Buying enterprise mobility management: How important is independence?

If you're in the market for enterprise mobility management applications — like most of the CIOs gathered in Orlando were — it's safe to say that you were bombarded with pitches that all sounded the same, promises of great collaboration and mobile workflow advances, architectures that'll support sensors in the future and lots of security.

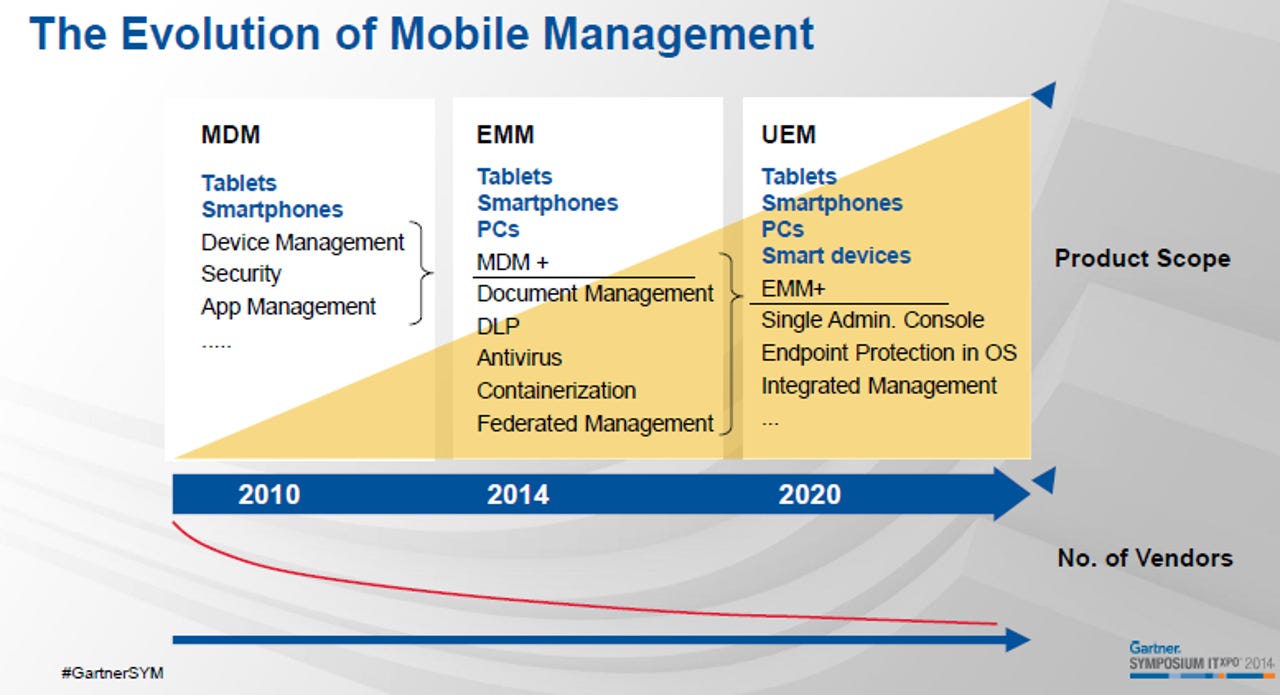

Welcome to the world of the mobile technology buyer. Simply put, bring your own device policies are a pain to manage, the security stakes are only getting higher and mobility is pervasive. Meanwhile, enterprise mobility management (EMM) vendors are still being sorted out. If I had a magic wand, I'd consolidate the industry down to four players just to make the buying process easier. Until then, here's Gartner's slide of mobile management evolution.

And here's the reality: Gartner's Symposium/ITxpo was littered with most of the leading EMM vendors and, frankly, many sounded alike. Another reality: There are dozens of EMM vendors and we all know the list will be whittled down to four, but there's a lot of growth to be had before these mobile management providers start to die or be sold. For the foreseeable future, you're going to have multiple EMM vendors with multiple pitches.

