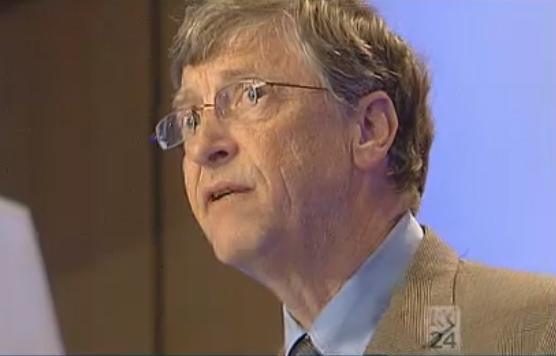

Changing tax laws won't bring in 'big cheques': Gates

As governments around the world look at ways to ensure big multinational corporations like Google, Apple, and Microsoft have their profits taxed in the country where that profit is generated, and not a country with a much lower tax rate, Microsoft co-founder and philanthropist Bill Gates has said that it's a good debate to have, but has warned that it will not bring in the big revenues governments are chasing.

In Australia, the government and the opposition have both pledged to close the loopholes that allow multinationals to send their profits offshore to avoid being taxed in Australia, as last week Apple CEO Tim Cook appeared before US congress to say Apple would bring more of its capital back to the US if the country had a "reasonable" tax rate.

Gates, who is in Australia to promote the work of the Bill and Melinda Gates Foundation's philanthropic work, told the National Press Club in Canberra today that he wasn't sure that closing the loopholes would ensure governments get their definition of a "fair share" of revenue from the mulitnational companies.

"That's a good debate people should have, but I don't think, whatever your definition of the word 'fair' is, that unless you change the laws, that they're likely to come bearing large cheques," he said.

Gates said that tax laws should always be discussed.

"My dad led a big campaign in the United States to preserve estate tax, which I thought was a very appropriate thing," he said.

"You won't find many people who are for a tax. It's kind of easier to be for spending than it is to be for tax, so I applaud everyone who's brave enough to get criticised for being for the mechanism that has to raise some amount of revenue to perform these functions."

Gates, who this morning had met with Prime Minister Julia Gillard and Opposition Leader Tony Abbott to lobby for an increase in Australia's foreign aid budget, devoted most of his speech to his work with the foundation, and its work in helping the world's poorest and dealing with diseases in developing nations.

Gates said that despite loving his work at Microsoft, he wanted to work on something that would reach the world's poorest, which technology doesn't quite reach.

"I devoted myself to a company that would participate in building the software that would bring that capability to life, that would give us all the tool to communicate and create in new and different ways," he said. "And that digital revolution is literally just at the beginning."

"But when I chose to change and focus on the foundation, I saw that technology doesn't naturally get to those most in need, and in fact, their most basic needs are not initially related to IT or the digital revolution in any way. In fact, the needs are based on wanting their children to live, wanting their child to have nutrition and to grow up to achieve their potential."

But Gates acknowledged that there was a difficulty in moving from the tech world to philanthropy. He said that while in Microsoft, he would be aware of signals from the market that would say whether the company is heading in the right direction, with philanthropy, it is much harder to determine whether the aid is going in the right places. He said it was essentially starting fresh.

"The difficulty with philanthropy, when you start out, you're naive."