 11 when the talks were announced, Softbank's share price fell by more than 25 percent. Today on the Tokyo Stock Exchange, Softbank was down by 5.3 percent.

In the past five years since Sprint CEO Dan Hesse took charge, more than 7 million customers have left the cellular network. The company began offering 4G LTE services in a handful of cities around the U.S. earlier this year but has failed to live up to the expectations of its customers -- let alone the levels of its rival networks.

"We were losing 1 million net customers per quarter. We needed to eliminate costs," he said during the media event. Hesse outlined that Sprint was at a significant disadvantage compared to other networks but noted two areas in which the stake sell-off to Softbank would help.

It is hoped that the investment by Softbank will allow Sprint to push ahead with its wider 4G LTE rollout faster than expected, allowing the network to keep up with the pace of its rivals in the next-generation network space. Also, while Sprint has cash, it also has debt -- around $1.8 billion maturing in 2013 -- but the Softbank investment could ease that figure.

But crucially, while Sprint's own company would be 70 percent down, it would allow the cellular network to acquire, acquire and acquire more to bolster its own infrastructure and offerings.