Worldwide server shipment up, revenue down

Global server shipments grew 1.5 percent last year but revenue dipped by 0.6 percent from the previous year, dragged down by budgetary constraints. The Asia-Pacific was one of three regions to clock an increase in shipment, according to new stats from Gartner.

In a statement released Thursday, the research firm revealed fourth-quarter 2012 numbers which saw server shipment drop 0.2 percent year-on-year to 2.5 million, while revenue climbed 5.1 percent US$14.62 billion.

Jeffrey Hewitt, Gartner's research vice president, said in the report: "2012 was a year that definitely saw budgetary constraint which resulted in delays in x86-based server replacements in enterprise and midsize data centers. Application-as-a-business data centers such as Baidu, Facebook, and Google were the real drivers of significant volume growth for the year."

He added that the year saw weak revenue for mainframe and RISC/Itanium Unix systems.

North America, Asia-Pacific, and Latin America saw the highest growth rates globally with shipment growing 5.5 percent, 3.4 percent and 0.2 percent, respectively, for the quarter.

Overall, despite weaker performance in some regions--specifically, Western Europe--2012 saw server revenue growth. Gartner attributed the boost to x86 servers which were the predominant platform used for large-scale datacenter deployments.

For the fourth quarter, IBM retained its market lead in terms of revenue, grabbing a 34.9 percent share compared to 33.7 percent in the same quarter the year before. Its revenue grew 8.9 percent year-on-year to US$5.1 billion. Hewlett-Packard, ranked second, accounted for 24.8 percent of overall revenue which dipped 3.3 percent year-on-year to US$3.62 billion. Third-placed Dell grabbed 14.3 percent of total revenue, growing 1.2 percent to US$2.08 billion.

It added that revenue from blade servers grew 3.2 perent but shipment numbers fell 3.8 percent for the year. Hewlett-Packard led this market segment, accounting for 43.9 percent of worldwide shipment for blades, followed by IBM at 18.4 percent and Cisco Systems at 12.5 percent.

In fourth place is Oracle, which saw its fourth-quarter revenue dipped 18 percent--the sharpest decline among the top 5 vendors--to US$603 million, accounting for 4.1 percent of the overall revenue. Fujitsu rounded up the top 5 list with 3.7 percent market share, clocking US$541 million for the quarter whcih climbed 8.6 percent year-on-year.

In terms of shipment, four of the top five vendors saw declines. HP led the market in the fourth quarter with 26.5 percent share despite seeing a 5.9 percent decline year-on-year to 663,598 units. Dell ranked second with 21.3 percent share and unit shipment of 532,890, a 7 percent decline year-on-year, followed by IBM at 11.6 percent share and unit shipment of 291,328, dropping 11.5 percent year-on-year.

Fujitsu ranked fourth, accounting for 2.8 percent of the overall shipments in the quarter, clocking a slight dip of 0.1 percent year-on-year to 69,853. Cisco was the only top 5 vendor to see its shipment grow by 40.9 percent to 63,342 in the fourth quarter, accounting for 2.5 percent of the market.

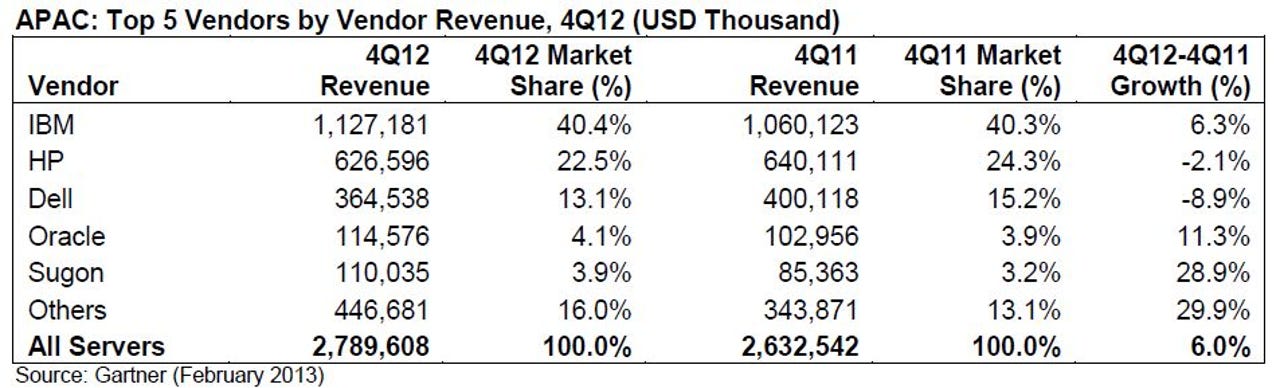

In the Asia-Pacific region, server shipment grew 3.4 percent in the fourth quarter to 587,484 while revenue also climbed 6 percent to US$2.79 billion, giving an overall 2012 growth of 2.3 percent and 2.2 percent, respectively, according to Gartner. China continued to lead the region's growth, fueled by government spending and deployments by Internet companies. Indonesia and the Philippines also saw strong growth rates.

In the region, the top five vendors for 2012 in terms of revenue were IBM, HP, Dell, Oracle and Sugon, with 39.7 percent, 24 percent, 14 percent, 5 percent and 3 percent market share, respectively. Chinese hardware manufacturer Sugon saw the highest growth, expanding its revenue by 44.9 percent in 2012 over the previous year to US$309.4 million.

Total server revenue across the Asia-Pacific clocked at US$10.2 billion for the year, up 2.2 percent from 2011. In terms of shipment, the region moved 2.14 million units for the year, up 2.3 percent from 2011. The top five vendors were HP, Dell, IBM, Lenovo and Sugon, with 24.3 percent, 22.2 percent, 19.4 percent, 7.6 percent and 5.4 percent market share, respectively. Again, Sugon saw the highest shipment growth at 47.3 percent.