Twitter Q4 dinged as monthly active users shrinks for the first time

Last week, #RIPTwitter predicted the death of the social network, ahead of a change to how the site displays users' timelines. This week, things don't look so hot for a different reason.

The San Francisco, Calif.-based company reported its fiscal fourth quarter and full year results after the bell Wednesday, marking the second round of earnings since Jack Dorsey returned to the company as its chief executive.

Although the company hit pretty much all its expectations, things looked dire in user growth.

Simply put: there wasn't any.

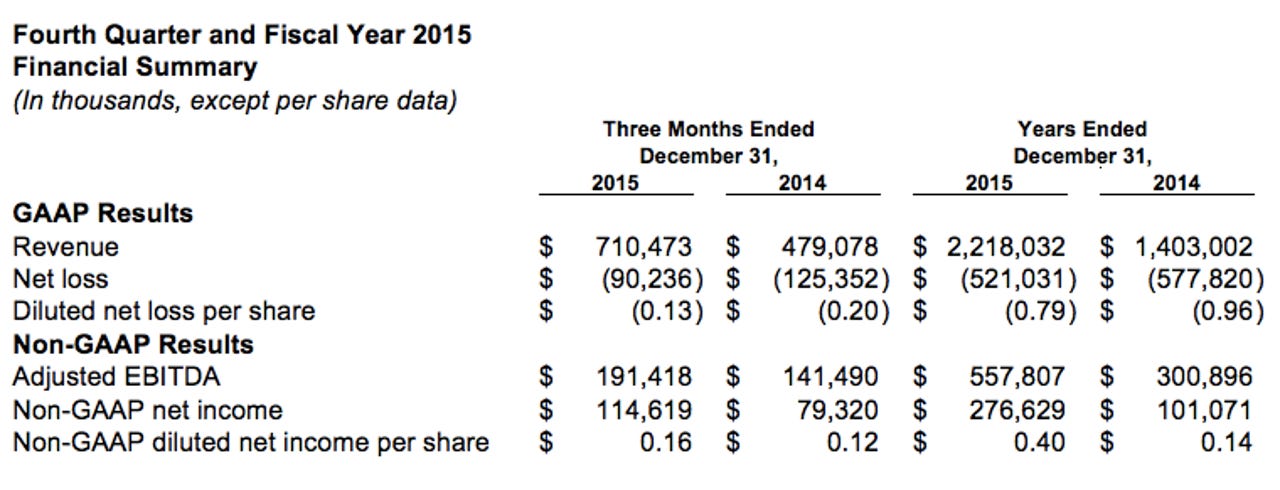

The microblogging site reported a fiscal fourth-quarter loss of $90.2 million, or a loss of 13 cents a share (statement).

On a non-GAAP basis, the company made 16 cents per share, on revenue of $710.5 million.

Wall Street was expecting 12 cents per share and $709.9 million in revenue.

For the full year, Twitter reported earnings of 40cents per share on revenue of $2.21 billion.

Wall Street was expecting 36 cents per share on revenue of $2.22 billion.

The big number that analysts had their eyes on were user growth and monthly active users. The company said it had zero user growth on the previous quarter, with the final user headcount standing at 320million users.

Analysts were expecting 325 million monthly active users.

But if you break down the figures, Twitter kept its international users at 254 million but lost one million users in the US as compared to the previous quarter, based on the release.

Year-over-year, the company saw a 9 percent growth.

Looking ahead, Twitter said it expects revenue between $595 million to $610 million, far below Wall Street expectations of $629.25 million

The company's stock ($TWTR) stock wasup 4 percent at market close, but collapsed in after-hours trading, falling at one point as 7.5 percent.