Vodafone gains market share at expense of Telstra and Optus: Kantar

Competition between Australia's three major mobile carriers is "intensifying", according to market research company Kantar, and while Telstra still leads the mobile market by a significant amount, it made losses across its prepaid and post-paid mobile market share.

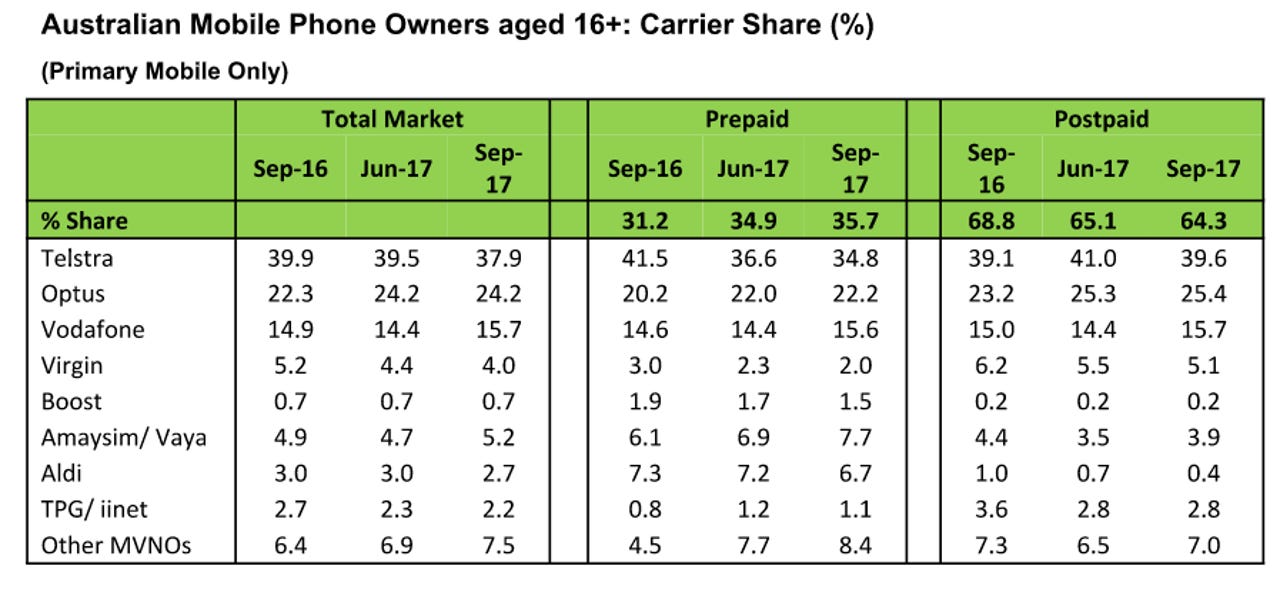

Kantar's most recent statistics for the quarter ending September 30 showed Telstra losing 1.8 percentage points in prepaid since June 2017, 1.4 percentage points in post-paid, and 1.6 points in total mobile market share.

Telstra's totals by the end of the quarter held 37.9 percent of the total mobile market, 34.8 percent of the prepaid market, and 39.6 percent of the post-paid market.

During the same period, Optus made very slight gains -- increasing its prepaid market share by 0.2 percentage points to hold 22.2 percent of the market, and increasing its post-paid share by 0.1 points to hold 25.4 percent.

Vodafone Australia gained market share from Telstra and Optus during the quarter, Kantar said -- a reversal of recent trends -- with Vodafone moving its prepaid lot upwards by 1.2 points for 15.6 percent of the market and its post-paid lot by 1.3 points for 15.7 percent market share.

"Telstra and Optus are the main sources of new Vodafone customers, who have taken advantage of the double data plans on offer, with AU$40 to AU$50 plans the most popular, entitling users to up to 20GB of data," Kantar explained.

Amaysim/Vaya likewise gained 0.8 points in prepaid and 0.4 points in post-paid for market shares of 7.7 percent and 3.9 percent, respectively.

"Within the prepaid market, Optus, Vodafone, and Amaysim gain share year on year, with this sector driving the decline in Telstra's overall share," Kantar said.

"The desire for cheaper calls and a larger data allowance grow as factors for influencing choice of network, with both of these reasons becoming increasingly important among customers choosing Vodafone and Amaysim."

