Big data and the disruption curve

Big data projects are aimed at revenue growth, many efforts are being funded by business units and not the IT department and money is increasingly being diverted from large enterprise vendors.

The Cowen take is interesting given that other Wall Street firms such as UBS are betting that Oracle and established players can ride the big data wave. Goldmacher sees big data as being much more of a threat to incumbents.

Here's a look at the highlights:

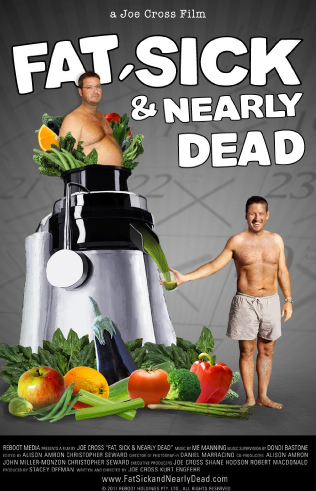

- Walmart uses big data techniques to take advantage of a spike in demand for juicers that correlated with a Netflix movie that discussed the benefits of juicing. Walmart is also segmenting the customer base on browsing and shopping patterns.

- Social media streams are layered in with broader data rivers.

- Money is flowing to big-data specific startups instead of legacy enterprise companies, which are expected to consolidate the industry at some point.

- Business units are funding big data projects separately. Big Data is a top three priority at Walmart and Intuit.

- Based on an audience poll, 70 percent of big data projects revolve around customer facing ventures---driving sales and boosting retention.

- Who benefits from big data? Forty two percent of the audience thought startups like Cloudera, Hortonworks and MongoDB would gain followed by storage vendors such as EMC and NetApp at 31 percent. Incumbents like Oracle and IBM got 15 percent of the vote with hardware vendors pulling 13 percent.

- Walmart Labs bought Kosmix and has licensed Twitter's Firehouse to determine product placements. This data analysis effort runs on different infrastructure than Walmart's core systems.

- Based on the Cowen analyst, 41 percent said business unit budgets would fund big data projects followed by special discretionary outlays (25 percent). Another 25 percent expected to divert dollars from existing vendors to big data players. And 9 percent expected big data projects to fund themselves.

Related: