Oppo and Vivo surge as Apple tanks in China

Chinese electronics manufacturer Oppo has topped the Chinese smartphone market for the first time, according to research by IDC, while Apple slipped to fifth place in the market.

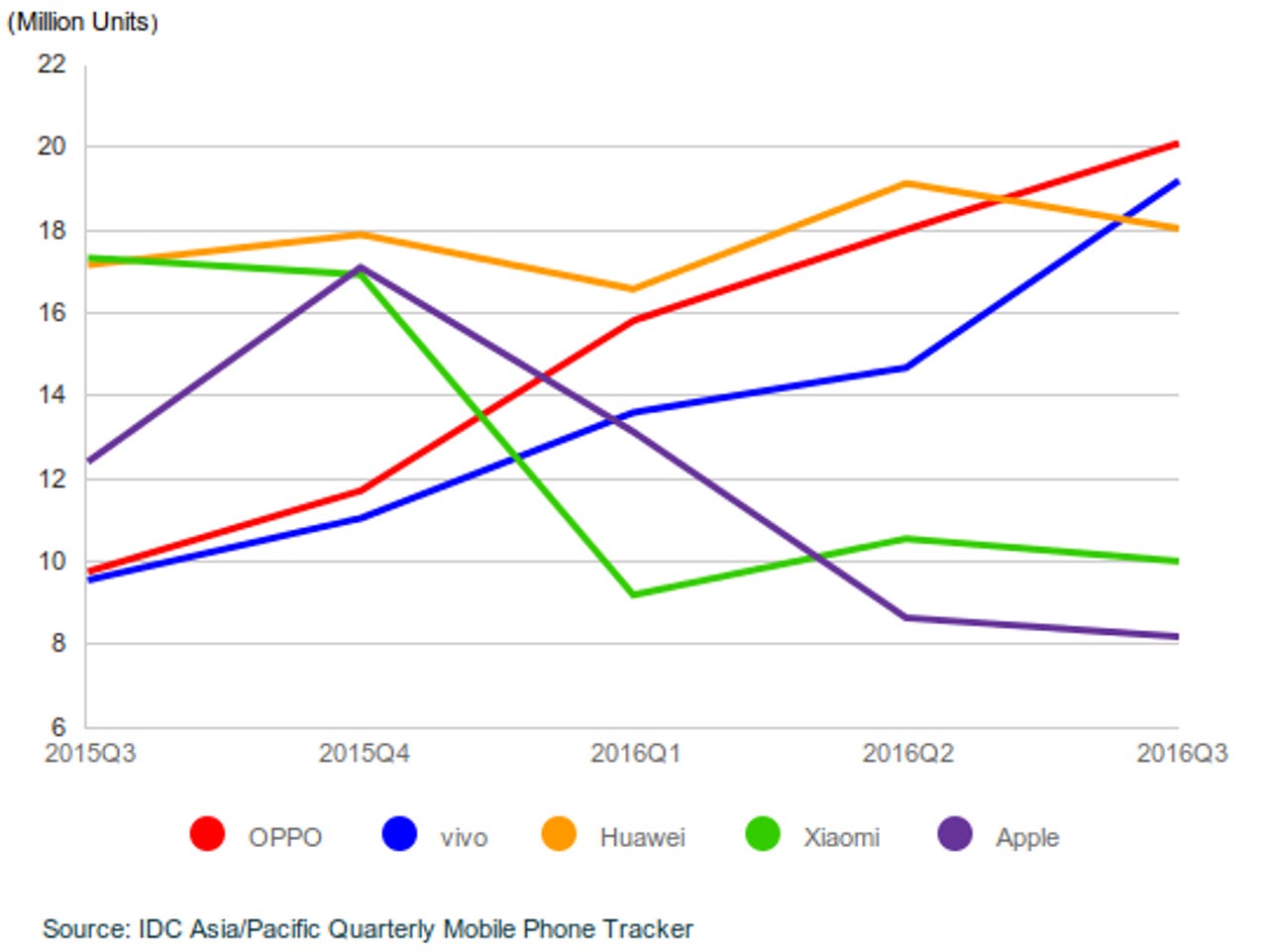

According to the research firm's Asia/Pacific Quarterly Mobile Phone Tracker, Oppo led the pack in China for Q3 2016 with 20.1 million shipments, or 17.5 percent of the market share -- marking year-on-year growth of 106 percent.

Latest news on Asia

This was up from Oppo's fourth-placed market share for Q3 2015 of 9 percent, or 9.8 million shipments.

The research firm added that the Chinese smartphone market has evolved beyond operator- and online-driven channels to an offline structure, which suits Oppo's strengths. It was also due in part to the success of its R9 handset, which played a big part in shipment numbers.

"Oppo's success is not something that was achieved overnight," said Xiaohan Tay, senior market analyst for Client Devices Research at IDC APAC. "Back in the earlier years, when vendors depended on operator subsidy to grow, Oppo was clear in its direction and focused on expanding its offline channels. It also had key strengths such as its VOOC fast-charging technology and in the elegant design of its phones. This, coupled with its aggressive marketing tactics, helped it succeed in the market."

Second-placed Vivo, with 19.2 million shipments or 16.7 percent market share, climbed from the lowest of the top five in Q3 2015, when it had 8.8 percent market share or 9.5 million shipments. It also marked year-over-year growth of 101 percent.

Vivo was followed by Huawei, with 18 million shipments or 15.7 percent of the market; and Xiaomi, with 10 million shipments, or 8.7 percent. In fifth place was Apple, with 8.2 million shipments or 7.1 percent share, down from third place in Q3 2015 when it had 12.4 million shipments and 11.4 percent of the market. Apple's year-over-year growth came in at negative 34.1 percent as a result.

IDC said that despite the slip for Apple, it expects the performance of the iPhone 7 to help it recover for Q4 2016, which will sell more than the 6s handset.

The Chinese smartphone market grew as a whole by 5.8 percent year on year, or 3.6 percent for the quarter. For Q4 2016, IDC expects the market to see both year-on-year and quarter-on-quarter growth. It also highlighted the need for offline channels and the need to focus on key customer areas in specific cities or provinces for a clear target audience.

"Blind expansion may eventually lead to higher risks and losses," Tay added. "It is also important for vendors to focus on investments in technology to have a key flagship product that stands out in the market. We have seen, in the case of Oppo, how its single product, the R9, played a huge part in increasing its shipment numbers and in getting people to talk about its brand."

Globally, Samsung shipped more smartphones than any other vendor for Q3 2016, with a market share of 20 percent; followed by Apple, with 12.5 percent; and Huawei, with 9.3 percent. The continued success of Samsung's Galaxy S7 and S7 Edge helped maintain the South Korean giant's hold despite the Note 7 disaster.

IDC said that globally, Chinese vendors Oppo, Vivo, and Huawei will increasingly challenge big players such as Samsung and Apple, due in part to high-end features at lower prices. The firm said that phones like the Oppo R9 and Vivo X7 are also having mild success in Western Europe due to athletic sponsorships, but that the US market will be crucial for global performance.

Earlier this year, IDC predicted global smartphone growth to slow to single digits due to a maturing market.