Forrester's U.S. IT spending forecast cut: Will 2010 show a rebound?

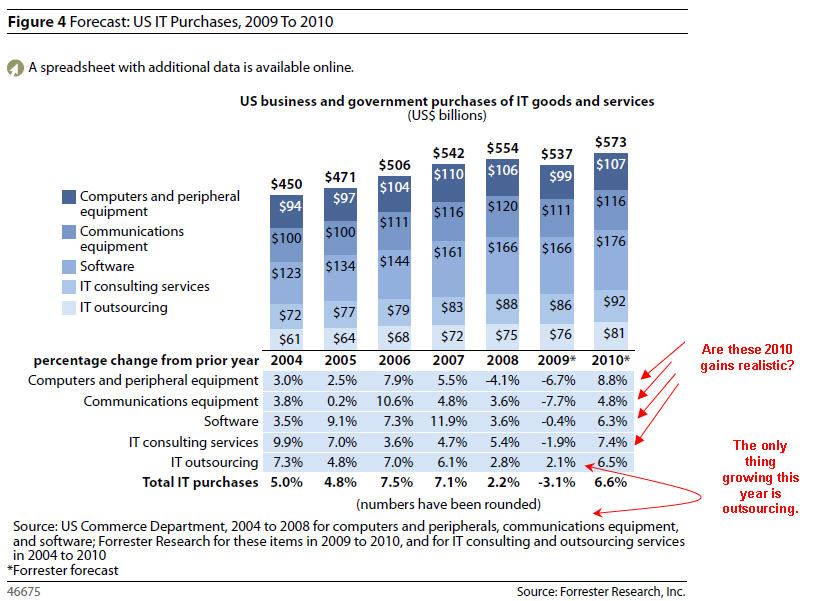

Forrester Research is now projecting 2009 IT spending to fall 3.1 percent, compared to the 1.6 percent decline the research firm had projected.

Forrester Research---along with Gartner---is the latest to cut its projections for 2009 following bleak fourth and first quarters (see full report). In many respects, the economy is confirming Forrester's subdued outlook. As expected computer equipment is expected to take the biggest spending hit in 2009. In fact, the only positive growth area in Forrester's forecast is outsourcing (and that's because it cuts costs).

The wild-card here is Forrester's assumption that there will be a late 2009 and 2010 rebound. Forrester analyst Andrew Bartels writes:

Computer equipment purchases will continue to bear the brunt of cutbacks in tech investment, but purchases of network equipment, software licenses, and IT consulting services will also drop. As the US economy starts to recover in late 2009, IT purchases will revive strongly, with strong growth projected for 2010.

Given that IT budgets are almost monthly and companies have no shot at providing guidance can a 2010 rebound really be on the table? After fall, Forrester has cut its U.S. IT spending forecast four consecutive quarters.

Here's a look at Forrester's money slide and my notes:

A few nuggets from Forrester's view behind the numbers:

- The credit crunch is killing IT capital expenditures. Forrester writes:

Companies large and small have been shut out of credit markets, and even those that still have access to bank loans, markets for commercial paper, or corporate bonds often have had to pay much higher interest rates. Businesses have responded by going into a cash-hoarding mode, with big and dramatic cutbacks in all forms of capital investment. Since many IT goods are in the capital budget, IT markets have taken a disproportionate share of the capital investment collapse.

- Computer and communications equipment spending in the U.S. will decline 6.7 percent and 7.7 percent, respectively, in 2009.

- Software purchases will decline slightly. Forrester sees all three categories rebounding.

- There was a breakdown of computer equipment revenue among key vendor in the fourth quarter. Only NEC showed revenue gains, up 7 percent. Storage is expected to recover quickly.

- For communications equipment only Cisco showed a gain in the calendar fourth quarter. Video conferencing and next-gen (4G, 3G) networks will be a bright spot.

- Software vendors mostly showed revenue gains in the fourth quarter. Hot software areas include: Virtualization, IT asset management, business intelligence and business process management tools.

- And the final item on Forrester's report can be summed up in one word: India. Forrester's recap of the outsourcing market shows Infosys, Tata Consultancy, ACS, Accenture, CSC, Wipro and IBM global services as showing revenue gains. You can argue that all of those players are big India players---the only difference is that some of the companies call India their home field.