"The market is evolving quickly and mobility has become strategic," said MobileIron CEO Bob Tinker. "Mobility is core to end user productivity."

Just a few minutes later, Tinker acknowledged the market is crowded. "We'll be happy to consolidate the industry," quipped Tinker. MobileIron recently went public so may need some time. "There's still greenfield and EMM is in the second inning of a nine inning game — especially outside of North America," he added.

iOS 8 and the enterprise: A roundup of EMM vendor support and resources

The best advice I heard from Gartner's powwow was not to sign any contract with an EMM vendor that lasts more than a year. IT buyers are going to have to date around with EMM vendors and pit them against each other in proof of concepts.

Given the EMM landscape, I went on a little briefing tour with executives at the key companies. I couldn't get to every vendor, but talked to enough to note a few key themes. Here's a look at the critical points — without getting into software bake-offs — and the key high-level issues.

How important is the role of Switzerland?

One thing you'll notice within hours of checking out EMM vendors is that there could be a few conflicts of interest. Mobility is a shot at new processes and one big risk is becoming locked into any one stack. The market is simply moving too quickly.

If you're looking for a neutral technology provider that doesn't care whether iOS, Android, Windows or any other mobile platform emerges victorious, the EMM list becomes shorter instantly.

"We live in a world of choice and there are advantages to being neutral," said Tinker. "Are other (EMM vendors) going to put their heart and soul to make iOS and Android successful?" Tinker added that MobileIron works with everyone from Box to Microsoft and has a long list of partners.

BlackBerry makes top 10 enterprise mobility management cut, says Forrester

Good Technology CEO Christy Wyatt sings from the same neutral party hymnal. "There's a lot of confusion in the market. Bring your own was the buzzword for 2013. 2014 has collaboration. Computing three to four years from now you won't know the difference between a PC, phablet or phone," she said.

The one certainty with mobility is that heterogeneity will rule. "We are a large pure play on mobility that offers value. We have no agenda with a phone, OS or virtualization strategy," said Wyatt, referring to her rivals.

Independence is one of the big themes for EMM players like MobileIron and Good Technology. These companies are focused on mobile management and that's all they do. In the EMM space, independence and focus are hard to find. Among big players EMM is either part of a bundle — VMware's AirWatch and Citrix Xen Mobile are likely to have an attempt at desktop virtualization cross selling — or neutrality with suites have to be proven over time. Will Microsoft really want to manage iOS and Android as well as it does Windows? BlackBerry manages iOS and Android devices too. But since both of those vendors have their own platforms the burden of proof is on them to show they're neutral.

Featured

John Sims, president of enterprise services at BlackBerry, says EMM vendors with their own platforms will have to show how they can manage other mobile operating systems well. "The proof point will be when we treat iOS and Android and Windows just like we would BlackBerry," said Sims. "We have to manage users not devices."

Not surprisingly, the CEOs of MobileIron and Good will play up the neutrality theme. IBM's MaaS 360 could claim neutrality to some degree, but Big Blue's deal with Apple may give iOS most-favored-platform status. Samsung has put together enterprise services to manage devices and can secure iOS too. However, Samsung has been known as an Android specialist.

If you're a tech buyer who buys into best of breed approaches over suites, then the Switzerland of mobility argument may hold weight.

Document management

The elephant in the EMM room at the Gartner conference was Microsoft. You've probably heard of the spiel by now. Microsoft is going to rev its enterprise mobility suite, which includes management tools as well as Office 365 collaboration. Security will be layered all the way down to individual Office docs. Microsoft's container will revolve around identity — Active Directory in Azure.

Tech Pro Research

It's hard to argue that Office, Microsoft's best platform, isn't a winner in the enterprise.

Other EMM players all have a spin on secure document management. Citrix has its Worx suite for productivity and historically has partnered with Microsoft even when the two look like they'll compete. AirWatch has document management as does Good and just about every other player.

