AWS cements hybrid cloud position with VMware partnership: Here's what it means

The hybrid cloud isn't some transient state in a tug of war between the public cloud and private data center infrastructure. If you need proof look no farther than the Amazon Web Services and VMware partnership and integration.

AWS, the big dog on the public cloud block, is now going to seamlessly integrate with VMware, the leader on the private cloud front. To see AWS CEO Andy Jassy on stage with VMware chief Pat Gelsinger was notable on a few fronts.

- The companies acknowledged that previous connections weren't up to snuff. Enter VMware Cloud on AWS with availability in mid-2017.

- AWS' Jassy noted that customers were forced to choose between AWS and VMware previously they "didn't like that decision." "We're driven by what our customers tell us matters," said Jassy.

- VMware has integrated AWS into vSphere and its management tools as a preferred public cloud provider. Gelsinger noted that AWS is VMware's "primary public cloud offering" and the beginning of a "rich cycle of innovation." AWS is VMware's primary public cloud partner.

To gauge how far we've come here's a brief history lesson. AWS pooh poohed the private cloud initially when the Amazon unit launched. Then AWS got the hybrid game with a bevy of services that directly connect private infrastructure to its cloud. Now that AWS is a staple it has to work with existing enterprise stacks. There is no bigger stack partner than VMware.

The VMware demo of its integration with AWS made it clear that the virtualization software giant will essentially become a massive reseller of AWS' public cloud. AWS services will be combined in the VMware control console. Add it up and VMware will move a ton of AWS instances.

Customers can purchase services through their existing VMware commercial agreement and use their existing VMware software investments to secure additional loyalty discounts for their VMware Cloud on AWS hybrid environment.

AWS and VMware didn't divulge financial details, but the win is clear. VMware keeps and expands customers for its software defined data center efforts. AWS continues to grow. Both companies are clearly gunning for Microsoft, which is well positioned in the hybrid cloud.

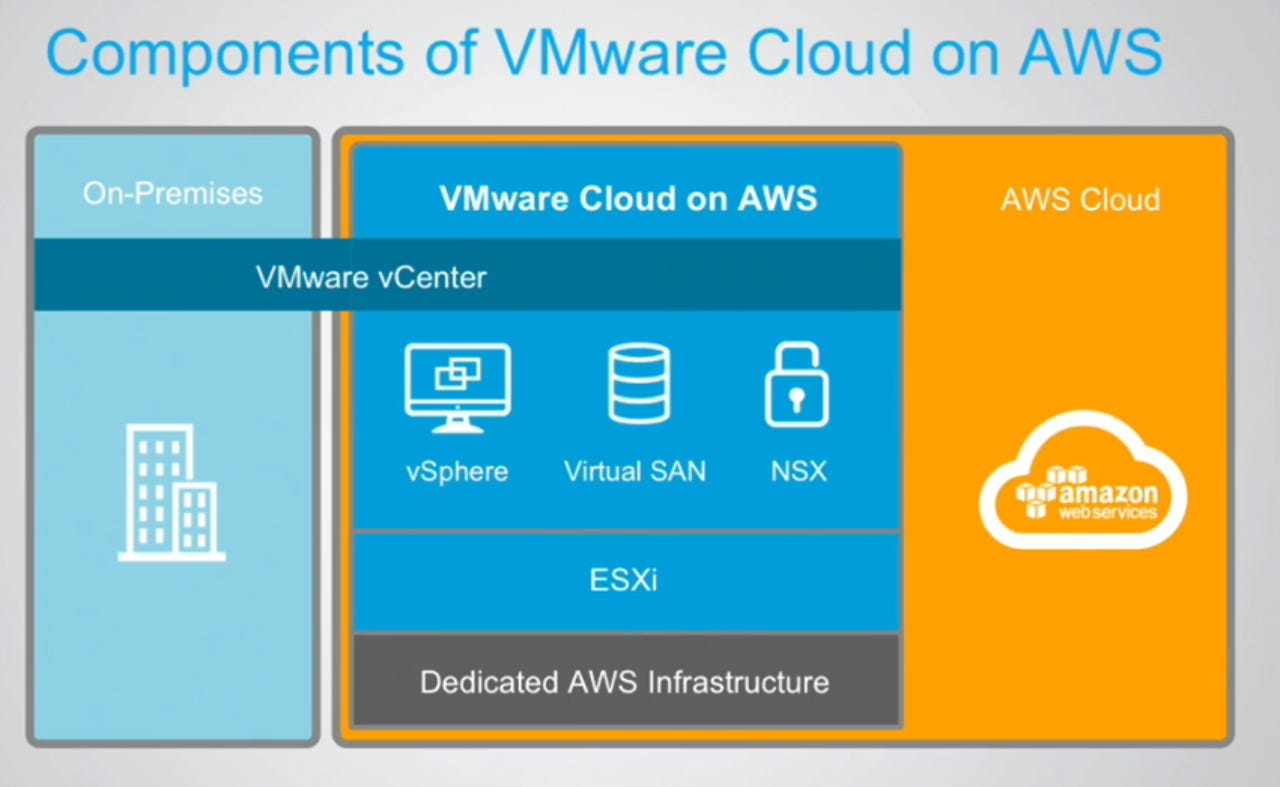

Here's a look at the integration points:

Bottom line: VMware is a front end to AWS and the two giants are essentially forming a entrenched hybrid cloud stack. Coupled with AWS partnerships with other key enterprise providers such as AT&T and it's hard to see Amazon being upended soon.

So what's the fallout?

- Microsoft Azure. Microsoft has a strong hybrid story to tell largely because its wares operate data centers and connect to Azure. Mary Jo Foley reported Thursday that Microsoft was already circling its hybrid cloud wagons. Why? Microsoft was anticipating this move.

- Google Cloud may be locked out. Having AWS as the primary public cloud provider in VMware environments effectively locks out Google Cloud as price competition in many enterprises. Google Cloud will have to step up its hybrid partnership efforts as it provides better integration and service.

- IBM's SoftLayer unit benefited from Big Blue's data center footprint. Depending on how the customer overlap with VMware and AWS falls IBM could take some kind of hit.

- Private cloud players may also need to integrate more with AWS. If VMware is on board with AWS it's possible vendors like Hewlett Packard Enterprise and Red Hat may have to follow.

- Oracle's AWS obsession gets tricky. Oracle's bet is that it can compete with AWS by making applications easy to move to its cloud. That argument works, but isn't as effective in light of the AWS-VMware partnership.