Fixing Motorola's mess: kick that smartphone strategy into high gear

Motorola's first quarter loss may have been smaller than Wall Street had expected, but that's nothing to celebrate about. The handset business continues to be a drag on the whole company and efforts to turn it around so far haven't been all that impressive.

Motorola needs more than that - and fast.

First, to the dismal numbers of the quarter:

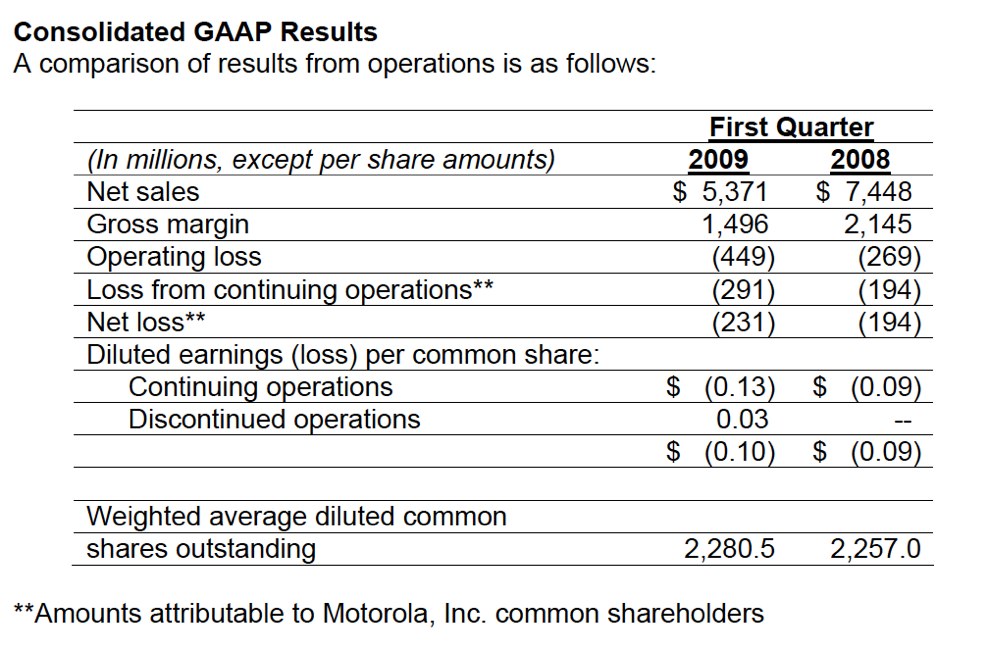

Motorola reported a first quarter net loss of $231 million, or 13 cents per share, wider than the loss of $194 million, or 9 cents per share, for the same quarter a year ago. The company said the loss included a charge of 5 cents per share, related to cost-reduction initiatives, bringing the loss to 8 cents. Analysts were expecting a loss of 11 cents per share, excluding items. Sales were $5.4 billion, down 28 percent from a year ago. Analysts were expecting sales of $5.6 billion. (Statement)

Sales in the mobile devices segment were $1.8 billion, a 45 percent drop from the year-ago quarter, and the net loss for the quarter was $509 million, greater than the $418 million loss a year ago. The company sold 14.7 million handsets in the quarter - barely half of the 27.4 million sold in the year-ago quarter. Market share slipped to 6 percent, down from 9.4 percent a year ago.

I know what you're thinking. That doesn't sound like a turnaround to me, either. As analyst Ed Snyder at Charter Equity Research said in an Associated Press report, "This is basically treading water more efficiently than they have in the past."

So what does Motorola need to do to fix it?

Well, let's start with that Android rollout. The company keeps talking about a holiday season rollout but it should be shooting for something sooner than that. Put development on warp speed and get an Android smartphone - at least one, if not the whole lineup - out there in time for the back-to-school season. Oh sure, there goes the summer vacation plans for the team - but start moving faster on that front or there may not even be jobs to take a vacation from next summer.

And speaking of smartphones, why is everything about Android? Where are those Windows Mobile devices? As of now, the smartphone lineup isn't all that impressive (see the "multitask" portion of the slide image). Maybe it would look better or shine brighter if there wasn't so much clutter on the other portfolio segments. How about this? Either up that game on smartphones fast and/or reduce the clutter to get that portfolio to at least 50 percent smartphone.

Also see: IDC: Global mobile phone shipments tank in first quarter; Smartphones up

Keep the customers interested by tapping them where it matters most - in their wallets. Here's an idea: mimic existing designs, use your scale and undercut on price. When the company brought in Sanjay Jha, a former Qualcomm exec, last summer to be co-CEO of the company and run the mobile division, he said his goal was to turn the handset division into a company that will “continue to innovate and grow for years to come.”

So far, it hasn't been "innovate and grow" but more like cutback and operate more efficiently. The company hasn't had much of a hit in mobile since the Razr. And they're definitely going to need some marketing heft if they plan to compete aggressively with the newly crowded field of smartphones that have become household names ahead of anything Motorola is putting out there - notably, the iPhone and the Blackberry.

The global economy is not going to change that much between now and the holiday season. But what will change is the landscape. Motorola is pinning all of its hopes on the holiday season - or the fourth quarter. If that's a bust, so is the full year - one where the handset division was supposed to be a spin-off.

Let's be realistic about it. Sure, Google's Android OS got some good buzz when it was launched in the G1 - but have you seen what RIM is doing to push the Blackberry into a mainstream market? Don't forget about the arrival of the Pre, the new Palm device that received quite a bit of buzz when it was announced at CES. And, of course, there's a little Apple product you might have heard of - called the iPhone - that is sure to generate some interest, especially with news expected at Apple's Worldwide Developer's Conference in June.

When it comes to smartphones, Motorola is way behind the curve and will need to double-time it, maybe even triple-time it, if it expects any real traction in that market. Is a lineup of Android devices introduced in time for the holiday season going to be enough? I suspect not.

Bottom line: if Motorola doesn't kick into warp speed on its smartphone portfolio, including its Android launch dates, then that dark storm cloud that hovered over the company all winter won't be clearing up anytime soon. On the contrary, it's only going to get darker.

For the current quarter, Motorola said it expects a loss of 3-5 cents per share, excluding cost-cutting charges. Analysts had been expecting a loss of 5 cents per share. Shares of Motorola were down more than 8 percent today.

Previous coverage: