Twitter posts mixed Q1, revenue guidance light

Twitter reported mixed first quarter earnings results Tuesday, with revenue guidance that fell well below Wall Street's expectations.

The social network posted a net loss of $80 million, or 12 cents per share (statement).

Non-GAAP earnings were 15 cents per share on revenue of $595 million, up 36 percent year-over-year. Twitter said revenue came in at the low end of expectations because brand marketers "did not increase spend as quickly as expected."

Wall Street was looking for earnings of 10 cents per share with $608 million in revenue.

In terms of guidance, Twitter now expects second-quarter revenue in the range of $590 million to $610 million, which falls short of the $678 million expected. Twitter's shares were down more than 11 percent in after market trading.

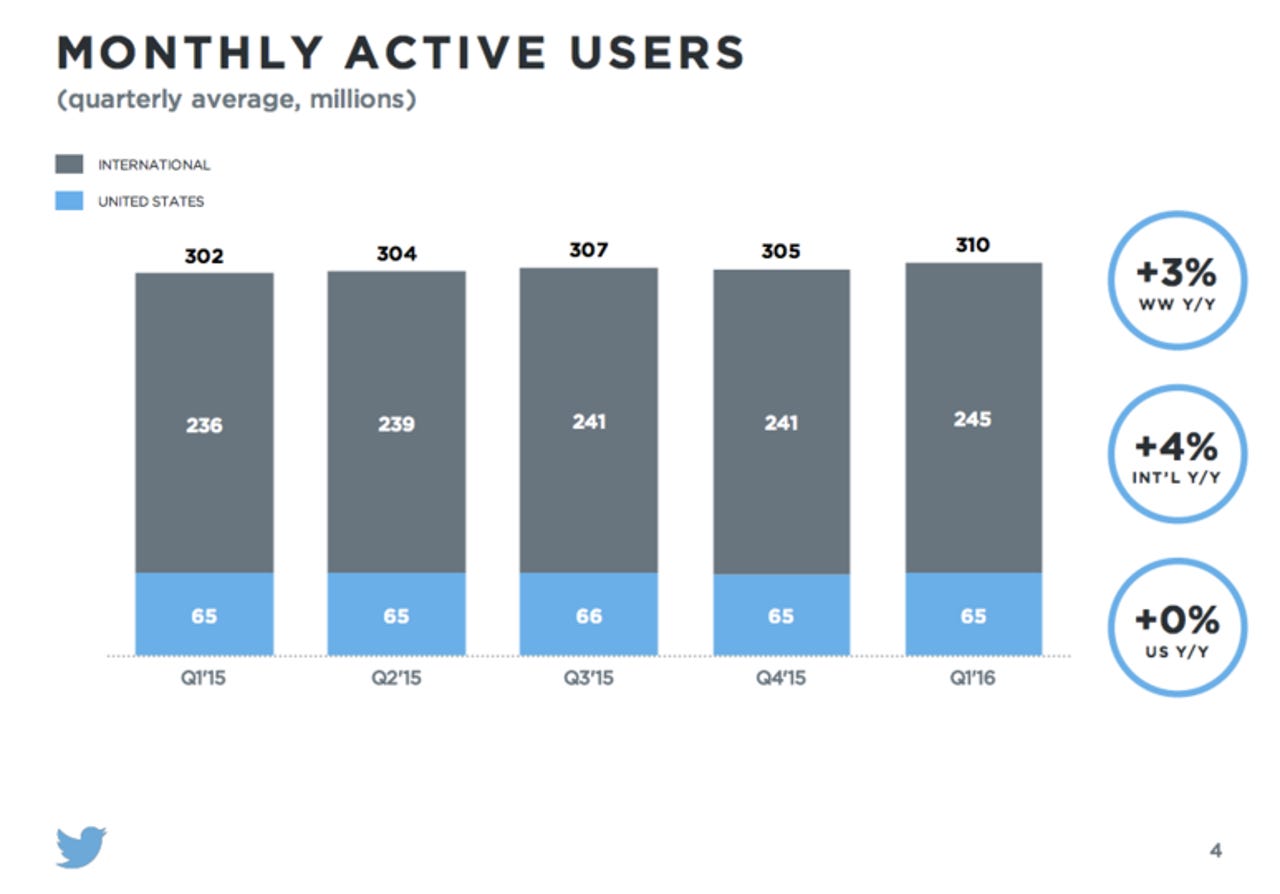

As always, Twitter's user growth and monthly active users (MAUs) remained a top interest for analysts. The microblogging giant has been unable to please investors on this front, with MAU totals repeatedly falling short of expectations.

Twitter reported 310 million MAUs for the quarter (83 percent from mobile). Comparisons here are a little tricky this quarter, as Twitter no longer includes SMS Fast Followers in the overall MAU tally.

That said, Twitter managed to add 5 million MAUs over the course of Q1. Wall Street had expected about 308 million MAUs. But as you can see in the chart below, MAU growth has been nearly stagnant for the last year.

"This is our first quarterly update after laying out our long-term strategy and priorities," Twitter said in the earnings release. "As a reminder, we have five priorities for the year: refining our core service, live-streaming video, creators and influencers, 3 safety, and developers. Each is critical to strengthening our platform and audience around live. We made meaningful progress across each in Q1."