AOL fourth-quarter profits beat expectations, still far from healthy

AOL, once the powerhouse of the Web, posted a drop in forth-quarter profits, but still managed beat Wall Street expectations. In short: the company is still doing badly, but not as badly as people think (or hope).

The company, whose media assets include TechCrunch, Engadget, and the Huffington Post, was expected to post a profit of 16 cents a share. But it managed to scrape 23 cents a share, compared to its 60 cents a year earlier.

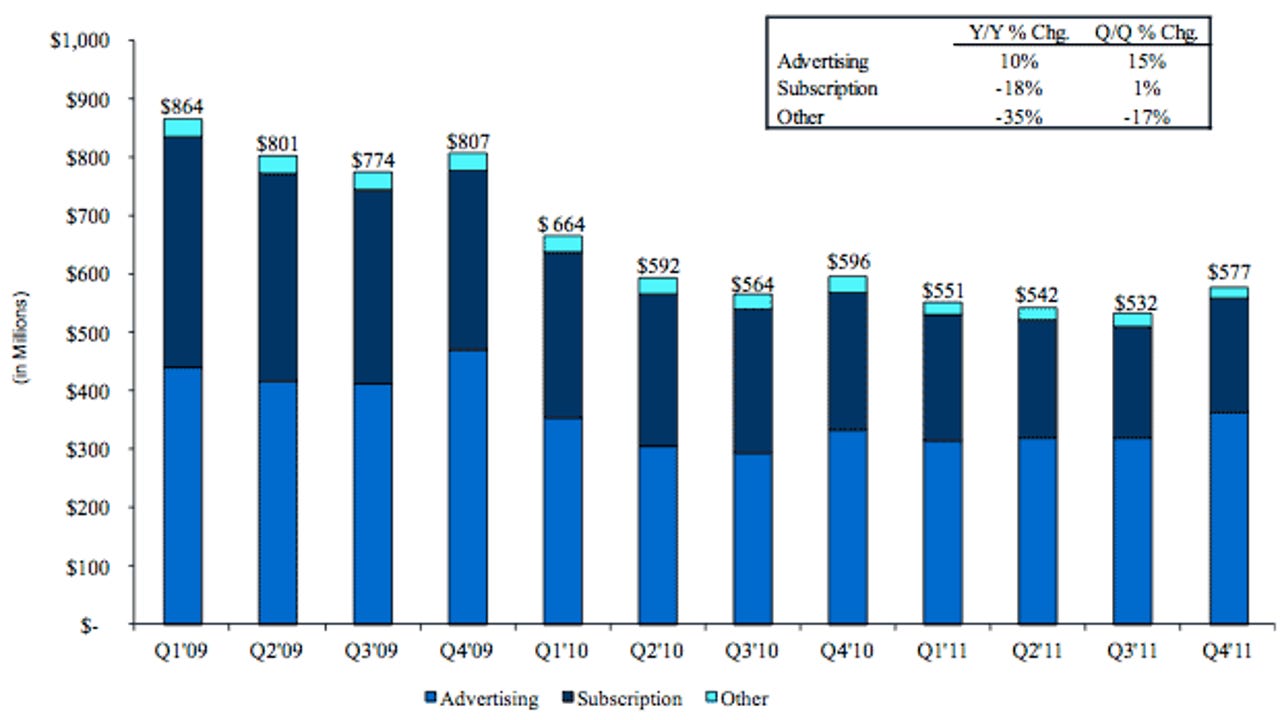

Net income decreased to $22.8 million, compared to $66.2 million last year. Sales dropped by 3 percent to $577 million, up slightly from a year ago, and beating the $567 million average prediction.

For its online outlets, there was a peppering of good news. While global display advertising rose 15 percent to $170.6 million, subscription revenue for AOL's dial-up Internet access unit dropped by nearly 20 percent. The latter means less money from dial-up Internet users, but it mostly recouped its losses through news subscriptions.

Considering that advertising is AOL's single biggest revenue source, the company is still holding on in there.

AOL quarterly revenue breakdown (Source: AOL)

As the company continues its shift from dial-up Internet to the media mogul it wants to be, it continues to attract investor concern over AOL's media business. Since the company bought TechCrunch for $25 million, and The Huffington Post for $315 million, it still draws in poor profit returns from the two, and continues to suffer top-level talent losses.

"AOL took a large step forward in Q4 and I am very pleased with the way we ended the year,” said Tim Armstrong, AOL's chief executive. "Our Q4 results highlight AOL’s ability to methodically improve our consumer offering and financial performance."

Words spoken like a true leader: an upbeat note amidst a time of crisis. If AOL wants to do better next year, perhaps a company refocus on the inner workings should take prime focus?

Two things to take away: keep the top-talent happy and from jumping ship. Secondly, buying up companies is all good and well, but it's worthless if the structure falls apart around them.

Related: