Apple device activations double Samsung's during holiday season

Nearly half of all new mobile device and app activations across the United States during the week leading up to Christmas and the beginning of Chanukah were for the Apple iPhone, according to analyst firm Flurry.

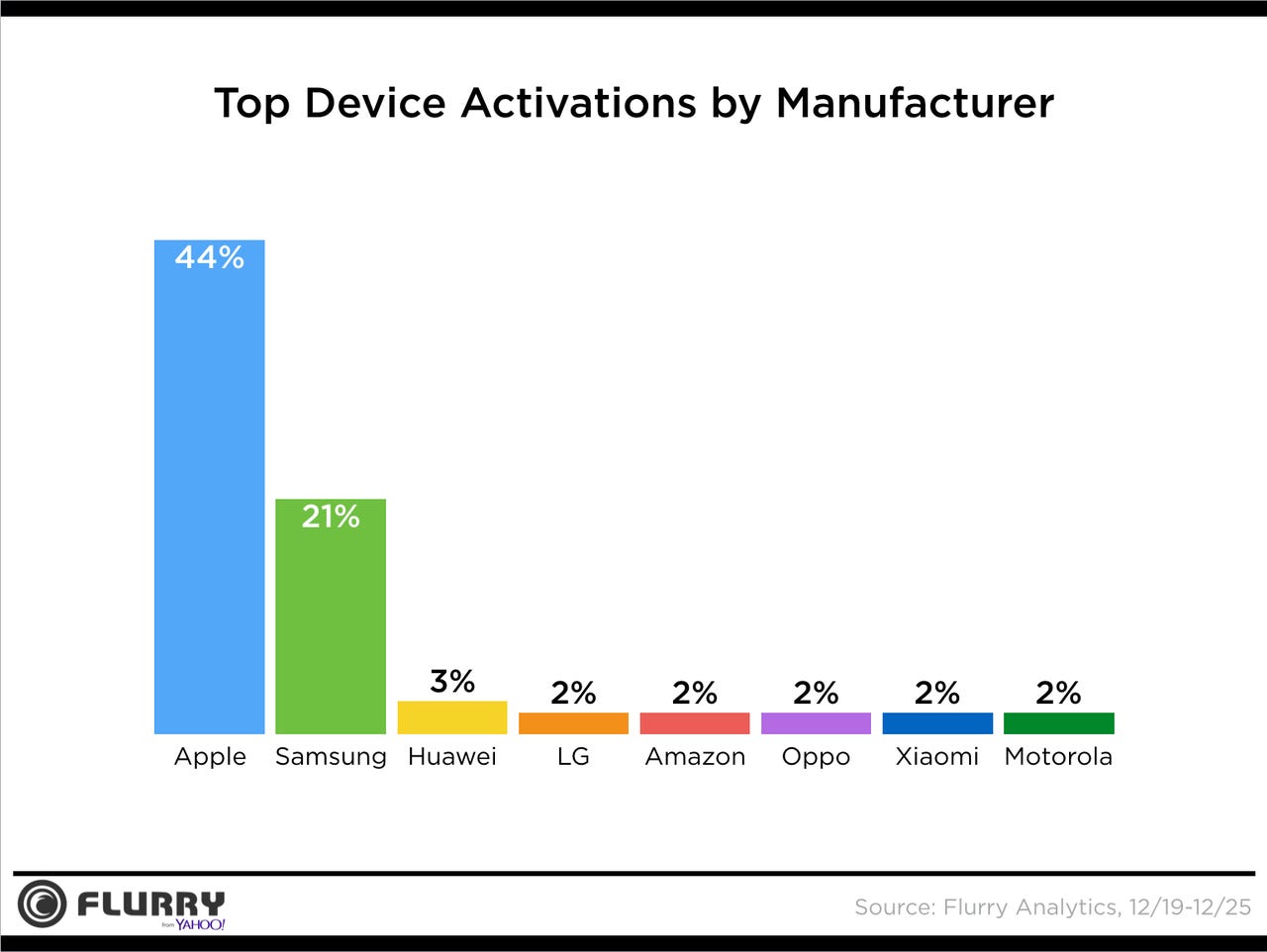

Flurry reported that during the week, 44 percent of all new phone and tablet activations involved Apple devices, while just 21 percent were across Samsung smartphones and tablets, with the latter still feeling the effects of its global recall of the Galaxy Note 7 in September following incidents of batteries catching fire or exploding.

