Optus taking mobile market share from Telstra: Kantar

Optus took mobile market share from Telstra across the prepaid segment during the quarter ending June 30, according to the most recent statistics published by market research company Kantar.

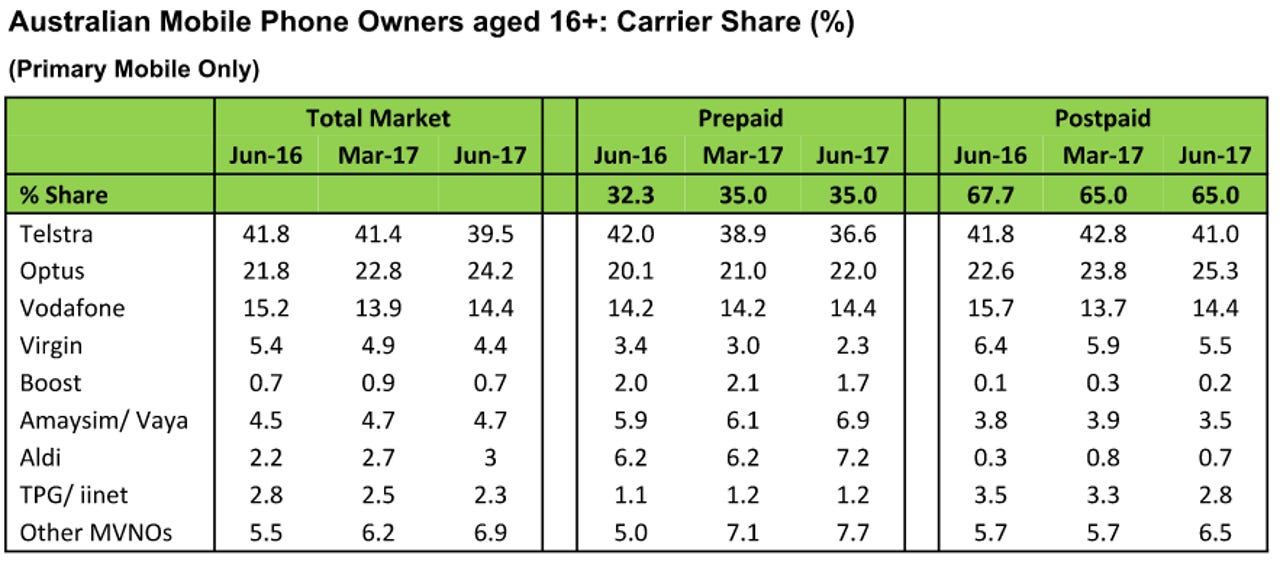

According to Kantar, Telstra holds 39.5 percent of the total Australian mobile market, followed by Optus, at 24.2 percent; Vodafone Australia, at 14.4 percent; Amaysim and Vaya, at 4.7 percent; Virgin Mobile, at 4.4 percent; Aldi Mobile, at 3 percent; and TPG and iiNet, at 2.3 percent.

Other mobile virtual network operators (MVNOs) accounted for 6.9 percent of the total mobile market.

Telstra lost market share across both post-paid and prepaid, down 5.4 percentage points year on year to hold 36.6 percent of the prepaid market and down 0.8 percentage points for a total of 41 percent of post-paid.

Conversely, Optus gained market share in both prepaid and post-paid for a total of 25.3 percent and 22 percent of the market, respectively.

Optus was the carrier to "shine" in the most recent quarter, Kantar said, adding that customers are leaving Telstra for the lower-cost Optus.

"Customer churn from Telstra to Optus is noticed, with consumers leaving Telstra due to the desire for 'cheaper calls/SMS'. Overall, the top reason for joining Optus is 'better network coverage'," Kantar said.

"Optus customers are higher users of most services, including music streaming apps such as Spotify, Pandora, and JB Hi-Fi and video-streaming services such as Netflix, Stan, and Fetch TV."

Vodafone again lost mobile market share, down by 1.3 percentage points to hold 14.4 percent of the post-paid market but up by 0.2 percentage points for 14.4 percent of prepaid.

Virgin Mobile lost 1.1 percentage points in prepaid market share and 0.9 in post-paid; Boost lost 0.3 in prepaid and gained 0.1 in post-paid; Amaysim/Vaya gained 1 percentage point in prepaid and lost 0.3 in post-paid; Aldi gained 1 percentage point in prepaid and lost 0.7 points in post-paid; and TPG/iiNet gained 0.1 percentage point in prepaid and lost 0.8 points in post-paid.

Other MVNOs jumped from holding 5 percent of the prepaid market to 7.7 percent, and from 5.7 percent of post-paid up to 6.5 percent as of the end of June.

"Optus, Aldi, and Amaysim enjoy share growth compared to the same period a year ago," Kantar said.

"Despite the overall importance placed on cheaper packages, 'customer service' and 'the need for larger data allowance' grow in importance as reasons for choosing a carrier within the prepaid market, with Optus over-indexing on 'customer service' as a reason for choice, whilst customers choose Amaysim SIM-only packages when 'data allowance' is a key factor."

Last week, the Australian Telecommunications Industry Ombudsman (TIO) had said that mobile, internet, and landline complaints against Telstra, Optus, Vodafone, and Amaysim all rose during the same quarter.

During the three-month period to June 2017, Telstra had a complaints ratio of 10 complaints per 10,000 services in operation (SIO), up from 9.3 last quarter.

Similarly, Optus rose from 9.3 to 10.1 complaints per 10,000 SIO over the quarter, as the average across all providers rose from 8.4 to 9.

While Vodafone Australia maintained a complaints ratio of half the industry average, its 4.5 complaints per 10,000 SIO was still a rise from last quarter's 3.9, and Amaysim rose slightly from 0.9 to 1.

The only telco that managed to reduce its complaints ratio was Pivotel, whose complaints fell from 1.3 to just 0.3 per 10,000 SIO.