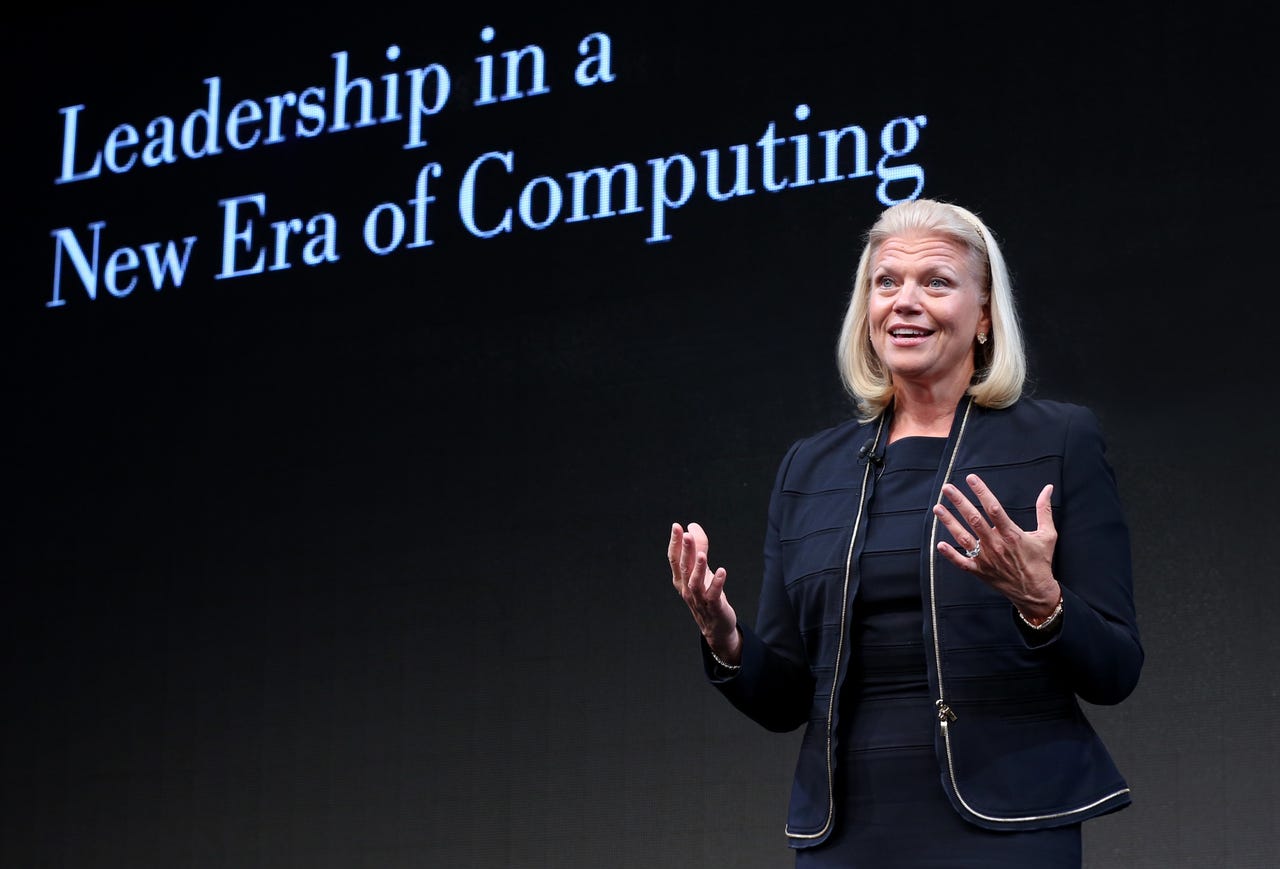

IBM boss Ginni Rometty to pocket a $3.6 million performance bonus

It's also no secret that IBM has been undertaking a lot of financial engineering, with the aim of driving up its stock price. Rather than grow the business, it aimed to raise earnings per share to $20 by the end of 2015, a pledge that Rometty abandoned when releasing IBM's third-quarter results in October last year.

IBM has also been taking on debt - which now stands at $41bn - to buy its own shares. Despite that, the latest financial results dropped the price by 14 percent. As a result, IBM became "the worst performer in the Dow Jones Industrial Average for a second straight year," according to Bloomberg Business News.

It was Bloomberg's Alex Barinka that spotted Rometty's bonus in a company filing. It revealed that Rometty is getting a salary increase of 6.7 percent to $1.6 million plus an incentive payment of $3.6 million, worth $300,000 a month. The bonus is based on operating net income (60 percent), plus revenue growth and free cash flow (20 percent each). You can only imagine how much she'd pocket if IBM had performed as well as Apple.

IBM's bosses forwent their bonuses for the 2013 fiscal year, no doubt realizing how bad it would look. Guess what, guys: it still looks bad.

Of course, you might expect IBM to run into trouble in the current decade. It has been making the bulk of its profits from hardware, software and services that revolve around its proprietary mainframes, which go back to the System/360 launched in 1964. Many of IBM's biggest customers in the Fortune 500 have been locked in, because moving off mainframes could be expensive enough to hit the quarterly profits by which American bosses live and die. Today, however, companies can shift new and some old workloads to cheaper cloud services operated by Amazon, Microsoft and Google in particular, as well as many smaller players.

It's interesting to speculate how IBM would be doing today if it had spent $100bn buying or building cloud infrastructure and high-quality software instead of buying back shares.

As it is, the current discussions are circling round the number of staff that IBM is going to lay off to reduce costs, though presumably this will also reduce the level of service on which its business is based. "Industry gadfly" Robert X Cringely predicted that 26 percent would go (IBM's reorg-from-Hell launches next week), which would be more than 100,000 people.

IBM denied the report, saying: "IBM has already announced the company has just taken a $600 million charge for workforce rebalancing. This equates to several thousand people, a small fraction of what's been reported."

It's unlikely that these "several thousand" will include the people most responsible for IBM's current predicament.