European PC sales plunged in Q1, says Gartner

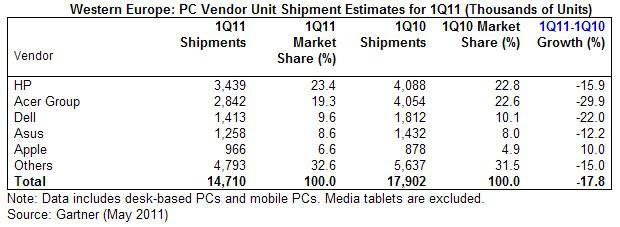

Gartner has released its estimates of first quarter shipments in Western Europe, and they're not happy reading for most PC manufacturers, with the obvious exception of Apple. Shipments tumbled to 14.7 million units, which is 17.8 percent down on the same period last year. Apple was the only one of the top half dozen to increase its unit shipments, and this finally brought it into a couple of the Top 5 tables.

Gartner principal analyst Meike Escherich said in a statement that "this quarter's poor performance was due to excess inventory accumulated at the end of the fourth quarter of 2010 in many countries in Western Europe," and that "consumers continued to hold back disposable spending on PCs, or they spent it on other devices like media tablets. This resulted in extending current PC life cycles. PC shipments in the consumer market declined 25 percent year-on-year, with the mini-notebook segment hit especially hard."

PC shipments in the professional market also fell by 8 percent year-on-year, she said.

As the table shows, HP remained the biggest vendor in Western Europe, shipping 3.5 million PCs for a market share of 23.4 percent. HP was followed by Acer, Dell, Asus, and Apple, which displaced Toshiba.

"The UK market exhibited the worst decline of the three major countries in Western Europe," said Gartner, with shipments falling by 17.5 percent to 2.7 million units. HP was the largest supplier, shipping 634,000 units for a market share of 23.2 percent. HP was followed by Acer (16.5 percent), Dell (15.7 percent), Toshiba (7.5 percent), and Apple (6.8 percent). In this case, Apple displaced Samsung from the Top 5.

Gartner research director Ranjit Atwal said: "The consumer market declined nearly 25 percent in the first quarter of 2011. The poor performance of this segment can be explained by a shift away from mini-notebooks [netbooks] by the PC channel. Vendors in the PC channel realigned to the weaker end-user demand for this platform, and they also realized that the subsidized selling model was not as effective as expected."

PC shipments in France fell by 15.5 percent to 2.7 million units, and in Germany, by 16.5 percent to 2.8 million units. In those two countries, Samsung held on to its fifth place, ahead of Apple.

Acer has clearly had problems, with shipments falling by 29.9 percent in Western Europe and by 45.8 percent in Germany, on Gartner's numbers. Such declines led to the rapid departure of the Taiwanese company's Italian chief executive, Gianfranco Lanci. Escherich speculates that this may mark a change in the market. She says:

"The recently announced change in Acer’s business strategy signifies an inflection point where PC vendors begin to realize that consumer demand, especially in mature markets, is no longer driven by the lowest price point. Instead, consumers are looking at some of the emerging devices, like media tablets. Alternatively they want to purchase a mid- or high-specification PC which they intend to keep for longer."