Tech

Fitbit: Can it make the business-to-business, software platform turn?

Fitbit's outlook showed promise, but the company has to grow its software and services and corporate wellness business to diversify.

Fitbit's second quarter results, the first since the wearable device maker went public, highlighted two growth areas--software and services--that don't drive revenue today but could ultimately save the company from price wars.

The company sold 4.5 million connected devices in the second quarter, ramped revenue and used the marketing wave from its initial public offering to grow its brand.

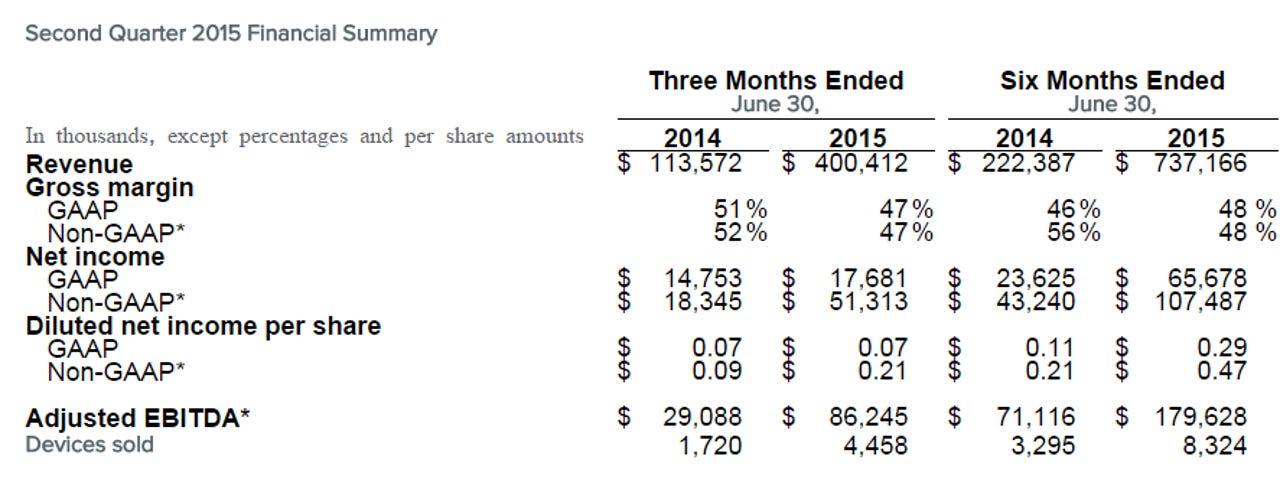

Fitbit's results were better than expected and broke down like this:

Meanwhile, Fitbit raised its outlook for the third quarter and 2015. The company is projecting 2015 revenue between $1.6 billion to $1.7 billion.

But to really project how Fitbit's business will diversify in the future you need to make a few bets on corporate sales as well as the company's software platform chops.

Special Feature

The easier mark is the corporate wellness business. Health care costs are only going up and companies are doing anything they can to make employees healthier (and therefore less expensive). In the second quarter, Fitbit said it signed 50 of the Fortune 500 companies to corporate wellness plans. Under these plans, Fitbit can sell devices in volume and ultimately use its data and software to offer other services.

Garmin may be signaling fitness wearable price war ahead | Samsung, Fitbit lead J.D. Power satisfaction rankings | Fitbit's big race: Grow software, services | Under Armour's digital product plan to be fleshed out | CNET Fitbit reviews

On a conference call with analysts, CEO James Park said:

Corporate wellness in 2019 is expected to be an $11 billion market. Again it's very early. Due to our early march and leadership position, we feel that were pretty well positioned to take advantage of the opportunity.

Certainly, Fitbit can work the enterprise cycle to move hardware and its integrated software. But to stay there, Fitbit's software and services will have to improve. On that front, Fitbit delivered the following software improvements:

- Redesigned the mobile experience for activity graphs on its apps.

- Updated the Fitbit Surge to enable GPS bike tracking.

- Users can use one account for multiple Fitbit devices so someone could shift from one at work to another for a run.

- Intelligence that can merge activity and access.

- Personal training on the Web.

Park noted that software and services is a "very small part of our business today." But the acquisition of Fitstar is a sign where Fitbit is going. The company wants to be more than a hardware company, but Park said "we don't want to set unrealistic expectations as to how quickly those revenue streams will build versus our hardware revenues."

Fitbit Charge review: Comfortable, easy, and powerful daily activity tracking

gallery

Edison Investment Research analyst Richard Windsor explained why Fitbit's software and services strategy is so critical. Fitbit's gross margins fell to 47.2 percent in the second quarter from 51.5 percent a year ago. Fitbit said the decline was due to newer products where the company couldn't drive down component costs. However, Windsor expects price competition at some point.

He added:

Typically the prices of devices fall faster than the components that are used to make them.

This means that gross margins are at their highest at launch and then decline over the life cycle of the product. Fitbit is likely currently able to hold its pricing flat over the life cycle of a product while still being able to optimize the cost of the components.

This would explain this unusual state of affairs and its very high gross margins but it also strongly implies that Fitbit is currently operating without any real competition. This is unlikely to last and as the market becomes more completive, Fitbit will have to begin cutting prices over the life cycle of its products.

This brings us neatly to the ecosystem issue. By creating an ecosystem around its devices that users love and upload their data to, Fitbit should be able to isolate itself somewhat from the ravages of competition when it finally emerges.

In other words, software and services for Fitbit can help it build a moat around what's likely to be a less profitable hardware business over time.