HP satisfies Q3 earnings targets; CEO Whitman 'pleased' with progress

Hewlett-Packard published fiscal third quarter earnings after the bell on Wednesday, and the results were both positive and negative, depending on how you look at it.

Tech Earnings

The tech giant reported net earnings of $985 million, or 52 cents per share, down 27 percent year-over-year (statement).

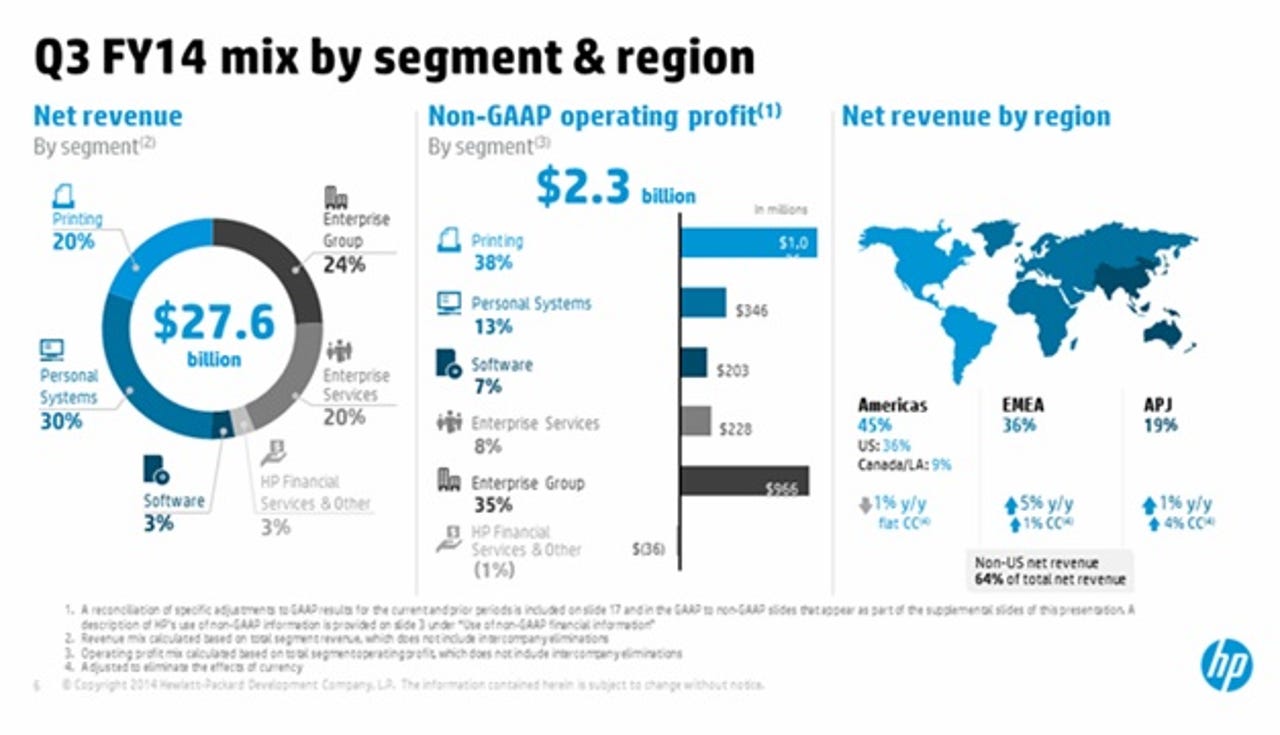

Non-GAAP earnings were 89 cents per share on a revenue of $27.6 billion, up just a point from the same time last year.

Wall Street was looking for earnings of 89 cents per share with revenue of $27.01 billion.

Declaring she is "pleased with the progress" HP has been making, CEO Meg Whitman reflected on the quarter in prepared remarks:

When I look at the way the business is performing, the pipeline of innovation and the daily feedback that I receive from our customers and partners, my confidence in the turnaround grows stronger.

Looking at HP's performance by department, the numbers were more of a mixed bag.

Personal Systems (i.e. desktops and laptops) and the Enterprise Group (a collective including servers, storage, networking and critical systems) all saw revenue rise year-over-year.

But Enterprise Services (i.e. infrastructure outsourcing and business app services), Printing, Software, and Financial Services all experienced declines on an annual basis.

For the current quarter, Wall Street is looking for earnings of $1.05 per share with revenue of at least $28.62 billion.

HP followed up with Q4 guidance of $1.03 to $1.07 earnings per share. For the year, HP offered earnings guidance of $3.70 to $3.74 per share.

UPDATED: Analysts and shareholders alike seemed pleasantly surprised with HP's revenue growth following quarter-after-quarter of declines and misses.

During the shareholders conference call on Wednesday, Whitman highlighted that Q2 marked "the third successive quarter of revenue growth for personal systems in a market that has stabilized but nevertheless continues to contract."

Nevertheless, Whitman argued that the expiration of Windows XP along with customers being pressed to upgrade should benefit HP.

"We believe we can continue to gain share in PCs despite the challenges in this market as it consolidates," Whitman reiterated.

Elsewhere, CFO Cathie Lesjak acknowledged "performance in printing, enterprise services and software was mixed."

Whitman concurred but touted personal systems and the server business as "back on track."

Our printing supplies business and parts of our software portfolio still face challenges, but HP today is nimbler and better prepared than ever to respond to rapidly changing business conditions, so the leadership teams in both these areas are quickly addressing those challenges. On the enterprise services side of the company, we're making progress. The nature of ES with longer business cycles and lengthy contract periods make it tough to realize improvements quickly, but I believe the changes Mike and his team are making are beginning to take hold. I'm confident that Enterprise Services is on the right path to improved performance and profitability.

Still, Whitman also warned that changes in the software unit, especially regarding Software-as-a-Service and subscription-based offerings, could stir up "near-term revenue headwinds," promising that this will position HP for "long-term success."

Slides via HP Investor Relations