The trajectories of great software companies

Part one: The different kinds of growing software vendors

Software buyers are second only to teenage clothing buyers when it comes to being fickle. The best vendors are those that capture as much market and mindshare as possible while the products are still perceived to be “hot." By inference, does this mean that the fastest growing vendors are necessarily the best?

The fickleness of software buyers has been known for decades and some may assume that the most successful software vendors are those that scale extremely quickly. But, is a great software company one that grows slowly, moderately or rapidly?

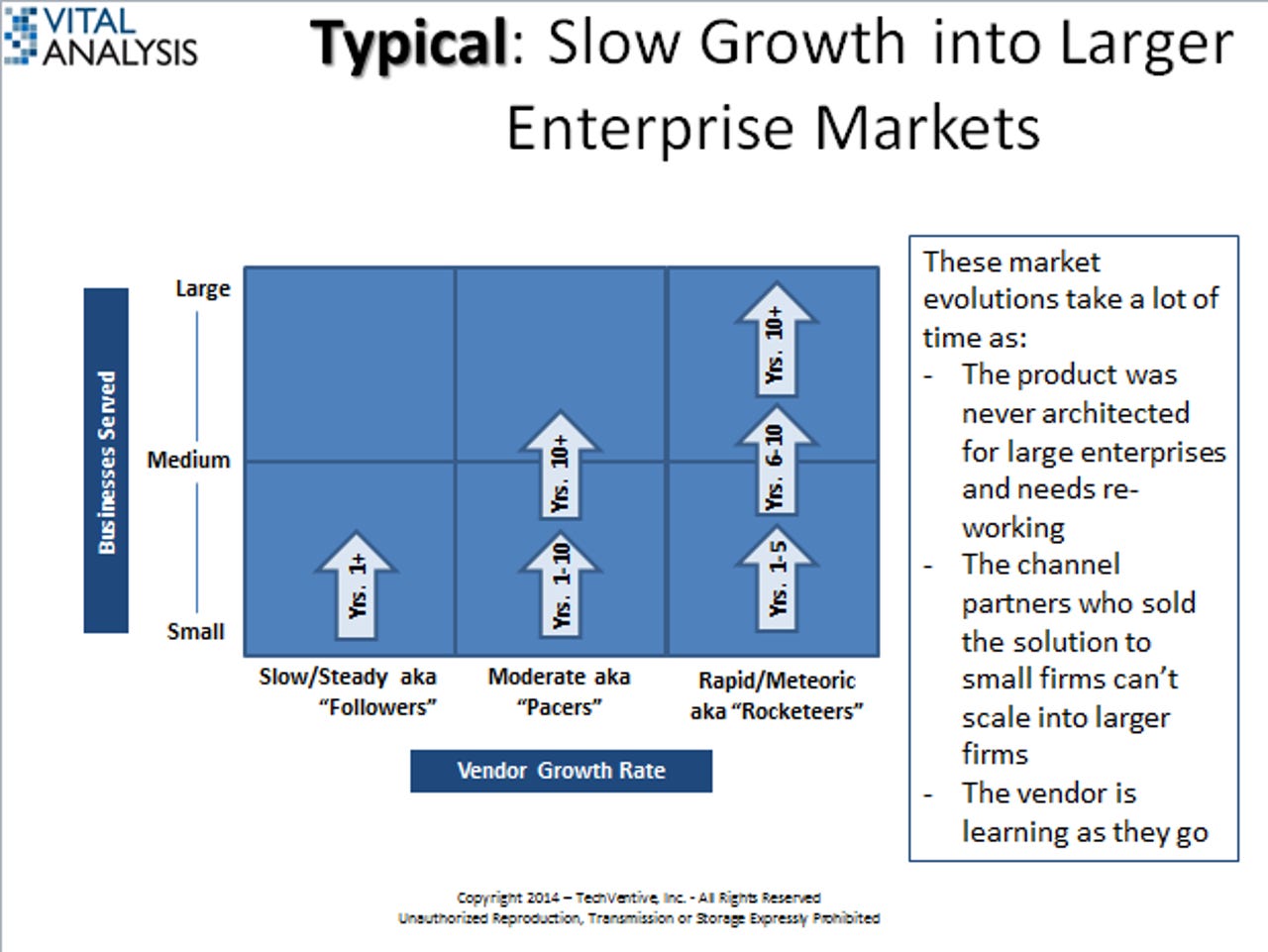

There are, it turns out, several growth trajectories for software companies. A significant number of vendors follow a very predictable pattern. These firms start off with a straightforward solution that solves a number of common business problems. Their solution usually appeals to a group of smaller businesses that may not need the capabilities (e.g., multi-currency) that larger firms require. As time goes on, these vendors expand their core functionality to solve more up-market needs and more vertical requirements.

