Comcast sees economic headwinds; Can anyone win broadband war?

Is it possible that no one wins the broadband wars between Verizon, AT&T and cable companies like Comcast? That question is worth asking following Comcast's second quarter results.

Comcast missed second quarter earnings estimates of 22 cents a share by a penny, but the cable giant's results weren't all that bad considering it is getting hit by "a challenging economic environment."

By the numbers (statement), Comcast reported second quarter net income of $632 million, or 21 cents a share, better than the $588 million, or 19 cents a share reported a year ago. Revenue was up 11 percent to $8.5 billion. And the company reaffirmed its guidance that operating cash flow will be 8 percent to 10 percent in 2008.

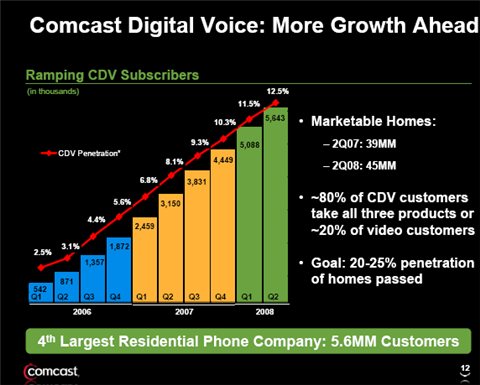

The cable company's subscriber tally was a mixed bag. Comcast lost 138,000 basic video subscribers in the quarter, but added 320,000 digital cable subscribers. The company added 278,000 high-speed Internet subscribers and revenue increased 10 percent to $1.8 billion in the second quarter. And it added 555,000 phone customers in the quarter.

However, Comcast added 339,000 broadband subscribers in the year ago quarter. Digital cable subscribers appeal to be gaining at the expense of Comcast's basic video subscribers (and possibly telecom companies). Only phone subscribers are jumping off the page. Comcast is landing triple play--TV, Internet, voice--customers and a fifth of its customers are taking that package, but is being hampered by the housing market.

In contrast, Verizon added 187,000 new FiOS Internet customers in the second quarter and 176,000 FiOS TV customers. AT&T added 170,000 U-Verse TV subscribers. In AT&T's second quarter, the company didn't break out U-verse broadband additions.

Why will all of these companies lose in the broadband wars ? Telecom giants are a thorn in Comcast's side, but aren't taking a bunch of customers. Meanwhile, all parties are spending heavily on marketing. And then there's the role of consumers.

How many new Comcast consumers will stick once the promotions end? How about Verizon FiOS? In the end, we're going to get a bunch of consumers that will flip services. I've seen this in action already and know a few people that have dumped FiOS for a better offer from Cablevision, which were their previous provider. And guess what? If Verizon comes back with a better offer than Cablevision they would probably flip back.

In the end, consumers win and that's good, but these broadband wars are going to turn into a quagmire pretty quickly. As for me, I remain a Verizon FiOS customer, but I'm pelted with "take us back" direct mail almost weekly from Comcast. And I'd consider it if I thought Comcast could keep its Internet access up. But neighbors note that Comcast still goes down a good bit. As for Verizon I haven't had an Internet outage yet. As a guy who makes his living on the Internet I'll pay a premium for that. But in the future I could always split the TV difference if the economics work.