HP: Blade, enterprise printing and channel happy

Hewlett Packard's head honchos outlined their divisional strategies on Tuesday. Here's a look at the key themes. In a nutshell, HP is big on blades, its printing prospects and defending its retail channel turf.

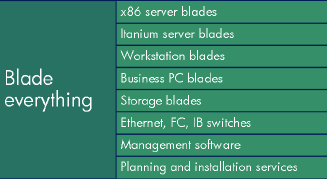

Let's blade everything

The approach isn't all that surprising, but HP appears to be looking at blades through a virtualization lens. For instance, blade servers are twice as likely to be virtualized as standard servers. With the blade as the entry point, Livermore said HP will layer in management software and virtualization tools. HP also plans to "blade everything."

Here's how Livermore sized up the server market by type:

More content, more printing (HP hopes)

Vyomesh Joshi, executive vice president of HP's imaging and printing group, outlined the company's printing strategy. Joshi wants to make sure that printing is integrated with Web habits such as sharing photos, chatting and reading documents online.

A few avenues for HP expansion of print growth:- Consumer (a $24 billion market size in 2010): Emerging geographies represent an opportunity as does Web content and digital photo conversion. Growth driver: home photo printing. HP also will target retail and Web photo printing. For instance, the photo media market grew 17 percent in fiscal 2007 from a year ago. In the emerging markets, that growth rate was 44 percent. The main objective: Allow consumers to print from anywhere. Snapfish, now owned by HP, has 45 million customers up from 11 million before being acquired, said Joshi.

- Graphic arts (a $34 billion market in 2010): "Mom and pop photo shops" are still analog, said Joshi. HP plans to go after this market just as it has photo finishing. Growth driver: Digital publishing and in-house marketing. The plan here: HP is acquiring its way into the market.

- SMB and enterprise ($224 billion market combined in 2010): HP intends to focus on network management for printing, the convergence of copying and printing and improving paper-based workflows. "We need to do better going after this market with a service based approach," said Joshi. Growth driver: Color printing in the office, supplies, software and services. In the SMB market, HP is looking to grab copier market share and expand its channel reach into the enterprise. On the enterprise front, HP is looking to be more of a service provider and help optimize infrastructure and workflow.

Across all of those markets, HP can sell a ton of ink. Lots of ink makes Joshi an even more enthusiastic guy.

HP loves the channel

- Bradley said component costs remain volatile. "It's a volatile component pricing environment. HP is focused on mitigating risk and at the same time drive cost out of our inventory mode," said Bradley.

- Bradley is optimistic about the thin client market. HP acquired Neoware to become a big player in thin clients. Profit margins on a thin client are two times those found on a traditional desktop.

HP wants to improve its standing in the education market where it is currently in third place.