Apple earnings surge, Jobs says 'amazing new products' still on tap

Apple delivered a strong fiscal third quarter as it exceeded Wall Street estimates on earnings, revenue as well as Mac, iPhone, iPad and iPod units. The company also said that it has more goodies in its product quiver and corporations are adopting the iPhone and iPad.

After the closing bell Tuesday, Apple reported fiscal third quarter net income of $3.25 billion, or $3.51 a share, on revenue of $15.7 billion. Apple was expected to report earnings of $3.11 a share on revenue of $14.75 billion for the third quarter ending June 30.

Apple's report comes just a few days after Steve Jobs and Co. held a press conference to address "antennagate." In a statement, Jobs said it was Apple's best quarter ever and the company has "amazing new products still to come." Jobs said:

"iPad is off to a terrific start, more people are buying Macs than ever before, and we have amazing new products still to come this year."

That comment obviously refers to the iPod refresh ahead of the Christmas shopping season. Apple projected fourth quarter earnings of $3.44 a share on revenue of about $18 billion. However, Apple is widely known for sandbagging analysts. For its fiscal fourth quarter ending Sept. 30, Apple is expected to report earnings of $3.81 a share on revenue of $16.98 billion.

Simply put, Apple is firing on all cylinders and even gaining momentum in the enterprise. On the company's conference call, Apple operating chief Tim Cook said the iPhone is being adopted by the enterprise. Cook said that "more than 80 percent of the Fortune 100" are planning or evaluating the iPhone and Apple is "seeing good momentum in the Fortune 500." That momentum is "transcending into education institutions," said Cook. And the real kicker: 50 percent of the Fortune 100 are testing and evaluating the iPad in the enterprise.

Cook also said that Apple is seeing no drop-off in iPhone 4 demand due to its antenna flap.

By the numbers:

- Apple sold 8.4 million iPhones in the quarter. Piper Jaffray analyst Gene Munster had the highest estimate for iPhone units at 9.5 million, but he acknowledged that the iPhone 4 launch made predictions potentially difficult. Given the channel flush ahead of the iPhone 4 launch, Munster said on CNBC that iPhone units were better than expected.

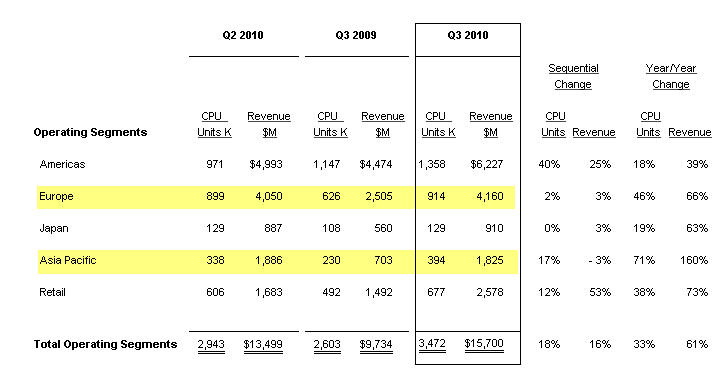

- Mac units for the third quarter were 3.47 million. Wall Street was expecting 3.1 million Mac units. CFO Peter Oppenheimer said on an earnings conference call that Apple beat its record on Mac shipments. Apple saw double-digit Mac growth in all regions and institutional sales were strong despite state government budget cuts. Half the Macs sold in Apple stores went to new customers.

- iPod units were 9.41 million. Wall Street was expecting Apple to sell roughly 9.5 million iPods. Munster was expecting between 9 million to 10 million units.

- Apple had said it sold 3 million iPads in the first 80 days. The final tally: 3.27 million.

- Apple had gross margins of 39.1 percent, comfortably beating its guidance of about 36 percent last quarter.

Meanwhile, Apple's international expansion is paying off very nicely. Revenue in Europe was up 66 percent from a year ago and Apple sales surged 160 percent from a year ago in Asia Pacific. That's some heady growth abroad. Oppenheimer talked up Apple's international expansion and noted the iPhone has 154 carriers in 88 countries. In addition, Apple's iPad rollout continues abroad.

A few key items from Apple's conference call via Oppenheimer and Cook:

- iPad's average selling price was $640 in the quarter. iPhone's average selling price was $595.

- Apple plans 24 new store openings this quarter.

- iTunes revenue topped $1 billion with 25 percent growth year over year.

- 5 billion apps have been downloaded on the App Store.

- The company is working hard to catch up with demand.

- Apple execs wouldn't disclose the splits between iPad 3G and Wi-Fi devices.

- There's no evidence that the iPad is cannibalizing sales of other products.

- The company doesn't manufacture shortages just for more buzz.

- Cook was asked about sustainability of iPad demand and what happens when all the early adopters are on board. Cook noted that the early adopter phase is over and added that corporate customers are piloting the device.

By product there are a few other key trends in the third quarter. To wit:

- Mac portable revenue was up 40 percent from a year ago.

- Music related products and services (iTunes) revenue was $1.2 billion, up 27 percent from a year ago.

- iPhone revenue was up 74 percent year over year.

Here's the chart.