The enterprise technologies to watch in 2017

Enterprise IT in 2017 continues to be highly influenced by consumer technology, but for a change this year we can see a concerted push to craft business-ready versions of emerging tech in hot new categories. This is particularly the case in areas like blockchain, digital twins, marketing integration solutions, and digital transformation target platforms.

Not too many items fell off this year's enterprise tech to watch list either, as organizations continue to struggle to adopt the growing raft of relevant new technologies that have steadily arrived on the scene recently.

Consequently, the portfolio of emerging tech that must be managed continues to grow quickly, even as IT spending -- and overall tech absorption capacity -- is increasing only in the low single digits. This is an untenable proposition that's putting more and more IT organizations under stress. Most significantly, this is creating service backlogs that are pushing "edge IT" implementation and acquisition -- or systems that are not considered mission critical enterprise-wide -- out into lines of business for realization as they see fit, as well as fueling so-called shadow IT projects at the departmental level.

As a result, I currently find that IT organizations are seeking novel ways to learn about and adopt emerging tech to ride the exponential curve of digital change. That's a whole separate conversation however, but one that is becoming urgent as we see the CIO under significant and steady pressure to deliver far more quickly in 2017.

For this year's list of enterprise tech to watch, I've attempted to synthesize data from all available sources, particularly industry trend data. In general, I prefer to include technologies on the list that are expected to grow in the double digits every year for a half decade or more from now. However, I'll sometimes include important new technology categories if they clearly warrant it based on early importance, even if forecasts aren't readily available.

Featured

As a result, we've seen the steady shift from SMAC (social, mobile, analytics, cloud) that dominated this list at its inception to one that is more focused on artificial intelligence, Internet of Things, distributed ledgers, immersive digital experiences (AR/VR), edge computing, low code tools, and much more.

That's not to say that essentially mainstream technology bases like public cloud, cybersecurity, or big data are staid and therefore are about to come off the list. In fact, they are shifting and evolving more now than ever before and should remain at the top of the technologies that most enterprises should be watching very closely today.