BlackBerry has document management too in its EMM message, but security is the big selling point.

Brad Anderson, corporate vice president of cloud and enterprise at Microsoft, is enthusiastic about the software giant's EMM prospects and sees Office 365 and security as the main selling points.

Anderson characterizes his competition as early EMM players who are maxed out on the innovation they can provide. He argued that containers in the mobile world will be built into operating systems and relegate some mobile device management features total commodities. "No one has critical mass among the early movers and they are stuck where they can go. Their ability to innovate is hitting a ceiling," said Anderson.

The secret weapon for mobility and Microsoft is the combination of Office 365, identity management and security. On security, Anderson said that devices will cede importance to identity management and the cloud and only Microsoft can secure the device, application, identity and file.

Microsoft's rivals all have productivity tools and the tech buyer will have to weigh the importance of Office when deciding to use the software giant for enterprise mobility management.

Future proofing

Every EMM executive will tell you their suites will future proof your mobility plans. After all, it's smartphones and tablets today, but wearables and Internet of things sensors tomorrow. Tech buyers are going to need applications that can handle whatever mobility play comes down the pike.

On this point, Microsoft is making a move. CEO Satya Nadella sees Windows 10 as an Internet of things option. BlackBerry via QNX, which is in autos and a bevy of otherend points, also makes the Internet of things points.

Here's the rub: For many CIOs at the Gartner conference, the Internet of things is on the radar but not top of mind or budget. Yes, every company and industry will become digital and retooled via smart machines, but not today.

Nadella: Windows 10 is an IoT play too

Samsung fires shots at Apple-IBM with enterprise device support

In other words, IoT future proofing is a nice to have, but a better option is to keep to short-term contracts and see what vendors really deliver over time. Make these vendors prove it.

AirWatch chief John Marshall, who now is part of VMware, said the future will include mobile with PC and application management too. To Marshall, the EMM wars will be won by platforms. AirWatch, Citrix and IBM are the subset of vendors that can manage the full spectrum of devices.

"You have to manage content and applications across the full spectrum," said Marshall. "There will be a shakeout."

According to Marshall, EMM is already becoming a zero sum game in the large enterprise as replacement cycles are underway. The mid-sized and small business markets are more green field opportunities. Marshall's point is that VMware doesn't have an OS, device or collaboration conflict and that virtualization across everything will be a winner.

Security

You can't talk EMM without yapping about containers. Containers are basically sandbox applications and data so devices can go missing, but critical information won't.

Container talk can make your eyes glaze over, but here are a few key points:

- Every EMM vendor has a container.

- Containers will be included in every operating system.

- Containers will be a commodity.

- Some vendors will try to use their containers as a way to grab market share by not playing nice with others.

- But a complicated mobile environment means these containers will have to be interoperable.

- In two years, you'll never hear about containers again as a differentiator.

The linchpin in the security equation as I see it is identity. Obviously, Microsoft has a big identity play, but companies like Centrify, which specialize in identity management, are just as important to the security equation.

Gartner gives Apple, Microsoft and Samsung mobile platforms about the same ranking in terms of enterprise security. Microsoft and Samsung are making EMM plays. It's worth noting that generic Android is viewed as insecure in the enterprise. Only Samsung's Android bundle will get enterprise traction.

At some point, security track record has to count for something. BlackBerry and Good have the most experience in regulated industries and if security is your biggest mobile issue those two will have to get a look.

BlackBerry's Sims has been meeting with customers over the last year ahead of November's BES 12 launch and is banking that security will be the defining factor with EMM. Sec "How many CIOs lost their jobs this year over security?" asks Sims. "We're going to have end-to-end security with an open architecture all the way to sensors. The conversation about the future of mobile management revolves around security."

All that said, only proof of concepts are going to surface security differences. Every EMM vendor is going to talk security because it's highly likely that a company won't get an auditor's sign off without mobile being locked down.