Gauging Your Own Risk, On This Black Monday

Don't you wish you had the same tools at your disposal to assess the riskiness of securities you hold, now that Wall Street is going through a Monday as black (or blacker) than the one in 1987.

Bear Stearns, gone. Lehman Brothers, bankrupt. Merrill Lynch, absorbed. AIG, on the brink. Washington Mutual, teetering.

The best financial minds on Wall Street couldn't figure out they were quite literally playing with a house of cards in their doling out of mortgages and their endless securitization and swapping of securities in same. So how can you do any better in figuring out how save your assets on Wall Street are?

You have to believe that tools work. The worst financial firestorm since the Second World War is due not to the lack of ability to assess risk by big securities firms but a "collective suspension of disbelief" about the quality of the underlying assets, is the view of Rami Entin, a consultant with the IRIS integrated risk management unit of FRS Global, a Belgium-based provider of risk management and regulatory compliance software.

So if you are willing to suspend your own potential disbelief of the power of software in determining risks, you may want to do an assessment of the fallout of the firestorm on your own assets. To do this, you can head to a site called RiskGrades. This grading service is based on technology spun out of the internal risk advisory group of J.P. Morgan, a company that is still standing (and part of the company that took over Bear Stearns' assets at government-backed fire sale prices).

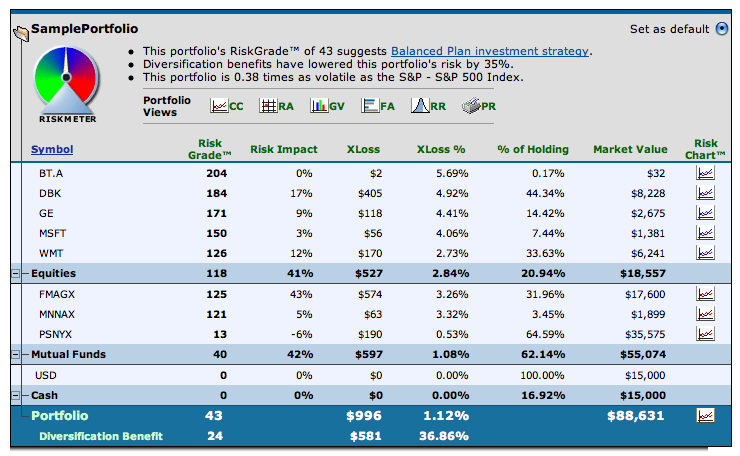

This site grades the riskiness of each stock or fund in your personal portfolio. The higher the Risk Grade, the higher the likelihood you will take a big hit at some time in the next 20 days. The XLoss tells you the Expected Loss and the Risk Impact shows how your overall risk changes if you took this security out of your holdings. In the case of BT.A (British Telecom), the Risk Grade is high, but the Risk Impact non-existent because the owner has sold off all but $32 worth of the stock.

You can even get a hint of how your portfolio will hold up under the storm on the Street today or this week. Under Portfolio Analysis, you can do a Portfolio Simulation that reflects Event Risk. Among the Events you can run your portfolio against are Black Monday, the big stock market drop in 1987; September 11, 2001, when terrorists struck New York and Washington, D.C.; or the Gulf War itself, for extended stress.

The problem is inherent in all risk analysis. The past is not necessarily predictive of the future. Yes, you can even create your own "user-defined" events that subject your assets to extreme conditions.

But the future constantly refuses to be predicted. It was only Thursday that Lehman Brothers reassured investors that it had a long-term plan to shore up its finances. And if you predicted that Merrill Lynch would wind up in the arms of Bank of America by Monday morning, you probably made enough money to evacuate to a Caribbean island and retire.