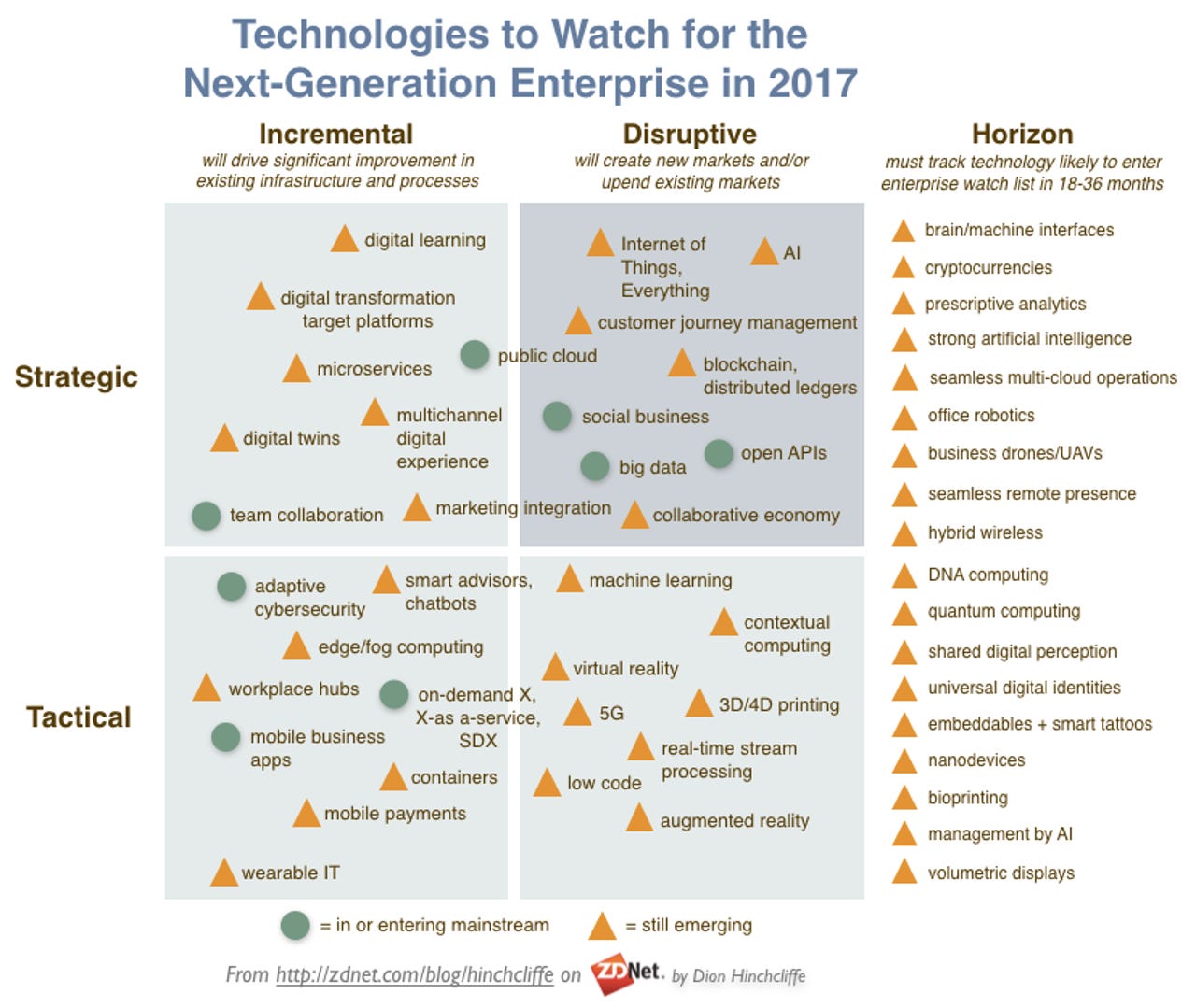

Based on my analysis then, here is the short list of enterprise technologies that organizations should be tracking for building skills, assessing their strategic and tactical impact, experimenting with, and subsequently preparing for wider-scale adoption, often as part of a more systematic program of digital transformation.

As in previous years, I've also included a horizons list in this year's tech to watch, which shows technologies that are almost certainly going to be significant in coming years, but should now be relegated primarily to tracking and monitoring, unless it's impactful for your core business in the near term.

The enterprise technologies to watch in 2017

In roughly clockwise order, here's the breakdown, with a brief note on why each enterprise technology to watch this year is significant, with data on its outlook if available:

- Machine learning. Separating out the topic of machine learning from artificial intelligence is still a tricky task. However, I categorize machine learning as the ability for systems to learn from data in an unsupervised manner and with minimal guidance, while artificial intelligence represents systems that can improve themselves through more abstract reasoning not necessarily dependent on data. It's tougher to tease apart the forecasts for the two, as they are often lumped together, however one leading report this year, citing the expectation that use of machine learning will become common to support activities in the workplace (a sentiment I very much concur with), expects 43 percent annual growth of the category, which will reach $3.7 billion in revenue by 2021.

- Contextual computing. The increasing desire to augment productivity and collaboration by supplying information on-demand, usually just as it's needed and before it's explicitly asked for, has already become big business. Established industry players such as Apple, Intel, and Nokia are working on and/or offering context-aware APIs already, while a raft of startups is competing to make the early market. Contextual computing is now expected to grow 30 percent annually and reach a market size of a whopping $125 billion by 2023, largely due to widespread use in consumer mobile devices and smart agents.

- Virtual reality. Still a niche technology despite the support from major industry players such as Samsung with its inexpensive yet high quality Gear VR set and Apple with its new ARKit, virtual reality is poised to grow dramatically for a growing percent of end-user experience as the technology becomes more refined, and especially, less bulky and intrusive. While just a small half billion dollar market today, virtual reality is expected to grow at the blistering pace of 133 percent a year on average, becoming a $35 billion industry by 2021.

- 3D and 4D printing. While evolving in fits and starts, 3D printing has already become important to a wide range of industries, from aerospace and energy to electronics and even culinary uses. 3D printing is remaking the logistics industry as well by moving manufacturing directly to the point of use and making it on-demand. 3D printing will become a significant industry quite soon, growing by 26 percent annually through 2023 and becoming a $33 billion market. 4D printing, which are objects whose shapes can be changed over time, is a much smaller industry but as a result is growing quickly at 39 percent a year through 2022, where it will likely be a $100 million plus market.

- 5G wireless. Few mobile technologies are as anticipated as 5G, the next generation of wireless telecommunications standards and infrastructure, which will bring revolutionary bandwidth increases (potentially up to 1GB per second in some cases) and enable new high value business scenarios including immersive virtual reality telepresence, 4K/8K video streaming, and other very high bandwidth uses. While still not expected to commercialize until at least 2019, 5G is widely expected to impact numerous industries and markets, despite real challenges in beaming millimeter waves significant distances, fueling futuristic experimental 5G projects like Google Skybender. 5G spending is expected to grow by 70 percent a year and reach at least $28 billion a year in revenue by 2025.

