Treasurer called to step in on EFTPOS fees

NSW Fair Trading Minister Anthony Roberts has called for Federal Treasurer Wayne Swan to intervene in the restructuring of EFTPOS fees borne by merchants and banks, saying that if left unchecked, consumers will end up paying to spend their own money.

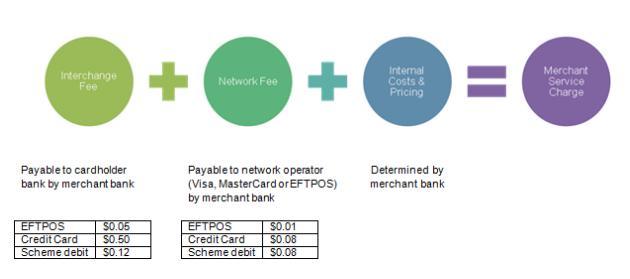

Estimates of fees for a $100 purchase. (Credit: ePAL)

Roberts said that he wrote to Swan after Westpac advised him that the bank would increase fees for accepting EFTPOS payments from some merchant customers due to changes made by EFTPOS Payments Australia Limited (ePAL).

ePAL has previously stated that its new fee structure would not result in it directly charging consumers. However, that's doesn't mean that banks can't pass the costs on to the retailer and then on to the consumer, which Roberts believes will happen.

"I am particularly concerned that changes to the fee structure will lead to an increase in transaction costs for retailers. Retailers, especially small business owners, will feel pressure to pass these costs onto consumers," he said.

Although he admitted that the fees seem modest, Roberts was also worried that a repeat of what happened to credit card transactions could happen to EFTPOS transactions.

"In the case of credit card fees, the end result was that charges increased significantly over time, without the extra costs being clearly explained," he said, stating that these surcharges are now as high as 10 per cent or more.

"The last thing consumers need is to be charged when they spend their own money."

When ZDNet Australia contacted Westpac, the bank confirmed that there would be some increases based on the ePAL changes, but were based on a number of factors, including the processing method being used, the card types the merchant accepts and its average transaction sizes.

"It's all based on the business' fee structure, so it's on a case-by-case basis," said the spokesperson.