Cisco buys Exablaze as it builds out low latency portfolio

Cisco said it will acquire Exablaze, which designs network devices and field programmable gate array (FPGA) technology, in a move to target low latency applications.

The Exablaze purchase comes a week after Cisco outlined its silicon strategy for its next-gen networking architecture, which is designed to be able to handle the workloads that 5G, AI and machine learning and edge computing enables.

In a statement, Cisco said that Exablaze will be integrated into the company's Nexus switching portfolio. Cisco plans to leverage Exablaze in areas like high-frequency trading, financial services, high performance computing and AI and machine learning clusters.

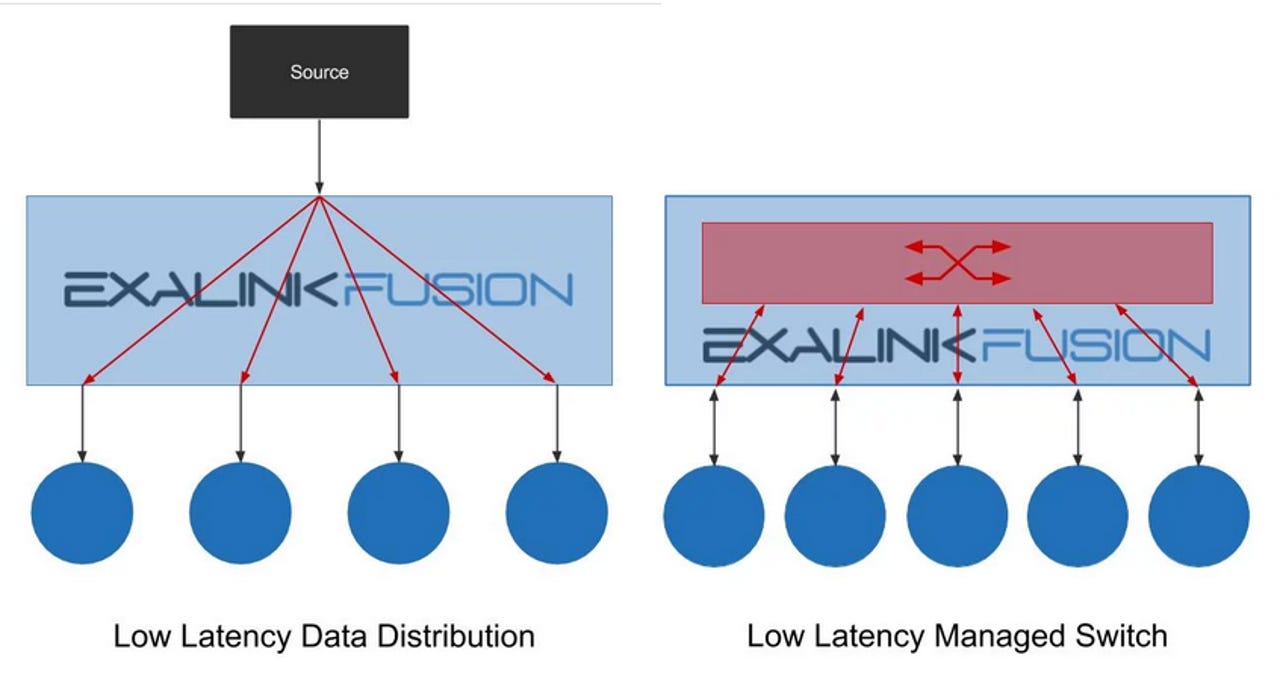

Exablaze also makes switches, network adapters and FPGA development products under the Exalink brand.

Terms of the deal weren't disclosed.

Exablaze is expected to be part of Cisco's intent-based networking strategy and complement the company's current switching technology.

In the big picture, Cisco is stepping up its investment in silicon, optics and software to target next-gen networking. Cisco Silicon One, a unified silicon architecture for networking, the IOS XR7 operating system and Cisco 8000 Series are designed to set the company up for the future.

If Cisco doesn't invest heavily it risks losing workloads to cloud computing giants such as Amazon Web Services, Microsoft Azure and Google Cloud Platform.

Also: AWS Graviton2: What it means for Arm in the data center, cloud, enterprise, AWS

To that end, Cisco's 'Internet for the Future' technology strategy has added AT&T, Century Link, Comcast, Facebook, Microsoft and The Walt Disney Studios as innovation partners.

Cowen & Co. analyst Paul Silverstein said that Cisco software, silicon and platform strategy is designed to "squarely address ongoing tectonic shifts in the networking industry and key threats to and opportunities for Cisco."

Silverstein added:

These threats and opportunities include an increase in the number and prominence of competitive threats and a shift in Cisco's addressable market opportunity in terms of the spending power of traditional customers and the rise of Webscale customers, especially Amazon, Facebook, Google, Microsoft and other cloud titans. More specifically, Cisco seeks to address the increasing prominence of Webscale companies and corresponding impact on traditional networking and other IT vendors; the rise of SDN; the ongoing impact of Broadcom as a merchant supplier of cutting edge switching and routing silicon.