- Real-time stream processing and analytics. Best exemplified by software and cloud services like Apache Spark and Amazon Kinesis, the Internet of Things revolution and rich media in general is fueling the need to process and analyze massive amounts of data without any delay -- both event metadata and the data itself -- that flows in from services and devices on the edge of the network. While not quite the white hot item it was last year, stream processing remains a critical technology for data-driven companies. Stream processing and analytics is expected to grow 33 percent a year through 2025.

- Low code tools and platforms. While developing sophisticated software will remain the purview of professional developers for the foreseeable future, it's getting easier all the time for anyone to code basic applications using low code development solutions. Services like Mendix, Appian, and Outsystems -- although there are now dozens of credible entrants including the new Microsoft PowerApps -- now make it easy to build real apps with minimal skill. This can greatly offload IT in simpler business situations and can even make it possible for digital transformation to occur in a far more decentralized manner than in the past, all by giving local business experts the self-service tools they need to meet their more basic needs. Recent data on market performance of low code is fairly limited, but the industry is generally expected to exceed a respectable $15 billion in revenue a year by 2020.

- Wearable IT. The market for enterprise wearables remains quite small and is still limited to niche applications like corporate wellness, hands-free scenarios, situational customer/workforce experiences (typically location-based or rapid notifications), and just-in-time decision making. Yet this belies the anticipated growth of the category, which is expected to expand by over 75 percent a year and become an industry $12 billion in size by 2021.

- Mobile payments. With Apple Pay's steady expansion, the rise of Samsung Pay, and the use of mobile devices for payments across the developed and developing world, the smart device is rapidly becoming the wallet of the future. Enterprises must become ready to access these revenue streams and watch the evolution of the industry closely, as revenue flows move to digital channels not controlled as much by traditional financial institutions. Mobile payments are currently expected to grow by 20 percent a year globally and become a $1.7 trillion dollar industry by 2022.

- Containers. Most well known by their effective bringing to market and popularization by Docker, containers remain a leading on ramp and direct pathway to both cloud computing as well as a more modern and effective model for the design, management, governance, and optimization of IT applications. Considered a contemporary method to architect and operate cloud software today, containers are on the short list of models most organizations are seriously considering for go-forward application models, either buy or build. The growth picture tells the story here with a 40 percent annual growth rate and $2.6 billion market industry size for container-as-a-service by 2020.

- Mobile business apps. Stubbornly one of the most challenging aspects of enterprise IT, good mobile apps for both internal and external customers remains a challenge for the average organization, yet is critical for the success of their digital experiences. Why are mobile apps so hard? A confluence of reasons: The two main mobile platforms (iOS and Android) are large and complex, and they are still fairly unfamiliar to most of IT, while mobile application management issues, the proliferation of devices and form factors, and security issues round out the barriers to good mobile apps. Mobile apps are expected to grow by 14 percent a year and reach $100 billion in revenue yearly by 2022, yet the enterprise component of that is likely to remain small. Leading organizations can seize opportunity in 2017 and beyond with first mover advantage by providing the mobile experiences their stakeholders want.

- On-demand, as-a-service, and software-defined everything. In short, everything in the IT business -- from security, storage, networking, computing, and applications -- is become software-defined and packaged as an on-demand service. While this is nothing new, it can actually be alarming to find that most modern IT offerings want to meter everything to you, and you can no longer purchase it and pay maintenance. This is distressing enough that I've had more than one CIO complain to me that it feels like buying all their IT over again every year, an expectation that will have to be managed by vendors. There are so many projections in this space that I'll just select one overall forecast of IaaS, PaaS, and SaaS as a whole, which is expected to become a $390 billion industry in just 2.5 years, by 2020.

- Workplace hubs. There is growing interest in streamlining and making the workplace more efficient and centralized. Many of the latest tools -- from Slack and Microsoft Teams to IBM Connections (with AppSpokes) and Cisco Spark -- are creating powerful new workplace hubs that allow systems of record and systems of engagement to come together more effectively into a consistent and contextual digital workplace, complete with integrated apps. How big is this trend so far? It's challenging to estimate as there is no dedicated forecasting in this category yet. However, I am included it as a clear industry trend based on the inclusion of these capabilities in most of the latest enterprise collaboration offerings.

- Edge/fog computing. As Internet of Things and other computing form factors that move data gathering out to the far-flung sides of the network grow in scale and data volume, there has emerged a growing need to put more intelligent processing at the edge of the network, rather than transporting it across the cloud. Instead of a cross-trend to the cloud, edge computing (sometime called fog computing) complements it by putting computing power in cloud-friendly technology packages where it makes the most sense for cost and performance reasons. Edge computing will grow by 35 percent annually through 2023, when it will become a $34 billion industry.