Chinese giant Huawei came in at third position, representing 3 percent of activations, while LG, Amazon, Oppo, Xiaomi, and Motorola each accounted for 2 percent of device activations.

A blog post by Flurry director Chris Klotzbach and Flurry marketing and analytics manager Lali Kesiraju called Huawei and LG's rankings "remarkable", as neither has a device within the top 35 devices activated.

"Their high rank is likely due to the fact that they have wide variety of devices and affordable options (hundreds of phablet and medium phones) for consumers to choose from," Klotzbach and Kesiraju wrote.

They added that Google's new Pixel smartphones were noticeably but "not so surprisingly" missing from the activations chart, attributing this to its mixed reception.

Also missing from the list are Nokia and BlackBerry smartphones, which have been tipped to rise again next year under new owners and licensing deals.

As for phone sizes, 45 percent of all smartphones and tablets activated over the week leading up to Christmas were medium-sized phones, down from 54 percent last year; phablets grew from 27 percent last year to 37 percent this year; small tablets fell by 1 percentage point down to 8 percent; and full-size tablets and small phones stayed stable, at 9 percent and 1 percent, respectively.

Earlier in December, Kantar reported that iOS holds the greatest market share in Japan, accounting for 51.7 percent of smartphone sales during the October quarter; 44 percent of sales in the United Kingdom; and grew by seven percentage points over the year to reach 40.5 percent of sales in the US.

"The lack of the headphone jack has proved to be a non-issue for US iPhone consumers, as iPhone 7 was the top selling device in the three months ending October 2016, achieving 10.6 percent of smartphone sales, despite not being available for the full three month period," Lauren Guenveur, consumer insight director for Kantar, said in December.

Huawei, Microsoft, and Google each accounted for 0.5 percent of sales in the US.

In the quarter ending October, Android accounted for 75.2 percent of smartphone sales in the UK, Germany, France, Spain, and Italy.

Featured

"Android remains the dominant ecosystem, topping 75 percent across much of the globe," Guenveur said.

"This is not a surprise, nor should it be, as Android's business model provides consumers with a variety of brands and price points from which to choose. It's unlikely that any other OS will ever reach this level of penetration."

In Germany, the iPhone's market share dropped by 2.7 percentage points to account for 16.5 percent of smartphone sales during the quarter.

Apple has been using the iPhone 7 to grow its smartphone share in Australia, however, with IDC last month reporting that Apple's Australian mobile market share grew from 40.41 percent last quarter to 46.42 percent this quarter, thanks to the launch of the iPhone 7 and 7 Plus.

Despite this, Samsung continues to enjoy the second-highest smartphone market share in Australia, followed by Alcatel, with 60.2 percent of the market, up 1.9 percent year on year and 0.66 percent quarter on quarter; ZTE, with 5.17 percent market share, up 2.29 percent year on year and 1.64 percent quarter on quarter; Huawei, with 4.92 percent market share, up 2.36 percent year on year and 1.64 percent quarter on quarter; and others including Oppo, with 11.46 percent market share, down 4.36 percent year on year and down 2.75 percent quarter on quarter.

Last month, IDC reported Oppo topping the Chinese smartphone market, with 20.1 million shipments or 17.5 percent market share, growing by 106 percent year on year.

Oppo was followed in China by Vivo, with 19.2 million shipments or 16.7 percent market share; Huawei, with 18 million shipments or 15.7 percent market share; Xiaomi, with 10 million shipments or 8.7 percent market share; and Apple trailing in fifth place, with 8.2 million shipments or 7.1 percent market share.