Once-tiny Microsoft has overtaken the mighty IBM

At the time, Microsoft had annual revenues of $7.5 million (not billion) and a staff of 40 that included a new hire from Procter & Gamble by the name of Steve Ballmer. By contrast, IBM had a turnover of $26.2 billion and a staff of 341,279 - it was about the same size as General Electric and Gulf Oil, but made more profits than both of them put together.

Of course, IBM had doubts about depending on such a small supplier, especially when its boss was around the same age as Jack Sams's son. But Microsoft had a stroke of luck. Phil Estridge, who was running the PC project, had mentioned the idea to IBM's president, John Opel, who said: "Oh, that's run by Bill Gates, Mary Gates's son." Opel knew Mary because they both served on the board of a charity, United Way.

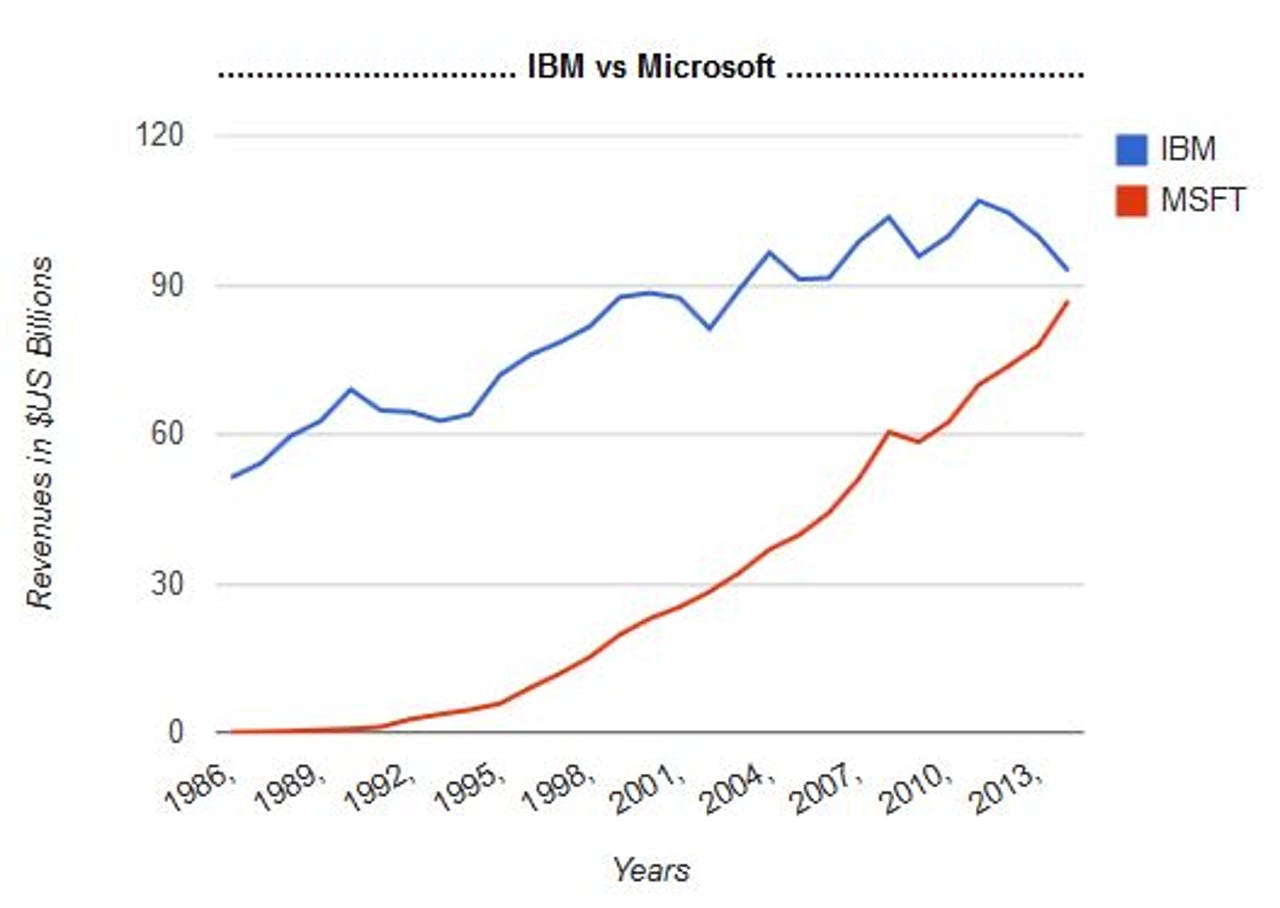

The latest financial results show just how dramatically things have changed.

Last week, IBM reported its 11th consecutive quarter of declining revenues, with sales that fell by almost 12 percent to $24.11bn. This week, Microsoft announced that its revenues had grown by 8 percent to $26.5bn for the latest quarter. The tiddler had actually overtaken Big Blue.

This overtaking reflects recent corporate manoeuvres. IBM has sold off its x86 server business to Lenovo, and paid Globalfoundries Inc - spun out of AMD - $1.5bn to take its loss-making chip-manufacturing unit. Microsoft, by contrast, has added revenues from acquisitions such as Nokia and, most recently, Minecraft.

However, Microsoft has been gaining on IBM for a long time, as my graph shows. In 1990, when Microsoft released Windows 3.0, IBM had a turnover of $69.0bn against Microsoft's $0.8 billion, but a "decade of Windows" narrowed the gap. By 2000, IBM had a turnover of $88.4bn while Microsoft's had climbed to $22.96bn. Now IBM was only four times larger.

In 2010, IBM had a turnover of $99.87bn while Microsoft's - after a decade mostly under Steve Ballmer - had grown to $62.48bn. So IBM was only about 40 percent larger than Microsoft.

Looking at the past 12 months, rather than fiscal years, IBM is still has a slight lead with revenues of $92.79bn against Microsoft's $91.50bn. But, barring the unexpected, it's reasonable to claim that Microsoft is now bigger than IBM by revenues, as well as by market cap. Microsoft is still growing, just, while IBM is in decline.

IBM should have become a $200bn corporation long before now - it peaked at $107bn - but instead has sold or hived off product divisions (printers, disk drives, PCs, x86 servers, chips etc) to concentrate on higher-margin offerings. But for all Ballmer's famous missteps, IBM still isn't as profitable as Microsoft.

Again, looking at the past 12 months, IBM declared $15.75bn in net income, $8.48bn in cash, and $40.80bn of debt. Microsoft had $21.37bn in net income, $88.54bn in cash, and $23.92bn of debt. So Microsoft is making more money, has half the debt, and 10 times the cash in the bank.

Microsoft richer than IBM? In the 1980s, that wasn't part of IBM's master plan for world domination....