- Adaptive cybersecurity. Perhaps the real top priority of many CIOs, cybersecurity has assumed a preeminent place in IT strategy and investment, despite being almost exclusively a cost center that keeps the business running and customers safe. Adaptive cybersecurity, which uses a combination of artificial intelligence and other methods to dynamically shift tactics and detect/remove threats as quickly as possible, is among the very forefront of security methods. Adaptive cybersecurity will grow by 15 percent a year and will become a $7 billion industry by 2021.

- Smart advisors and chatbots. Generally not put into the same category together, smart advisors and chatbots nevertheless are digital facilitators that employ an easy means of engagement to elicit IT systems to perform tasks that are needed, from customer support to financial analysis. The more specialized smart advisor space will grow by 34 percent a year and become a $4.3 billion market by 2022, while the broader chatbot industry will grow at the same pace and become $3.1 billion industry in roughly the same time frame.

- Team collaboration. Smaller scale collaboration has become very popular in the last few years, augmenting the big shift toward enterprise-scale collaboration five years ago or so. The rise of nimbler, more team based tools like Slack has been well documented, as have the dozens of me-too competitors. At the same time, many applications have adopted chat tools within them and consumer services like WhatsApp are used for business on a wide basis. Enterprises have been forced to realize multi-layered collaboration strategies to cope. Nevertheless, it's clear that the resurgence of team collaboration is here to stay. Overall, the global cloud collaboration market (where the vast majority of team collaboration is offered today) is growing at 13 percent a year and will be a $38 billion industry by 2020.

- Marketing integration. One of the worst-kept secrets of the marketing technology industry is that almost none of it fits together without manual integration, despite a rapidly expanding multichannel world where this is far-and-away the largest problem that's currently reported by brands. Yet as I explored recently in the struggles of companies to gain a single view of the customer, the explosion of marketing solutions is making the problem worse, not better. Yet there is no actual category of marketing integration tools, though a good number of solutions apply at least to some of the issue. There will be volumes written about the mismatch between marketing technology availability and actual customer needs today, but we can use marketing automation as a related "stand-in" industry that does some "martech" integration, which will grow at 11 percent a year and be an $8 billion industry by 2025.

- Digital twins. One of the new entrants to the main list this year, digital twins are software-based replica of business assets, processes, and systems -- especially ones based on IoT -- that can be used for various purposes such as modeling, forecasting, and business transformation and has been trumpeted prominently by market leaders like GE as a key to successful digital transition. Organizations can increase predictability, lower risk, and test innovation much more quickly using their digital twins. As a very new enterprise concept, there is no publicly available market forecast yet for digital twins, but Gartner has prominently included it in its top 10 strategic tech trends for 2017.

- Multichannel digital experience. As I explored in the marketing integration pieces, creating a cohesive experience across multiple digital channels (mobile, social, devices, apps, etc.) remains a top challenge for organizations, and one that goes well beyond marketing. Often known as the "omnichannel" problem, the issue is that new digital channels emerge and become important far faster than the response windows of digital experience teams. Digital experience capabilities help outsource the solution to this channel fragmentation issue. Also known as customer experience management (CEM), though I don't use the term because customer is a misnomer as the digital experience must be managed alike for customers, prospects, suppliers, partners, and the workforce. The digital experience industry will grow by 21 percent a year and become a $13 billion industry by 2021.

- Microservices. A more refined and fine-grained way to architect modern IT, microservices have gained the upper hand as the leading way to open up data and systems for use and reuse by other parts of the business and for open APIs to 3rd party suppliers and developers. As a key part of the strategic digital ecosystem story, microservices will grow at a reported 16 percent a year and be a $10 billion industry within a few years.

- Digital transformation target platforms. These are capabilities built on top of enterprise cloud stacks from the likes of Amazon, Microsoft, and Google Cloud that provide patterns, templates, industry accelerators, emerging tech capabilities like blockchain and IoT in business solution frameworks, to provide a proven path through which to implement an enterprise-scale digital transformation. One recent notable example of this product category is SAP Leonardo. I'll be posting my findings on other top solutions soon. There is no market estimate yet of this brand new digital category.

- Public cloud. Needing no introduction, public cloud is projected to host the majority of enterprise workloads sometime later this year or in early 2018. IDC estimates public cloud will be a $203 billion industry by 2020, with an annual growth rate of 22 percent.

- Digital learning. Retiring MOOCs and global solution networks as explicit entrants from last year's list, which are still important categories, but subsumed into this larger category, digital learning -- essential to staff the modern digital enterprise with talent -- is shifting to more sophisticated models, from microlearning and adaptive learning systems, even as community-based models remain as important and fast-growing as ever. The overall smart learning market is a juggernaut, as education is generally, and will grow at 25 percent yearly to be a $584 billion industry by 2021.

