Micron stock jumps as FYQ2 results, outlook top expectations

Memory-chip giant Micron Technology this afternoon reported fiscal Q2 revenue and profit that both easily topped Wall Street analysts' expectations, and an outlook that was higher as well.

The report sent Micron shares up 4% in late trading.

CEO Sanjay Mehrotra remarked that the company's "excellent second quarter results exceeded the high end of our guidance for both revenue and margin, reflecting our strong execution."

Added Mehrotra. "We're leading the industry in technology across DRAM and NAND, and our product portfolio momentum is accelerating.

"With outstanding first half results, Micron is on track to deliver record revenue and robust profitability in fiscal 2022."

Revenue in the three months ended in February rose 26%, year over year, to $7.8 billion, yielding a net profit of $2.14 a share, excluding some costs.

Analysts had been modeling $7.53 billion and $1.98 per share.

Micron's gross profit margin on a non-GAAP basis came in at 47.8%, which was up almost 15 percentage points from 32.9% in the year-earlier Q2.

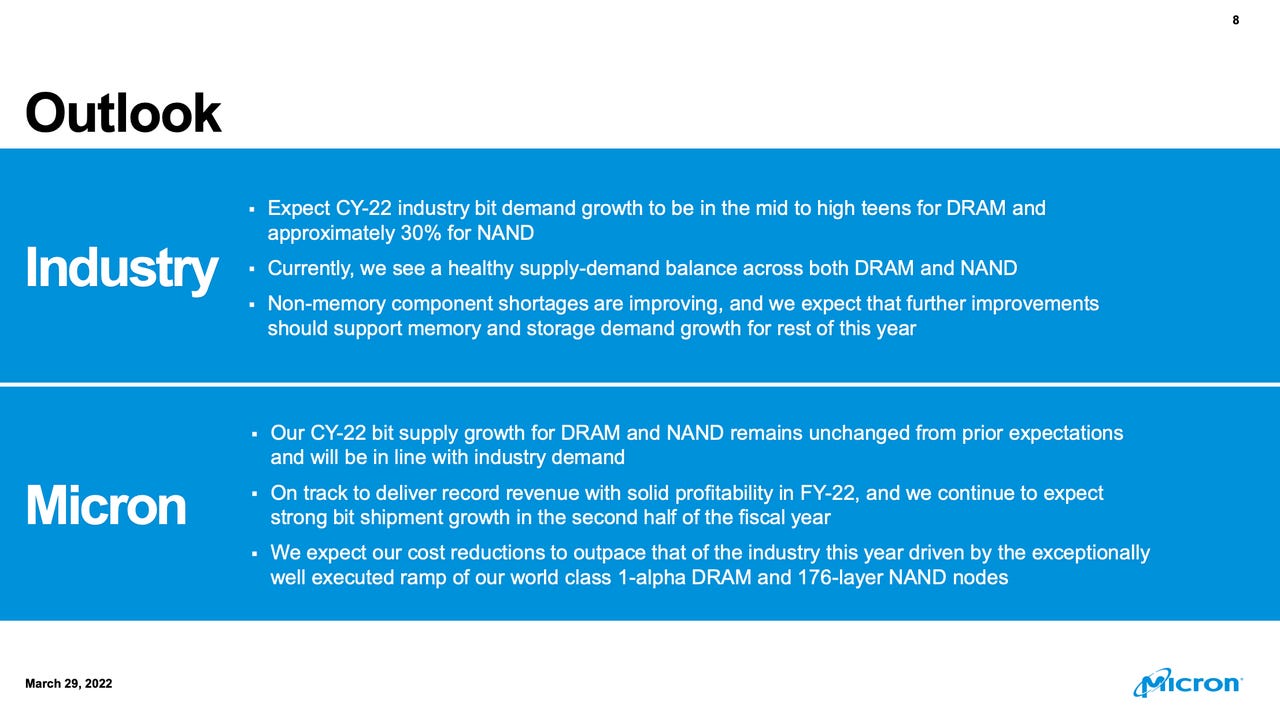

In a deck of slides prepared for the company's conference call with analysts, Micron said that it expects demand for DRAM across the industry this year to rise by "mid to high teens," and for NAND, "approximately 30%." That language is the same commentary the company offered in December. Micron also said that there is a "healthy supply-demand balance" for both kinds of chips.

For the company's outlook, Micron said, "Our CY-22 bit supply growth for DRAM and NAND remains unchanged from prior expectations and will be in line with industry demand." However, the company also said that "We expect our cost reductions to outpace that of the industry this year driven by the exceptionally well executed ramp of our world class 1-alpha DRAM and 176-layer NAND nodes." That is a change from the company's statement in the prior quarter that it expected its "annual cost-per-bit reductions to be competitive with the industry in FY-22 and over the long term."

For the current quarter, the company sees revenue of $8.5 billion to $8.9 billion, and EPS in a range of $2.36 to $2.56. That compares to consensus for $8.13 billion and $2.24 per share.

Gross profit is expected in a range of 47% to 49%.