HPE: Supply chain issues have been worsening

Finance

As HPE closes out the 2021 fiscal year, it expects supply chain challenges to remain an issue for at least another six months, the company said Thursday.

"We continue to navigate the industry-wide supply chain challenges that have been worsening lately," CFO Tarek Robbiati said during the company's Securities Analyst Meeting. "With materials in short supply and logistic costs rising, we expect the supply chain issues will likely take well into the second half of the next calendar year to begin abating."

At the same time, the company expects to end the fiscal year with even higher backlogs than it did at the beginning of Q4.

"The demand environment is also stronger with firm orders in Q4 across all our segments, which gives us great momentum throughout next fiscal year," Robbiati said.

Encouragingly, he said, HPE's edge-to-cloud strategy is delivering revenue growth that is increasingly recurring at higher margins.

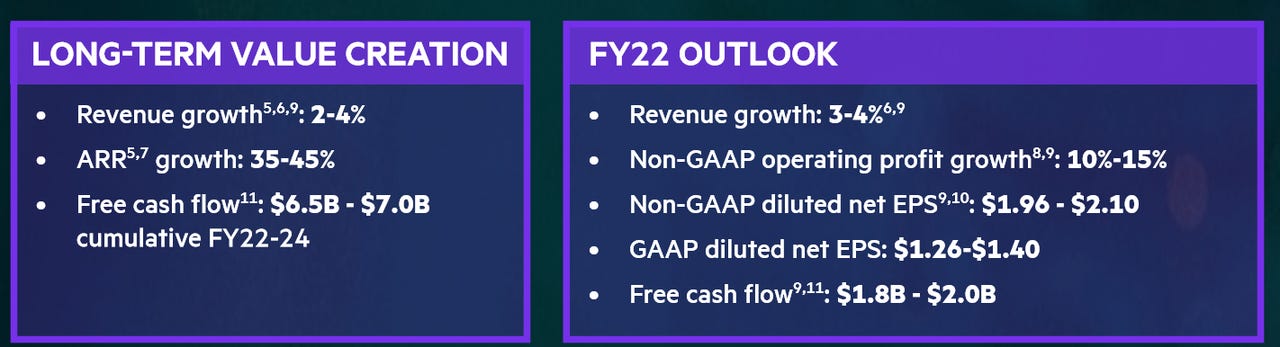

For the fiscal year 2022, HPE expects its revenue growth to be 3% to 4% in constant currency and non-GAAP operating profit growth of approximately 10% to 15% year-over-year. It expects non-GAAP diluted net earnings per share of $1.96 to $2.10.

HPE continues to shift towards delivering everything as a service, and by FY 2024, its as-a-service revenues should hit $2.3 billion, the company said. It expects as-a-service annual recurring revenue (ARR) growth to accelerate from 35% to 45% over the next three years.

A series of megatrends are driving the IT industry, HPE CEO Antonio Neri said during the meeting: the rise of data at the edge, a mandate for a "cloud-everywhere" experience, and the need to quickly extract value from data.

"Cutting across all these trends is the shift in how enterprises are consuming their technology, paying only for the IT they use," he said.

As of Q3 2021, HPE had 46% as-a-service order growth. The company has about 1,100 enterprise customers using GreenLake, the platform it launched about four years ago to deliver everything-as-a-service.

Between FY 2022 and FY 2024, HPE now expects a compound annual revenue growth rate of 2% to 4%. Its previous three-year view was 1% to 3%. The company said it expects to see growth across edge, HPC & AI, as well as its as-a-service businesses.

The company also said it expects the compound annual non-GAAP operating profit growth rate of 8% to 10%, driven by investments in key growth areas and an optimized operating model, which will be slightly offset by Other Income and Expense. HPE expects non-GAAP diluted net EPS to grow at a compound annual growth rate of 7% to 9%.