Big Blue delivers strong fourth quarter, a rarity these days

Updated: IBM delivered a strong fourth quarter--a rarity in the technology industry these days. Big Blue handily beat Wall Street estimates while it was at it.

After the closing bell Tuesday, IBM reported net income of $4.4 billion, or $3.28 a share, on revenue of $27 billion. Earnings were well ahead of Wall Street estimates of $3.03 a share. Revenue was light relative to the $28.15 billion Wall Street target because of a strong dollar, IBM said in a statement (Techmeme).

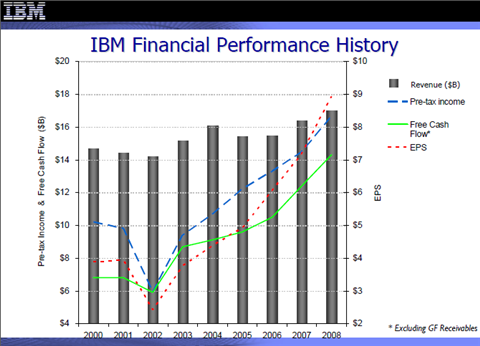

For 2008, IBM reported earnings of $8.93 a share on revenue of $103.6 billion.

As for the outlook, IBM projected 2009 earnings of at least $9.20 a share.

Meanwhile, IBM CEO Sam Palmisano said:

"With our strong financial position, solid recurring revenue and profit streams and global reach, we are confident about 2009 and, based on our 2008 performance, we are ahead of pace on our roadmap for $10 to $11 per share."

That outlook is a nice ray of light in what is expected to be a dismal tech earnings season. On a conference call, IBM CFO Mark Loughridge said the quarter was strong. The message: IBM's transformation is paying off. Meanwhile, companies are increasingly turning toward outsourcing in a recession. That trend is benefiting IBM, said Loughridge.

Loughridge added:

We had relatively stable revenue performance -- by delivering what customers need in this environment.So for the customers that are trying to save cost and conserve capital, we can adapt our offerings to help them do that. As a proof point, of our $4.5 billion of shortterm signings in GBS, about three-fourths of the signings delivered cost reduction to our clients.

So how did IBM top estimates on weaker than expected revenue? Big Blue has been adept at managing costs--expenses down 5 percent in the fourth quarter--and a lower quarterly tax rate sure didn't hurt. IBM noted:

IBM's tax rate in the fourth-quarter 2008 was 23.8 percent compared with 28.0 percent in the fourth quarter of 2007, a decline of 4.2 points due primarily to the utilization of tax credits, including the retroactive benefit of the recently-enacted U.S. research tax credit. The full-year 2008 tax rate was 26.2 percent, and IBM expects its full- year 2009 tax rate to be sustained at approximately 26.5 percent.

Tax rate aside, IBM's Loughridge said the company has been delivering what customers want. The company also enjoys annuity business and garners 82 percent of its revenue from software and services. That fact minimizes the damage from weak hardware sales.

Loughridge also added that it is cutting costs via automation, outsourcing, supplier deals and process changes.

By the numbers:

- IBM's Americas revenue was $11.5 billion, down 2 percent from a year ago. Europe Middle East and Africa revenue was $9.5 billion, down 12 percent. Asia Pacific revenue was down 1 percent to $5.5 billion.

- Fourth quarter free cash flow of $14.3 billion.

- Global technology services revenue fell 4 percent to $9.6 billion. business services revenue fell 5 percent to $4.7 billion. IBM said it signed services contracts worth $17.2 billion and had a services backlog of $117 billion with currency adjustments.

- Software revenue was $6.4 billion, up 3 percent a year ago. Middleware sales were up 4 percent to $5.2 billion.

- Hardware revenue was whacked. IBM said that revenue from its systems and technology unit was $5.4 billion, down 20 percent from a year ago. System x server sales fell 32 percent with its System i servers down 92 percent. The good news: Hardware only accounts for 9 percent of IBM sales.

And.

- Gross margins were 47.9 percent in the fourth quarter, up from 44.9 percent from a year ago.

- Industrial and small business revenue was the worst of the lot in terms of IBM verticals, but the decline wasn't dramatic.

And IBM's market share trends by product.