Featured

A shorthand way of seeing the differences between these vendors is to classify a vendor into one of three categories:

- Followers or Ernst & Julio Gallo vendors (with apologies to the winery) — These vendors move at a slow and steady pace. Like the winery’s old marketing adage: they won’t release a product before its time. Making sure the vendor only releases functionality that the market has absolutely demanded means the vendor usually offers products and enhancements after their competitors have done so. Slow and steady may be admirable in winning some races but not for firms vying for market share in rapidly changing, quick-to-obsolescence, fickle buyer markets.

- Pacers — These software companies do a solid job of keeping up with the Joneses. They are not leaders but they aren’t followers either. Their innovations are often predictable and unsurprising yet they are still market relevant. Their unsurprising nature rarely garners much press or analyst focus.

- Rocketeers — These vendors are screaming hot. They outpace competitors with their innovations and the speed with which they make their products attractive to ever larger customers. They can, though, spectacularly flame out if they get too far ahead of the market or bet the farm on an innovation that the market neither wants nor fully gets. Rocketeers can also flame out if they introduce bad products often enough that customers quit forgiving them. One software executive once said to his sales team something to the effect of “If you can name it, sell it. If you can compile it, ship it. We’ll fix the bugs after we achieve 85% market share.” That’s the kind of attitude that sinks a software company in a short time.

Analysts, market watchers and other influencers often focus on only one category of vendors: the ones experiencing rapid, meteoric growth — the Rocketeers. Why? These vendors are doing lots of noteworthy or cool things. They’re taking chances, big risks and disrupting the status quo. They might also fail and fail spectacularly.

It’s that morbid curiosity of seeing a train wreck happen in real time that fascinates market watchers. They all want a front row seat to this spectacle just in case something wild, unexpected or explosive occurs. This is why high-growth firms are at hype-central. Other firms often can’t buy any publicity for themselves as the shadow cast over them by the fast growing firm(s) is huge.

There’s another group of firms out there: Idlers. They make a number of innovations in the market space they currently occupy. These innovations just keep them in the same place competitively. Rarely are the innovations big or competitively differentiating. The changes they make keep them relevant but little more.

Even rarer still are the scant firms that can start off selling and serving small firms and rapidly grow into an enterprise-class provider to the biggest software buyers globally. This kind of firm often has a serial entrepreneur at the helm. Think about someone like Dave Duffield at Workday. He’s launched four software companies in his career and understands what it takes to incubate, nurture and grow a software firm.

Solid growth in the application software space is actually a common occurrence. What’s less common is hockey-stick growth and rarer still is the firm that can sustain hockey stick growth for long periods of time. Xero, a cloud financial accounting software vendor, has produced the following chart of their revenues and losses over the last few years. This chart is an example of what many Rocketeers would want to achieve.

The best of these big and explosive firms do one thing very well: They create their initial solution to be one that can and will scale. By doing this one thing well, they can easily increase their product line’s functionality and market appeal.

But whether the vendor can maintain its posture in that rarefied space where their solutions appeal to the biggest customers and their growth is still meteoric is far from guaranteed.

Small, entrepreneurial software companies often displace large monoliths simply because they possess the nimbleness that larger vendors have designed away. Large software firms, with their billion dollar R&D budgets, often relax their hiring standards just to meet their growth targets. When they were smaller, they often held out for the best and most amazing people possible. Now, they’re hiring average people who often deliver below average products at longer than average delivery rates. Mediocrity settles in for these firms. You can spot this happening when big firms prefer to “acquire” their innovation instead of “develop” it internally.

But larger firms often reach practical limits to their growth. Straight-line or curvilinear growth gets harder and harder to achieve once a software company approaches a given size. A new product that generates $100 million in new sales looks monstrous to a startup, while it barely makes a blip in a large vendor’s revenue numbers.

Many software companies hit the implosion point every year. When their growth stalls or goes negative, their best and brightest employees leave to work with firms that are growing. Growing firms offer career and equity opportunities for software employees. Contracting firms only offer the potential for a paycheck and maybe not for long. You can spot the failing firms by the exodus of great talent and the circling of potential acquirers looking to snap up the cash cow maintenance revenue business that is keeping the firm afloat.

