AOL ad revenue slide continues; Time Warner writes down acquisitions

Time Warner's fourth quarter financial results showed more pain for its struggling AOL unit.

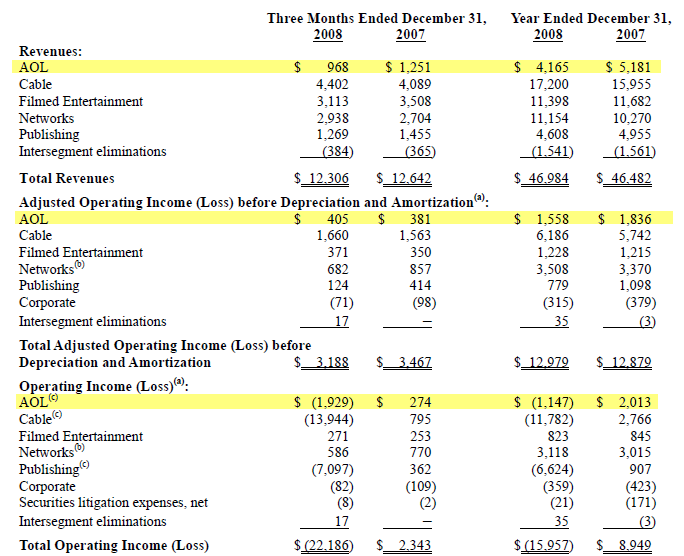

In the fourth quarter (statement), AOL revenue fell 23 percent from a year ago to $968 million. Ad revenue fell 18 percent and subscription revenue fell 27 percent from a year ago. AOL also had an operating loss of $1.9 billion largely due to a $2.2 billion non cash charge related to the carrying value of goodwill. In a nutshell, AOL acquired a bunch of companies such as Bebo that aren't worth anything near what Time Warner paid for them.

For the year, AOL revenue declined 20 percent to $4.2 billion due to a decline in subscription and ad revenue. Subscription revenue fell 31 percent from a year ago and ad revenue fell 6 percent.

By the metrics, AOL still has plenty of eyeballs, averaging 109 million average monthly unique users in the U.S. AOL still--can you believe it?--has 6.9 million people paying for online access.

As a combined entity, Time Warner reported a fourth quarter net loss of $16 billion, or $4.47 a share, due to a bevy of write-downs on revenue of $12.3 billion, down 3 percent from a year ago. If you exclude the kitchen sink of charges, Time Warner reported earnings of 23 cents a share. Wall Street was expecting earnings of 26 cents a share.

For the year, Time Warner reported a loss of $13.4 billion on revenue of $46.9 billion, up slightly from $46.5 billion in 2007. In a statement, the company said that is also pondering a reverse stock split. For 2009, Time Warner says it expects adjusted earnings to be flat compared to earnings of 66 cents a share in 2008. Wall Street was expecting earnings of 99 cents a share for 2009.

Here's a look at Time Warner's results by unit: