ebay beats Q3, adjusts guidance for Q4, FY08

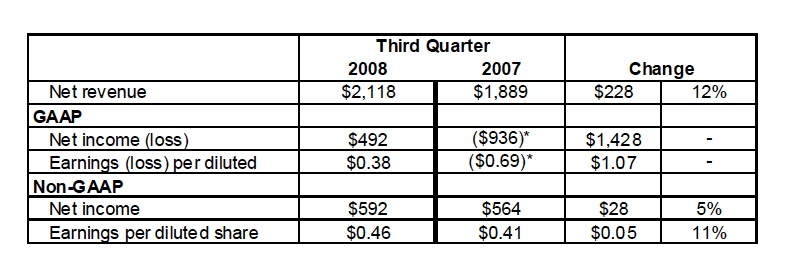

eBay reported third quarter earnings today, beating Wall Street’s expectations with revenues of $2.12 billion, up $228 million from the third quarter of 2007. It reported non-GAAP profits of $592 million, or 46 cents per share. GAAP profits were $492 million, or 38 cents per share. Analysts had been expecting 41 cents per share on revenue of $2.1 billion. (statement)

Of course, these days, Wall Street analysts seem to be caring less and less about the quarters that just ended. Their eyes are on the quarter that we're in now - the one that's feeling the biggest pinch from global economies in crisis. Their concern is on the outlook for the fourth quarter and full year.

In its statement, the company updated its guidance to "reflect current business trends," as well as other factors:

- Fourth quarter 2008 — eBay expects net revenues in the range of $2.020 to $2.170 billion with GAAP earnings per diluted share in the range of $0.25 to $0.27 and non-GAAP earnings per diluted share in the range of $0.39 to $0.41.

- Full year 2008 — eBay now expects net revenues in the range of $8.525 to $8.675 billion with GAAP earnings per diluted share in the range of $1.32 to $1.34 and non-GAAP earnings per diluted share in the range of $1.69 to $1.71.

Shares of eBay were down more than 13 percent in regular trading Wednesday, closing at $15.33. On news of the revised outlook, shares continued its downward spiral in after-hours trading, dropping more than six percent in the hours after the bell to $14.40.

The company said it benefits from its diverse business offerings, notably growth in PayPal, Skype and global classifieds.

Other company highlights from the quarter:

- Marc Andreessen, founder of Netscape, Loudcloud and Ning, joined the eBay Inc. board of directors.

- eBay Inc. repurchased approximately 25 million shares of its outstanding common stock at a cost of approximately $623 million. Since the inception of the stock repurchase program in the third quarter of 2006, the company has repurchased approximately $5.3 billion of its common stock.

- eBay lowered listing fees for the Buy It Now format by more than 70% and extended listing periods to 30 days, up from seven.

- The company’s global classifieds businesses averaged 84 million unique visitors per month during the quarter, representing an increase of 55% year-over-year.

- Payment volume from PayPal’s merchant services business exceeded the volume received from the eBay marketplace for the first time.

- Skype-to-Skype minutes reached nearly 16 billion, a 63% increase year over year.

Earlier this month, following the close of the third quarter, the company announced the acquisition of online payment company Bill Me Later for $820 million in cash and $125 million in outstanding options. At the same time, it announced a 10 percent reduction of its workforce, or about 1,000 jobs.

The online auctioneer is being squeezed by rivals like Amazon and taking a hit from a slowing economy. Another theme: It’s unclear whether consumers want to screw around with auctions long term. As a result, eBay’s traditional growth is slipping. eBay said it will take charges of $70 million to $80 million in the fourth quarter.

In a call with analysts today, CEO John Donahoe acknowledged the uncertain times of the fourth quarter and year ahead. But he also tried to paint a picture of a company that's well-positioned to help cash-conscious customers buy, sell and communicate. PayPal, he cited as an example, has strong momentum and, with the acquisition of BillMeLater, the company is situated as a leader when it comes to online transactions.