Netflix makes case for its price moves, but cuts Q3 outlook

Netflix defended its decision to raise prices on DVD and streaming movie bundles, but does anticipate some impact to the third quarter as it delivered a weaker-than-expected outlook.

Netflix reported second quarter earnings of $68.21 million, or $1.26 a share, on revenue of $788.6 million. Wall Street was looking for earnings of $1.11 a share on revenue of $791.5 million. The three months ended June 30 reflect a quarter that ended before Netflix changed its pricing model. Neflix ended the second quarter with 25.56 million subscribers.

But all eyes were on the company's outlook with the price change. Netflix decoupled its DVD by mail and streaming media plans. One DVD out and streaming movies is now $15.98. Netflix said in a shareholder letter:

Some subscribers will cancel Netflix or downgrade their Netflix plans. We expect most to stay with us because each of our $7.99 plans is an incredible value. We hate making our subscribers upset with us, but we feel like we provide a fantastic service and we’re working hard to further improve the quality and range of our streaming content in Q4 and beyond.

In Q3 we will see only the negative impact of the pricing change, given that the announcement was early in the quarter and that the increases won’t take effect until late in the quarter (September 15th on average). We expect domestic net additions in Q3 to be lower than the previous year Q3, and because of the timing of the price change, revenues will only grow slightly on a sequential basis.

Speaking during the company's quarterly conference call for investors on Monday, CEO Reed Hastings maintained an optimistic front:

The price change takes effect upon each subscriber's renewal in September. So we don't have a full range view of it. But so far, from what we've seen, we've been very pleased at the effects and we're feeling great about the decision. As tough as it is. And it's going to allow us to have just fantastic streaming content going forward.

The fact that some folks will leave Netflix or downgrade will hit the company's financials. Here's the overview:

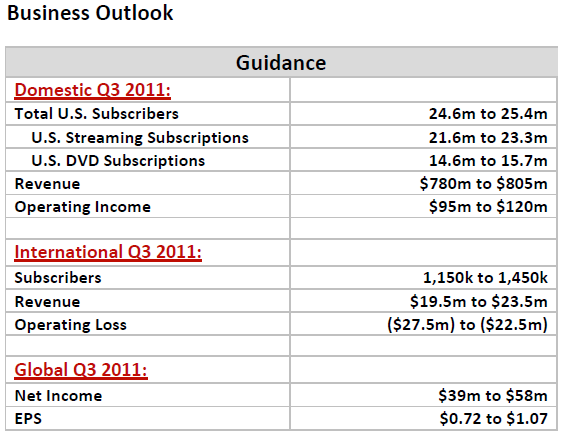

Overall, Netflix is projecting $799.5 million to $828.5 million in third quarter revenue with earnings between 72 cents a share to $1.07 a share. The problem: Wall Street was looking for earnings of $1.09 a share on revenue of $846.5 million.

It's also worth noting that Netflix's wide earnings range reflects continued investment, international expansion and the fact that the company doesn't know how its pricing will affect its customer base. Netflix projected U.S. subscribers of 24.6 million to 25.4 million with streaming customers being 21.6 million to 23.3 million of that sum. DVD subscriptions will be 14.6 million to 15.7 million.

On the international front, Netflix is expecting 1.15 million subscribers to 1.45 million subscribers.

Netflix's bet is that it can weather the storm in the third quarter and then resume growth in the fourth quarter. The company said:

In Q4, we expect domestic net additions to return to a pattern of year-over-year growth while revenue will reflect a full quarter’s impact of the pricing changes, which could result in Q4 being our first billion dollar global revenue quarter, driven by strong U.S. performance.

However, it's unclear this third quarter slump and fourth quarter rebound will play out. The economics from Netflix in the second quarter illustrated a few trouble spots.

- The company's domestic churn rate was 4.2 percent in the third quarter, up from 3.9 percent in the first quarter. Netflix's churn rate is in line with the historical norm, but came in at the highest level since the third quarter of 2009.

- Netflix spent $15.09 to acquire a customer who delivered an average of $11.49 in revenue each month.

- The company expects revenue to increase in the fourth quarter, but it is targeting a 14 percent domestic operating margin because it will spend more on content.