Nokia cuts outlook, cites competition, Euro, pricing

Nokia cut its second quarter and 2010 outlook due to "multiple factors" including fierce competition and higher costs. Nokia said its device sales will be at the lower end of its range.

As noted before, Nokia is feeling the heat from Research in Motion and Apple in the smartphone market. Simply put, Nokia just doesn't have a smartphone response yet. It doesn't help that the decline of the Euro vs. the U.S. dollar has increased its cost of goods sold.

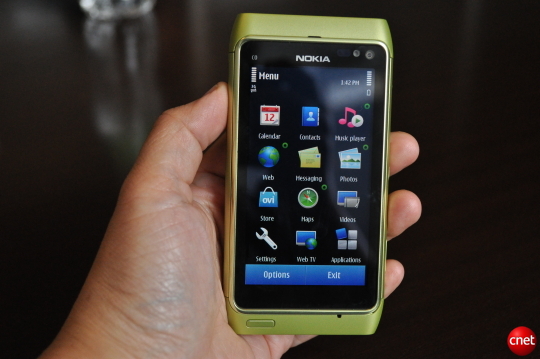

In short, Nokia can't use price as a weapon as easily across the globe. Toss in the fact that Nokia lacks the high-end smartphones to keep RIM and Apple, two companies hellbent on competing in key markets like China, at bay. Nokia's new smartphones (right) don't arrive until the third quarter.

Nokia's new outlook goes like this:

- Device and services sales will be at the lower end or "slightly below" its range of 6.7 billion to 7.2 billion Euro for the second quarter. The decline is due to lower average selling prices and volume.

- Device and services operating margins will be below Nokia's 9 percent to 12 percent target.

- For 2010, Nokia expects the industry's mobile device volume to grow 10 percent.

- For 2010, Nokia plans on keeping market share flat.

- Nokia expects to lose share in the high-end phone market.

- Full year operating margins will fall short of the 11 percent to 13 percent target.

Nokia reports earnings on July 22.

The only good news for Nokia is that analysts seem to have been expecting the worst. Simply put, expectations for Nokia were extremely low. In a research note June 13, Oppenheimer analyst Ittai Kidron chronicled how Nokia's second quarter was unraveling.

Kidron wrote:

Based on our most recent channel checks, we believe Nokia's performance in the quarter is likely worse than we first envisioned in our recent company update on 5/26. Our checks suggest the company is challenged on almost every front, from pricing pressures through share losses to poor product mix (graphic and tier). We're aggressively cutting our estimates (2Q10 EPS of €0.10 vs. consensus €0.14) and wouldn't be surprised to see even further downside to our well below Street revised targets as the only possible relief (N8 and C7) is still more than a quarter away.

We believe Nokia is seeing strong competitive pressures from Samsung and LG, which are aggressively pricing this quarter. Also, the Chinese vendors continue to take share.

Related:

- Nokia feels the smartphone heat

- Nokia N8 hands-on (photos)

- Can T-Mobile improve Nokia mind share in the US?

- Nokia announces reorganization of devices and services business

- Nokia, Symbian still lead smartphone market, Gartner says

- Nokia adds Apple's iPad 3G to its lawsuit parade: The 5 patents in question