Apple tells investors its $14bn Irish tax bill won't change anything

Despite the hysterical letter that Apple CEO Tim Cook wrote to European Customers - which claimed the tax decision will have a "profound and harmful effect ... on investment and job creation in Europe" - Apple has told shareholders that the EC-imposed $14bn Irish tax bill won't make any difference to its financial results. Apple's statement to investors (PDF) says:

"We do not expect any near-term impact on our financial results nor a restatement of previous results from this decision."

"We do not currently expect this decision to have an impact on our tax rate going forward."

"Our cash balance will not change as a result of this decision, but we anticipate we will place some amount of cash in an escrow account."

Apple's statement also says: "Both Apple and Ireland plan to appeal the decision and we are confident that it will be overturned by the courts of the European Union." This will take several years.

Either way, Apple pays so little in overseas taxes that the extra €13 billion (plus interest) for 2003-2014 doesn't make any significant difference. As European Commissioner Margrethe Vestager pointed out, Apple only paid "an effective corporate tax rate of 1 percent on its European profits in 2003 down to 0.005 percent in 2014."

The cash is also insignificant relative to Apple's overseas cash mountain, which is somewhere over $200 billion.

So why is Apple so concerned?

The answer that the global tax regime is getting tougher and this is the thin end of the wedge.

European countries are fed up with companies that benefit from their expensive infrastructure - roads, schools, hospitals, police and other services - without paying reasonable sums for its maintenance. Indeed, the OECD (Organisation for Economic Co-operation and Development) is working with more than 100 countries to stamp out tax avoidance on a global basis.

The OECD project is known as Beps, "for base erosion and profit shifting".