- Artificial intelligence. Cognitive systems have become powerful enough to begin cracking some of our most challenging business issues and is at the top of venture capital, acquisition, and enterprise IT priority lists of many organizations. The industry is expected to grow at a 52 percent annual pace and be a $36 billion market by 2025.

- Customer journey management. Using data to dynamically provide the best quality, adaptive, and personalized customer experience across an organization's various silos (marketing, sales, operations, customer care, etc.) is the next and more strategic progression of multichannel digital experience. While still allocated to the customer experience management function, it's a separate concern that can and is often dealt with separately. Again, this is an emerging product category, but in the sense it realizes an effective data-driven customer experience, it will be a 14 percent year-over-year growth category that will turn into a $12 billion enterprise industry by 2023.

- Internet of Things (IoT) and Internet of Everything (IoE.) As just about everything manufactured object in the world -- and quite a few non-manufactured objects which will be instrumented with sensors -- is becoming pervasively connected, the number of devices on our networks is set to grow by many orders of magnitude. This creates large business opportunities for organizations ready to capitalize on the global streams of data, analysis, and two-way ability to control and converse that IoT represents. IoE is even more strategic and has become a catch-all phrase that describes adding both connectivity and intelligence to practically every device and connected scenario in order to give them useful smart functions. IoT numbers almost always impress due to their scale. The IoT market will be $267 billion size by 2020, with at least a 20-percent compound annual growth rate (CAGR) at every level of the IoT stack. For its part, IoE is estimated to become a vast $7 trillion industry through a 16 percent growth rate, due to so much of the connected computing universe being attributable to it.

- Blockchain and distributed ledgers. A complex yet historic amalgam of network, cyrptopgraphy, and database technologies, blockchain and decentralized record systems like it are making big waves in industries like healthcare, insurance, and especially finance, given blockchain's roots in Bitcoin. While many organizations are grappling with the implications of decentralized, open record keeping to their business models, the writing is on the wall: Most legacy transaction logging systems that are closed and proprietary are likely nearing the end of their useful lifetime. Blockchain and related models for digital ledgers are expected to grow at a 58 percent annual rate and create a $5.4 billion dollar market by 2023.

- Social business. Long a combined technology and mindset approach to create more connected and effective communities and organizations, social business remains the most strategic set of ideas and tools to create modern organizations using new communications and collaboration methods. Along the way, the approach has logged hard data on its benefits. While the term itself is aging out, the practice remains at at all time high in organizations and is growing steadily at a 26 percent annual rate through platforms like enterprise social networks and social business analytics.

- Big Data. A combination of tactical analytics and strategic business intelligence that can process enormous amounts of data in useful timeframes to drive useful business outcomes, big data remains a leading topic in both the software industry and on CIO priority lists. IDC says the discipline will be a $203 billion industry by 2020, with a 12 percent annual growth rate.

- Open APIs. Part and parcel with the microservices discussion, which it now has a lot of overlap with, open APIs have come of age to open up IT for reuse and remixing within organizations and especially out to developer communities and business partners. I've been sanguine about this approach for a decade and it's finally matured into a major industry. While APIs represent many types of technologies and approaches, one key barometer is API management platforms, which will be a $3.4 billion market by 2023 via a 33 percent annual growth rate.

- Collaborative economy. Also known as the sharing economy, the approach for using the Web as a platform to exchange goods and services more directly and democratically has had its up and downs over the years. Although the implications of the collaborative economy, originally coined by Jeremiah Owyang, go to the very heart of business models and have disrupted entire industries from hospitality to transportation, its proven a bit harder a model to repeatably delivery on that some originally thought, even though my opinion is that most industries have yet to feel the brunt of it. That said, respected organizations like the Brookings Institute have pegged the sharing economy at a whopping $335 billion in yearly revenue by 2025. Consequently, it very much belongs as a core, though existentially challenging, technology on this list again this year.

The upshot is that there are a great many technologies on the enterprise tech to watch list, an all-time high in fact, never mind the horizon list, which is poised to be even more disruptive in many cases. As I pointed out a few years ago, technology cycles are coming more and more quickly and fixed, traditional strategic planning cannot take them into account adequately.

For most organizations, this will mean all new ways of thinking about and managing the technology adoption life cycle. Fortunately, we have fresh choices and new ways of activating forces for change at scale that do seem to be able to better accommodate the size and scope of the challenge at hand. In the meantime, we live in very exciting times indeed, even though it's still literally just the dawn of digital technology in the enterprise.

Additional reading