Tesla Q2 report crushes expectations: $11.96 billion revenue, EPS $1.45; shares rise

Tesla this afternoon reported Q2 revenue and profit that were sharply above Wall Street's expectations.

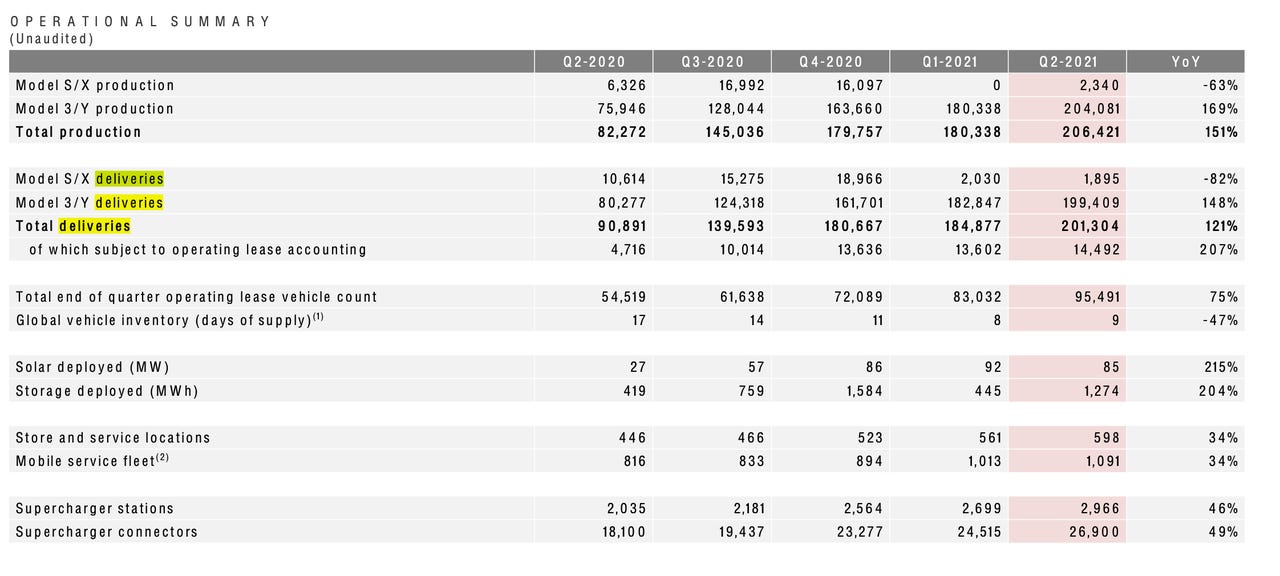

The report follows Tesla's announcement July 2nd of automobile deliveries that fell short of the highest expectations. The final number of deliveries reported this afternoon, 201,304, was slightly below the preliminary number on July 2nd of 201,520.

The report sent Tesla shares up almost 3%, inititially, in late trading.

The company noted in its shareholder letter that supply-chain challenges are still a risk to the company's production:

Supply chain challenges, in particular global semiconductor shortages and port congestion, continued to be present in Q2. The Tesla team, including supply chain, software development and our factories, worked extremely hard to keep production running as close to full capacity as possible. With global vehicle demand at record levels, component supply will have a strong influence on the rate of our delivery growth for the rest of this year.

Revenue in the three months ended in June nearly doubled, year over year, to $11.96 billion, yielding a net profit of $1.45 a share.

Analysts had been modeling $11.4 billion and 98 cents per share.

While the previous quarter had been dominated by Tesla's bitcoin investment, the only mention of the crypto currency this time around was a Bitcoin-related impairment charge that Tesla sustained of $23 million. Bitcoin has fallend over 20% since CEO Elon Musk tweeted on May 12th the company would stop accepting the currency for payment.

Also: Tesla sank $1.5 billion in Bitcoin in Q1, made small profit

Tesla said its gross profit margin was 24.1% in the quarter, compared to 21.3% in the prior quarter, and 21% in the year-earlier quarter. Tesla considers gross profit as a key indicator of its success as it seeks to consistently reduce the cost of goods.

Tesla said it expects to produce a 50% increase in deliveries on an annual basis over a "multi-year time horizon." That is the same expectation the company offered last quarter.