AMD beats Q3 expectations

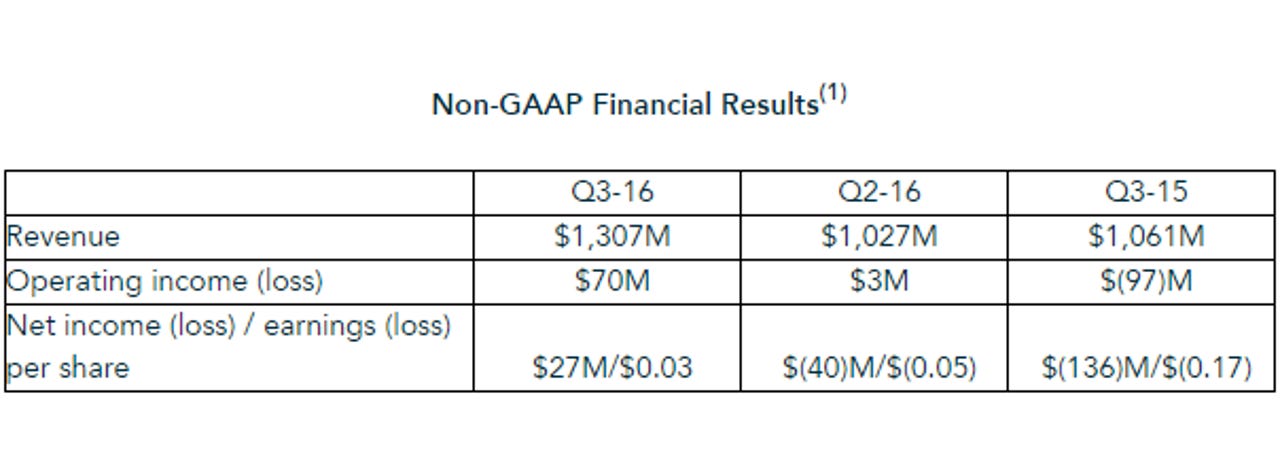

Advanced Micro Devices (AMD) posted solid third quarter earnings on Thursday, reporting earnings of three cents a share on revenue of $1.307 billion.

For Q3, Wall Street was expecting flat per-share earnings on $1.21 billion in revenue for the quarter.

The company's revenues were up 23 percent year over year, primarily because of its record semi-custom SoC and higher GPU and mobile APU sales. That, however, was partially offset by client desktop processor and chipset sales.

"Our third quarter financial results highlight the progress we are making across our business," said President and CEO Lisa Su in a statement. "We now expect to deliver higher 2016 annual revenue based on stronger demand for AMD semi-custom solutions and Polaris GPUs. This positions us well to accelerate our growth in 2017 as we introduce new high-performance computing and graphics products."

AMD's Computing and Graphics segment brought in revenue of $472 million, up 9 percent sequentially and 11 percent from Q3 2015. The increases were driven primarily by increased GPU sales but offset by decreased sales of client desktop processors and chipsets. The year-over-year increase was also driven by increased sales of client mobile processors.

Enterprise, Embedded, and Semi-Custom segment revenue hit $835 million, an increase of 41 percent sequentially and 31 percent year over year, due to higher sales of semi-custom SoCs.

For Q4, AMD is forecasting revenue to decrease 18 percent sequentially, plus or minus 3 percent.