Vodafone has attracted customers in their early 20s with its "generous data plans", Kantar said, while SIM-only plans are growing in popularity, "which is where Amaysim is heavily concentrated".

"Huge data allowances in excess of 10GB are becoming commonplace but at more competitive prices, allowing consumers' monthly bills to shift towards mid-range prices between AU$30 to AU$60," Kantar said.

Virgin Mobile, Aldi Mobile, TPG/iiNet, and Boost Mobile all saw losses in their market share, Kantar reported: Virgin lost 0.4 percentage points in total mobile market share down to 4 percent; Aldi lost 0.3 percentage points in total market share down to 2.7 percent; TPG/iiNet lost 0.2 percentage points down to 2.2 percent; and Boost maintained its total market share but lost 0.2 points in prepaid.

The category containing all other mobile virtual network operators (MVNOs) was the only other to make gains, holding 7.5 percent of the total mobile market, 8.4 percent of prepaid, and 7 percent of post-paid by September 30.

According to the Australian Telecommunications Industry Ombudsman (TIO) annual report for 2016-17, published last month, complaints about Telstra rose by 43.5 percent during the year, with a total of 76,650 complaints, 13,536 of which were about services being delivered over the National Broadband Network (NBN).

Since then, Telstra has announced that it will be compensating 42,000 NBN customers for not providing them with the speeds advertised in their plans.

Complaints about Optus rose by 31.2 percent to 28,766, 3,938 of which were about NBN services; complaints about Vodafone rose by 37.5 percent to a total of 10,684, with the telco yet to launch NBN services; complaints about iiNet rose by 79 percent to 10,170; with 2,197 about NBN services; and complaints about TPG rose by 44.9 percent to 6,995, 1,916 of which were about NBN services.

Complaints also rose across smaller providers and MVNOs: Dodo complaints rose by 1.1 percent to 3,309, 726 of which were about the NBN; Southern Phone Company complaints rose by 266.7 percent to 2,068 in total, 865 of which were about the NBN; Primus complaints rose by 32.1 percent to 1,917, 300 of which were about the NBN; and complaints about M2 Commander rose by 25.3 percent to 1,704, 259 of which were about the NBN.

Virgin was the only telco to see a fall in complaints, with an 11.6 percent decrease to a total of 1,354 complaints during the year.

According to the TIO and Communications Alliance Complaints in Context report for the July-September period also published last month, however, Telstra and Vodafone reduced their complaints over the most recent quarter.

As of the end of September, Telstra had a complaints ratio of 8.7 complaints per 10,000 services in operation (SIO), down from 10 in the previous quarter, while Vodafone's complaints dropped from 4.5 per 10,000 SIO to 4.3 this quarter.

Optus, Amaysim, and Pivotel complaints all rose during the quarter, however, from 10.1 to 10.3, 1 to 1.5, and 0.3 to 0.8 per 10,000 SIO, respectively.

Overall, the Complaints in Context report showed complaints dropping from 9 to 8.3 per 10,000 SIO during the September quarter.

"The industry is dealing with significant disruption that has been difficult for some customers and has generated worrying increases in complaint levels during the past 12 months following four years of continuous reduction in complaints," Communications Alliance CEO John Stanton said.

"Industry -- including service providers and NBN -- are working intensely on a range of customer, service, and process initiatives to improve the overall consumer experience. It is pleasing that these latest Complaints in Context results appear to indicate that these efforts are beginning to bear fruit."

Related Coverage

Australian 4G coverage in global top 10: OpenSignal

The percentage of time that Australians have access to 4G ranks within the top 10 globally, OpenSignal has said, with the fastest speeds nationally clocked by Telstra and lowest latency by Optus.

Optus launches 'Yes Business' SMB community

Yes Business will provide SMBs with a free-to-use online community where they can find advice and information on the common issues involved in setting up and running a business.

Smartphone usage by the numbers via Deloitte

Smartphone usage and adoption has matured, but 47 percent of consumers want less of their devices.

Intel has announced its XMM 8000-series 5G NR modem suite, with the first modem to be available commercially in mid-2019, while also saying it has enabled 5G calls over its Gold Ridge 5G modem unveiled at CES 2017.