NextDC reports large jump in half-year revenue and pre-tax profits

NextDC has reported a 32 percent boost in revenue for the first half of its 2018 fiscal year, experiencing a jump from AU$58.7 million last year to AU$77.5 million for the six months ended December 31, 2017.

The company on Friday also reported a 41 percent jump in underlying earnings before interest, tax, depreciation, and amortisation (EBITDA) to AU$33.6 million. However, with an income tax expense of close to AU$4 million paid, compared to a one-off AU$11 million tax benefit last year, post-tax profit more than halved to AU$8.4 million.

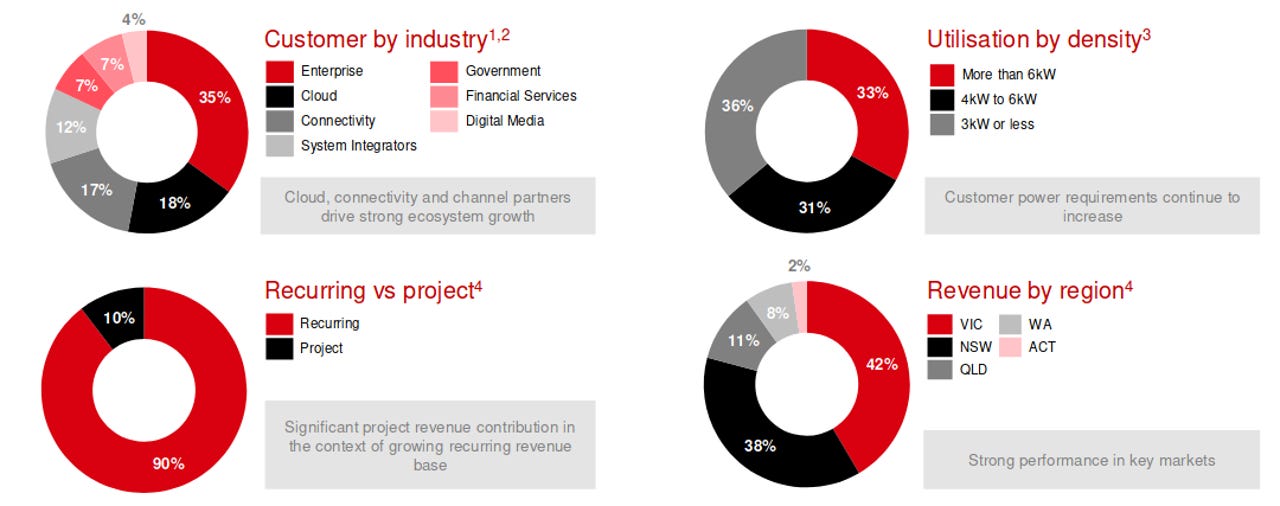

Broken down by state, Victoria and NSW carried the bulk of revenue and profitability, followed by Queensland, and Western Australia. NextDC's business in the ACT was the only geography not to be profitable, even though it doubled its revenue year-on-year.

NextDC said in its results that as of December 31, it has 39MW of contracted utilisation, which is 90 percent of its installed capacity, from its 875 customers, across all of its sites.

"The first half of this year was the largest sales half in the company's history. 1H18 also represented a watershed period in the development of NextDC's ecosystem, with the company adding a new record number of more than 1,100 interconnections," NextDC CEO Craig Scroggie said.

"As a result of tracking ahead of expectations, the company will upgrade its FY18 guidance and also accelerate new project investments in the second half of FY18. With liquidity greater than AU$500 million, combined with record operating cash flow, NextDC is in an outstanding position to take advantage of current and future customer opportunities."

In its outlook, the company said it is expecting a revenue increase of 23 to 28 percent for the full year, and EBITDA to grow by between 18 to 27 percent. The company cited the rising energy costs as a drag on profit, and said around 5 percent of its total direct costs were as a result of the increase, with its impact to worsen in the second half of the year.

Over recent months, NextDC has been involved in an ongoing tussle with the Asia Pacific Data Centre Group (APDC), after its ownership switched to 360 Capital in November.

NextDC has been pushing to have the real estate trust underpinning APDC wound up, stating that it is unhappy with the direction that 360 Capital is taking the company under its steerage, while APDC has been looking to sell off its Australian assets for around AU$300 million.

APDC was originally created as a real estate investment trust that was responsible for the buildings and land upon which NextDC operates its business, and, under the terms of the leases, if any sale of those assets is to occur, NextDC has first right of refusal on any sale of the datacentres.

Last week, APDC said it had an interested buyer of the datacentres solely occupied by NextDC, with the sale price set at AU$280 million.

NextDC has 20 days to exercise its refusal rights once a finalised sale contract is agreed to.

"Based on the limited information about the terms of the sale disclosed by APDC, NextDC is not currently prepared to acquire the APDC Trust's assets at a AU$280 million price," the company said last Thursday.

Related Coverage

APDC drops NextDC datacentre sale price to AU$280m

NextDC will need to cough up AU$280m if it wants to own the three datacentres it currently leases from Asia Pacific Data Centre Group.

NextDC offered APDC datacentres it occupies for 'illogical' AU$300 million

Asia Pacific Data Centre Group offers NextDC the datacentres it leases for a valuation it has already trashed.

NextDC looks to wind up APDC Trust following 360 Capital capture

Not happy with the direction of the new ownership of Asia Pacific Data Centre Group, NextDC is wanting to wind up the APDC Trust.

Oracle prepares for war with Amazon, adds 12 new data centers for cloud business (TechRepublic)

Oracle will add new cloud regions around the world over the next two years, in hopes of stealing market share from AWS, Microsoft Azure, and Google Cloud.

Packet rolls out AMD EPYC CPUs for global bare metal cloud

Get access to an EPYC 24-cores/48-threads processor, 64GB of RAM and gigabytes of fast SSDs for $1 a hour.

Samsung launches 30.72 terabyte SAS SSD

Samsung Electronics has launched a 30.72 terabyte SAS SSD, the PM1643, which boasts the largest memory capacity ever for a single form factor storage device aimed at next-generation datacentres.