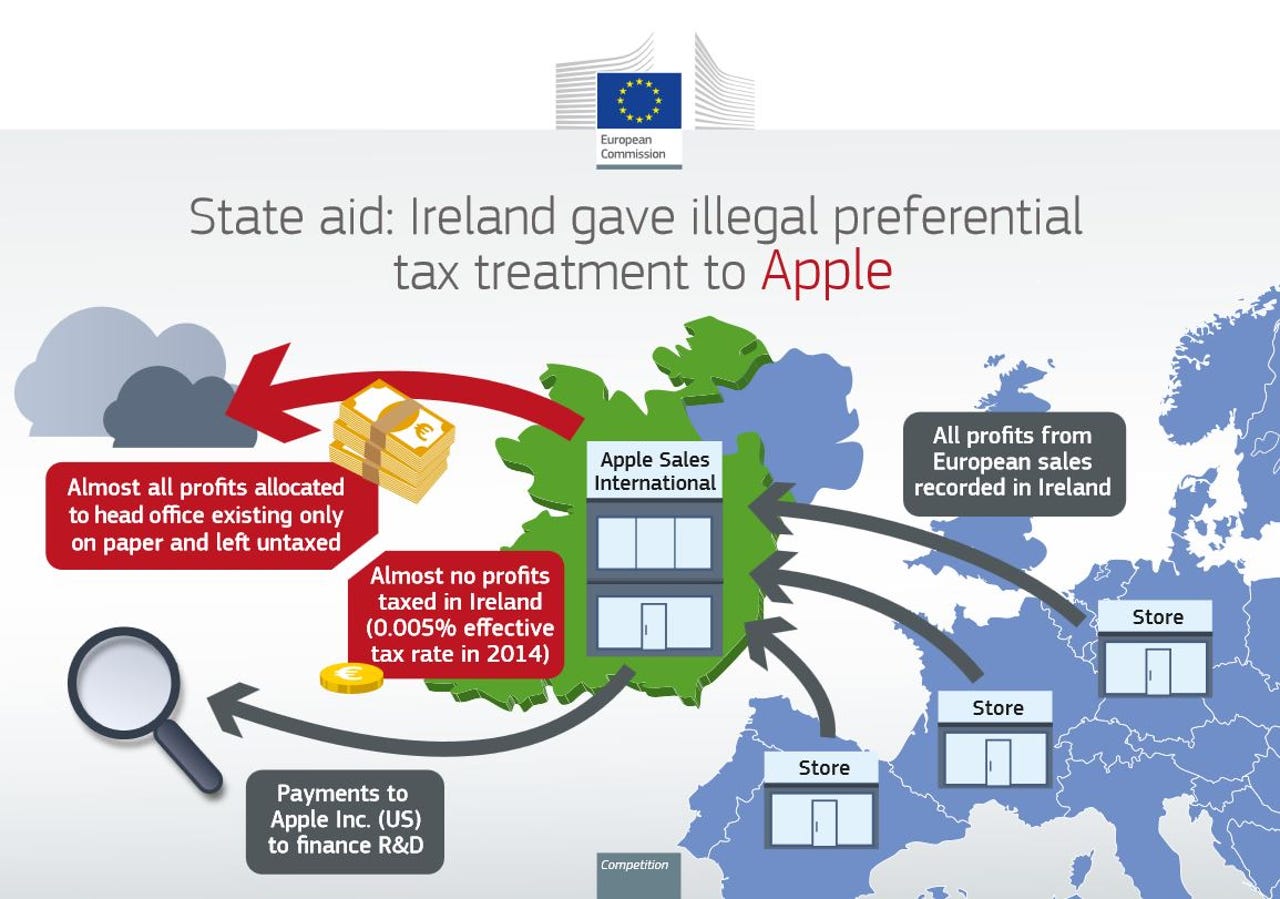

The Irish government is helping Apple to exploit a loophole. Apple avoids paying some taxes in Europe, the Middle East, Africa and India because sales are contractually (though not actually) made by Apple Sales International in Ireland. (See the EU graphic above.) The profits are therefore "earned" in Ireland.

However, these profits are not taxed in Ireland either.

The Irish Revenue's chairman, Niall Cody, told The Irish Times: "Under Irish law, non-resident companies are chargeable to Irish corporation tax only on the profits attributable to their Irish branches by reference to the facts and circumstances. The profits of non-resident companies that are not generated by their Irish branches - such as profits from technology, design and marketing that are generated outside Ireland - cannot be charged with Irish tax under Irish tax law."

Wait, isn't Apple Sales International based in Ireland?

Yes, but under the tax deal, some internal book-keeping diverts these profits to "head offices" where they avoid tax altogether. As the European Commission explains (my emphasis):

Under the agreed method, most profits were internally allocated away from Ireland to a "head office" within Apple Sales International. This "head office" was not based in any country and did not have any employees or own premises. Its activities consisted solely of occasional board meetings. Only a fraction of the profits of Apple Sales International were allocated to its Irish branch and subject to tax in Ireland. The remaining vast majority of profits were allocated to the "head office", where they remained untaxed.

During a US Senate investigation of Apple's practices, John McCain said Apple's "creation of companies that don't exist anywhere for tax purposes" was "the epitome of tax creativity".

Apple is right to be concerned. Apple, Google, Amazon, Starbucks and many other companies are now being targeted by the EC and European governments for tax strategies that are ultimately based on different definitions of words like "residence".

But far from having a "harmful effect on investment and job creation in Europe," as Cook claims, this should result in a more level playing field and more open competition.

To put it simply, the European view is that a multinational company operating shops in a country, and selling products to the residents of that country, should be paying their fair share of taxes on the profits made in that country. If they are not doing that, then morally and ethically they are cheating that country, regardless of whether it's technically legal or not.

The EU and the OECD are now trying to close loopholes and profit-transfer deals that make tax avoidance technically legal, and ultimately that's good for everybody.

READ MORE ON THIS STORY

Apple's €13bn tax fallout: Could this be the trigger for Ireland to leave the EU?

Apple should repay up to €13bn in 'illegal tax benefits' says European Commission

Europe opens tax probe into Apple in Ireland

Ireland refuses to be US 'whipping boy' over Apple tax claims