Part two: Why moderate growth may be good after all

I will admit to have fallen into the love affair with super high-growth technology firms. I like to cover these companies as they are doing lots of interesting things before others get to the same ideas. But, amongst the hype, there is still a lot of risk for the firm, its customers and its investors.

Recently, I got a briefing from SYSPRO. While SYSPRO has always targeted SMB customers in four main manufacturing verticals, the company has been building out its technical infrastructure and product functionality a lot in the last couple of years. The changes are actually quite impressive especially with regard to their workflow technology and their new Espresso mobile solutions.

When I saw this last month, I knew then and there that the product was now capable of serving more than SMB software buyers. I even challenged their top North American leaders about the ability of their channel partners to sell this more robust, bigger and powerful solution to ever larger, more complex customers. This company and its products have not only changed/grown but their speed-to-market appears to be changing as well and this is in spite of their growing size/market success.

Like SYSPRO, I have challenged the senior management of HR vendor Ultimate Software. I kept pushing them to grow faster, expand their product line more aggressively, etc. I tried to push them into a super-growth mode.

But Ultimate’s CEO is quite focused on delivering a constant 20+ percent growth rate per year. It is at this level that the company can delight its shareholders (it’s publicly traded – Symbol: ULTI), manage its cash position, fund growth and fund R&D. Moreover, it can hire new talent at a rate that the company can effectively assimilate and make productive. Growth beyond this range might be expensive and counterproductive.

What Ultimate has achieved in recent years is a steady expansion in its product line and a noticeable movement up-market. It has also quickened its innovation pace.

AR + VR

Ultimate has gone from being a follower to a Fast-follower. It now produces innovations similar to Workday’s within a few months of their solutions. Compared to other Payroll/HR vendors (excluding Workday), Ultimate appears to be matching or surpassing many of these firms’ innovation rates as well.

Moderate growth rates in the software industry may seem absurdly high in other industries. For example, a manufacturer might be overjoyed to experience topline revenue growth of 4-5 percent annually (just a couple of points greater than annual GDP growth). But a software company that doesn’t grow 100 percent year-over-year can be looked upon with suspicion. Nonetheless, 20-30 percent topline growth is still a remarkable achievement even if Wall Street or tech analysts find it boring.

Is a slower growth rate always a good thing for software firms? No. Hot, fickle markets are only hot for a limited amount of time. For this reason, it’s important to know that whatever goes up (in technology) will definitely go down, too. The decline rates (once a technology sector becomes obsolete or out of fashion) can be directionally massive, too. Slowing down a company’s growth rate won’t necessarily cause the decline rate to slow down. The two actions are independent with one the vendor can control and the other subject to market forces.

But moderate growth may be a smart idea especially for cloud vendors. Cloud vendors generally need a lot of cash. They don’t always get the big upfront license fees that a prior generation of on-premises vendors got. They have to earn their cash revenue one month at a time. They still have the same big sales and marketing costs. They also have datacenter costs and other expenses. Altogether, cash flow may be the single biggest controlling factor in a cloud firm’s growth.

Now, you might argue that cloud vendors could tap the venture capital or public markets to fuel their growth. And you’d be right if:

- The owners don’t mind additional dilution of their shares

- The company is big enough to go public

- etc.

Part three: The vendor to-dos

Determine the growth rate that’s right for your firm — I call this the Goldilock's dilemma. But whatever pace you select, be sure you understand the risks and tradeoffs that come with this decision.

Recognize your firm might have a problem — As many vendors grow, they get slower. Innovation, which used to be a core competency, is now AWOL (absent without leave). Instead of maintaining its innovation pace and market currency, bureaucracy, complacence, indecision and cumbersome processes have sucked the fun, speed and entrepreneurialism out of the place.

Continually upgrade the processes and people — Some of the people who helped launch your firm may not be able to scale and your firm can’t wait for them to grow into ever more demanding roles. That may sound cruel but it’s nonetheless true. Smart firms always look to acquire ever better talent throughout the life of the firm. Likewise, have your processes gotten so regimented that innovation rarely succeeds because of countless obstacles newer processes create? Households benefit from a periodic cleaning. Is it time to de-clutter your firm a bit?

Keep your foot on the accelerator — Take care to avoid backing off and don’t be afraid to sporadically rev it a bit. Create a periodic stretch goal to pass a competitor.

Stress fundamentals to those who don’t get it — Analysts, Wall Street, hedge funds and others might not understand why you move at the speed you do. Just be patient and keep repeating it. Eventually, they’ll come to understand why.