Apple posts record Q4 revenue, EPS, fueled by services and wearables

Apple published its fourth quarter financial results on Wednesday, reporting record Q4 revenues and earnings. The strong results, which beat expectations, were due to year-over-year growth in the wearables, services and iPad categories. Revenue from the iPhone was down year-over-year.

Shares were up in after-hours trading.

The Cupertino tech giant reported earnings of $3.03 a share, up 4 percent year-over-year, on revenues of $64 billion, an increase of 2 percent over the year prior.

Wall Street was expecting earnings of $2.84 per share on revenue of $62.99 billion.

"We concluded a groundbreaking fiscal 2019 with our highest Q4 revenue ever, fueled by accelerating growth from Services, Wearables and iPad," said Tim Cook, Apple's CEO. "With customers and reviewers raving about the new generation of iPhones, today's debut of new, noise-cancelling AirPods Pro, the hotly-anticipated arrival of Apple TV+ just two days away, and our best lineup of products and services ever, we're very optimistic about what the holiday quarter has in store."

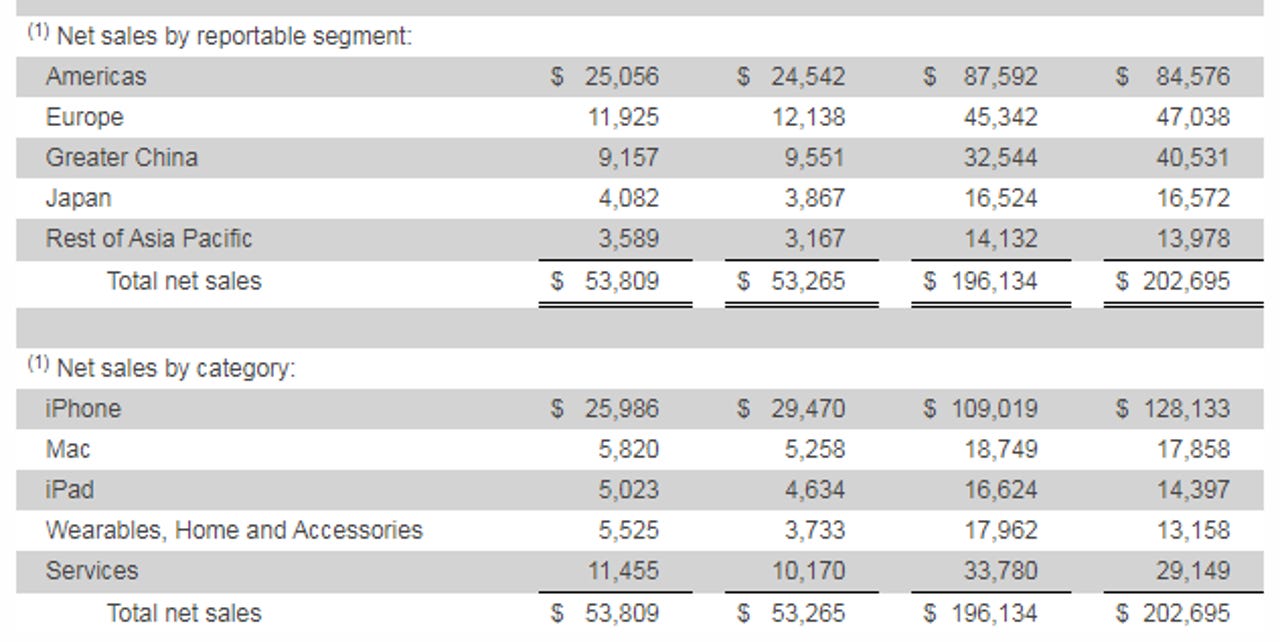

Revenue from iPhone sales totaled $33.36 billion, down from $36.76 billion in Q4 2018. Apple no longer breaks out product unit sales by device.

Apple announced the iPhone 11 lineup in early September, meaning the new devices didn't have much of an impact on Apple's Q4.

While iPhone sales were down 9 percent year-over-year, Cook noted on a conference call that this was an improvement over the 15 percent decline Apple saw in the first three quarters of the year.

"The significant upswing in demand in the final part of the quarter is mirrored in the overwhelmingly positive reviews, customer feedback and in-store response we've seen for this new generation of devices," Cook said with respect to the iPhone 11 lineup.

- SEE: iPhone 11 review: The best iPhone for most people

- iPhone 11 Pro review: Apple scores near perfect 10, thanks to battery life, cameras and phenomenal performance

- Apple iPhone 11 event: How you can still watch and what happened

He declined to forecast whether iPhone sales would return to growth in 2020 but said "the trends look very good." Cook added, "We put our current thinking in the guidance, and you can tell from the guidance, we are bullish."

Mac sales totaled $6.99 billion, down from $7.34 billion a year prior. The quarter looked relatively bad compared to a year prior, when Apple updated both models of MacBook Pro, Cook noted. However, for fiscal 2019 overall, Apple generated the highest annual revenue ever from its Mac business.

Meanwhile, iPad sales in Q4 came to $4.66 billion, up from $3.98 billion a year prior. The growth was driven by iPad Pro and the ongoing momentum of the wider iPad lineup, Cook said.

The Wearables, Home and Accessories segment brought in $6.52 billion, up from $4.22 billion a year prior. Apple set Q4 revenue records for Wearables in every single market that it tracks around the world.

Services revenue in Q4 came to $12.51 billion, up from $10.59 billion a year prior. Apple's services revenue amounted to an all-time high, Cook noted, beating the previous quarterly record by more than $1 billion. The Services business is now the size of a Fortune 70 company, Cook said.

Services saw double-digit growth in all five geographic segments, while Apple established new all-time revenue highs in multiple services categories, including Apple Care, Music and Cloud services.

Apple's Payment services also set an all-time revenue record, with Apple Pay revenue and transactions more than doubling year-over-year. With more than 3 billion transactions in the September quarter, Apple Pay exceeded PayPal's number of transactions and is growing 4x as fast, Cook said. Apple Pay is now live in 49 markets around the world with more than 6,000 issuers on the platform.

"We believe that Apple Pay offers the best possible mobile payment experience and the safest, most secure solution on the market," Cook said.

Cook also announced a new perk for Apple Card users -- customers will be able to purchase their new iPhone and pay for it over 24 months with 0 percent interest using the card. They'll also get 3 percent cash back on the total cost of their new iPhone.

Apple also announced Wednesday that its board of directors has declared a cash dividend of 77 cents per share of the company's common stock.

In terms of guidance Apple said it expects revenue between $85.5 billion and $89.5 billion for the first quarter of 2020. Wall Street is expecting revenues of $86.92 billion