AOL: Good progress, but turnarounds take time

AOL reported a better-than-expected third quarter and CEO Tim Armstrong delivered a bunch of interesting metaphors about the company doing sprints, heading to the gym and generally getting its balance sheet in shape. The company's acquisition strategy will also be all about ball control, no Hail Mary passes for AOL, said Armstrong.

But enough with the sports metaphors. Armstrong seems to be indicating that AOL is a wait for 2011 story. Indeed, Armstrong said he'd be disappointed if AOL's ad sales were growing in the back half of 2011.

AOL is one interesting story. If you took Armstrong's strategy, which revolves around content, and slapped it into Yahoo you'd have a nice match. However, it's unclear whether AOL has too many moving parts right now.

On the positive side:

- The company is ditching non-core stuff. It sold part of its Dulles, Va. campus.

- AOL has acquired TechCrunch and a series of tuck-in type companies.

- And AOL unloaded its Kayak software business and ICQ.

Now AOL has $623 million in cash on its balance sheet---a nice chunk of change assuming AOL won't go for any crazy acquisitions.

As for the negatives, AOL is still a work in progress. And at some point patience may wear thin for Armstrong's efforts, which make a lot of sense over the long run. However, investors are notoriously short sighted.

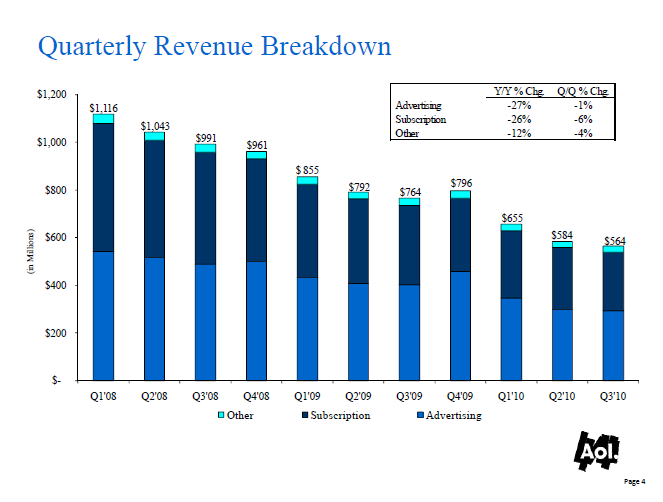

That's why AOL's third quarter earnings report (Techmeme), which handily topped muted expectations was a fairly big deal. AOL reported third quarter net income of $171.6 million, or 93 cents a share, on revenue of $563.5 million, down 26 percent from a year ago. The good news is that earnings surged 132 percent from a year ago even as sales tanked. Earnings topped Wall Street estimates of 48 cents by good cost management as well as the gains on the sales of Kayak and ICQ.

The more upside Armstrong can deliver, the more time he'll have to send AOL to the gym so to speak. At some point, AOL will be buff. Armstrong said he is focused on execution and delivering a "magical" experience for consumers.

Jefferies analyst Youssef Squali said the quarter was a step in the right direction.

Domestic owned and operated display revenue came in better than expected at $112.5M (down 8%Y/Y vs. our 12%Y/Y), actually up 2% sequentially even as AOL continues to lose Display market share to Yahoo! and Google. This was AOL's second positive sequential revenue growth. The Y/Y decline was attributed to a decline in premium inventory sales as well as less AOL Properties inventory monetization.

However, less worse results will only go so far. AOL will need to need to reverse these charts.