IBM vs Microsoft and the battle for the corporate cloud business

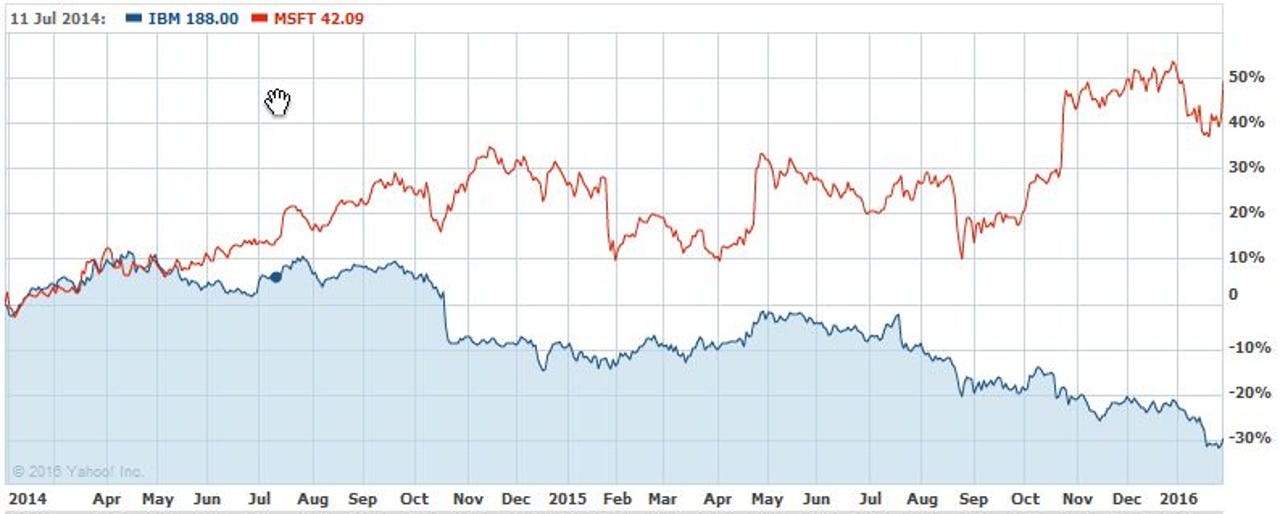

The graph of IBM vs Microsoft shares over the past two years suggests that Satya Nadella's story is working better than IBM CEO Ginni Rometty's.

One year ago, I wrote a blog post to mark the fact that Microsoft's quarterly results were better than IBM's, and that what had been a tiny start-up when it supplied IBM with PC DOS had overtaken a company that had had a monopoly market share of corporate data processing since the 1930s. Nobody expected that.

Of course, nowadays, both companies are trying to move from fading legacy businesses into fast-growing cloud-based businesses. And, like Apple, both have been hit by "headwinds" in the form of a strengthening dollar, which has devalued their overseas earnings.

IBM had also set itself up for a fall by selling its System X (Intel x86 server) business to Lenovo. This boosted IBM's profits when the deal went through, but hurt its revenues over the full year.

As a result, IBM's revenues fell by 8.5 percent to $22.1 billion in its latest quarter, and its profits fell by 18.6 percent to $4.5 billion. In the same quarter, Microsoft's revenues fell by 2 percent to $25.7 billion, but its profits grew by 8 percent to $6.3 billion.

This was IBM's 15th straight quarter of revenue declines, and in after-hours trading, its shares fell by 4.9 percent to $121.86, the lowest for five years. After Microsoft's results, by contrast, its shares jumped by "more than 8 percent in after-hours trading, but then gave back some of those gains", according to CNBC.

In its full year results, IBM's revenues dipped to $81.7bn, a fall of 11.9 percent. This is a level IBM first achieved in 1998, when Microsoft's turnover was $15.3bn and a struggling Apple could only manage $5.9bn. For comparison, Microsoft's revenues were $88.1bn in calendar 2015, while Apple managed an astonishing $235bn.

IBM peaked at $107bn in 2011, and looks unlikely to see that number again.

Either way, IBM's $81.7bn was some way behind the $93.6bn that Microsoft achieved in its fiscal 2015 results, declared in June. This substantiated my claim that Microsoft really was bigger than IBM.

But the real question is: Is everything is going to plan? IBM's stated strategy is to move out of low-margin businesses (PCs, servers, printers, etc) and into high-margin businesses. These are what IBM calls its "strategic imperatives": analytics, cloud, mobile, and security.

In the statement about its results, IBM claimed that "strategic imperatives" grew by 17 percent to $28.9bn in 2015, while "cloud as a service" grew by 50 percent to $4.5bn. In other words, these terrible results demonstrated IBM's success.

Fine, but I still see problems. First, IBM's "strategic imperatives" are still only a third of the company. Second, I can't see these "strategic imperatives" in IBM's results.

The fact is that, in its 2015 annual results, every IBM division showed a decline in revenues. Global Technology Services? Down 10 percent. Global Business Services? Down 12 percent. Systems Hardware? You'd expect that division to be struggling without x86 servers, and it was down by 24 percent. However, Software was also down by 10 percent, and that was supposed to be growing rapidly.

It makes sense that "strategic imperatives" businesses are spread across the company, but if every IBM division is showing revenues in decline, where are these fast-growing "strategic imperatives" making a meaningful contribution?

It prompts the suspicion that IBM is mainly cannibalizing its existing business, rather than developing new businesses. Indeed, it may be worse than that, because IBM has tried to bolster its strategy by buying roughly a hundred companies in the past decade. These include Cognos, which cost $5bn, Softlayer ($2bn), Netezza ($1.7bn), Kenexa ($1.4bn) and Trusteer ($1bn).

Obviously, Microsoft has a similar problem. However, Microsoft takes the view that companies can have clouds on their own premises, and hybrid clouds, so it doesn't really matter where the hardware is located. It has therefore bundled its server software into a new "Intelligent Cloud" division. Many customers will be running stuff in their own data centers, and some in Microsoft's, and they can move jobs between the two, so why should they be counted differently?

This approach makes Microsoft's cloud division look bigger and more successful than it really is. But at least Microsoft runs some very visible cloud businesses. These include Office 365, Dynamics CRM, Skype, Outlook email, OneDrive, Bing, Windows Store, Cortana Analytics etc. Second, Nadella claims that Microsoft is "the only one in this market providing SaaS, PaaS, IaaS and hybrid cloud at scale". This is winning new business from platforms that Microsoft didn't support before, such as Linux.

During the conference call following Microsoft's results, Nadella said: "The enterprise cloud opportunity is massive, larger than any market we have ever participated in." This is true. It's also one of the most competitive, with rivals that include Amazon, Google, and IBM.

It's a battle that looks likely to be won by price-cutting - led by Amazon and Google - and by the ability to support corporate customers - led by Microsoft and IBM. In that situation, IBM will have to provide much better services than Microsoft in order to justify the higher margins required by its "strategic imperatives" mantra.

While it's busy shedding thousands of experienced staff, to cut costs, I wouldn't bet on IBM doing that. Would you?