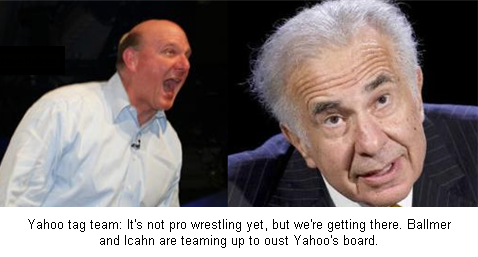

Icahn, Ballmer pair up, talk Microhoo; Push to boot Yang and Yahoo's board

Updated: Activist investor Carl Icahn and Microsoft are now in cahoots to toss Yahoo CEO Jerry Yang and the company's board of directors.

Icahn says in a letter that he has been chatting up Microsoft CEO Steve Ballmer along with other key executives about how the two companies can "do a transaction together." In the letter, Icahn claims that Ballmer "made it clear to me that if a new board were elected, he would be interested in discussing a major transaction with Yahoo."

For its part Microsoft confirms Icahn's account and says in a statement that "it would be premature to discuss at this time important details such as the price or other terms of a possible transaction."

The message is clear: Boot Yahoo's board at the company's shareholder meeting on Aug. 1 and Icahn can pull off a deal with Yahoo. And Microsoft is interested.

The letter and Microsoft's confirmation--timed to coincide with one another on the wires by the way--are notable because it puts all the cards on the table. Icahn and Microsoft are teaming up against Yahoo's current management and aren't being shy about it. To date, the biggest question about Icahn's bid is whether Microsoft would actually step up to the plate if the billionaire managed to grab control of Yahoo's board. Yahoo launched a few strikes last week to fend off Icahn's upcoming assault. Meanwhile, Microsoft dropped hints that it was still interested in Yahoo.

The opening paragraph of Icahn's letter says it all:

During the past week I have spoken frequently with Steve Ballmer, CEO of Microsoft. Several of our conversations have lasted as long as an hour. Also, a few of our discussions have taken place while other top executives, such as Kevin Johnson, participated. Our talks centered on the industry in general but, more importantly, on how Yahoo! and Microsoft can do a transaction together. Steve made it abundantly clear that, due to his experiences with Yahoo! during the past several months, he cannot negotiate any transaction with the current board. His logic is simple. If and when a transaction was consummated, Microsoft would be guaranteeing a great deal of capital at closing. However, a transaction could take at least nine months and perhaps longer to obtain regulatory clearance in the U.S., Europe, and elsewhere. During that period, if the current board and management team of Yahoo! mismanage the company (and their recent track record is far from reassuring), Microsoft would be putting its money at risk and a great deal could be lost.

Microsoft bolsters Icahn's letter with:

Despite working since January 31 of this year, as well as in the early part of last year, we have never been able to reach an agreement in a timely way on acceptable terms with the current management and Board of Directors at Yahoo!. We have concluded that we cannot reach an agreement with them. We confirm, however, that after the shareholder election Microsoft would be interested in discussing with a new board a major transaction with Yahoo!, such as either a transaction to purchase the "Search" function with large financial guarantees or, in the alternative, purchasing the whole company.

The bottom line: If Icahn wins, Microsoft will "enter into discussions immediately after Yahoo!'s shareholder meeting if a new board is elected."

There's some good old fashioned hard ball fo r you.

r you.

Now the big question is whether Yahoo's shareholders will toss the entire board, some of it or just enough to put Icahn in control.

Icahn indirectly panned Yahoo's latest restructuring effort adding in his letter that:

Our company is now moving toward a precipice. It is currently losing market share in its "Search" function; our current Board has failed to bring in a talented and experienced CEO to replace Jerry Yang (right) and return Jerry to his role as Chief Yahoo!, and currently it is witnessing a meaningful exodus of talent. It is no secret that Google (which hired a great operator as CEO) continues to dramatically outperform Yahoo!. According to publicly available information, Google's income from operations grew 59% per year over the last two years while Yahoo!'s shrank 21% per year. However, none of the above has caused the Yahoo! board to hesitate in paying themselves $10,000 per week. IT IS TIME FOR A CHANGE.

Icahn says that voting with his slate of directors will ensure that Yang and Yahoo's board "will not be able to 'botch up' a negotiation with Microsoft again, simply because they will not have the opportunity."

Yahoo responded to the Icahn letter in a statement noting that the Icahn-Ballmer plan is off the mark.

Yahoo!’s Board of Directors continues to stand ready to enter into negotiations with Microsoft Corporation for an acquisition of Yahoo!. Indeed, as recently as June, Yahoo!’s independent directors and management approached Steve Ballmer about just such a transaction, only to be told that Microsoft was no longer interested even in the price range which they had previously proposed. Now Mr. Ballmer and Mr. Icahn have teamed up in an apparent effort to force Yahoo! into selling to Microsoft its Search business at a price to be determined in a future “negotiation” between Mr. Icahn’s directors and Microsoft’s management. We feel very strongly that this would not lead to an outcome that would be in the best interests of Yahoo!’s stockholders. If Microsoft and Mr. Ballmer really want to purchase Yahoo!, we again invite them to make a proposal immediately. And if Mr. Icahn has an actual plan for Yahoo! beyond hoping that Microsoft might actually consummate a deal which they have repeatedly walked away from, we would be very interested in hearing it.

For shareholders, this latest turn of events has really clarified the Yahoo decision. If you want Yahoo--or a part of it--to be acquired by Microsoft vote Icahn. There are no mysteries anymore. If you want Yahoo to stay independent in some fashion stick with your current management.

Full text of the Icahn letter:

Carl C. Icahn ICAHN CAPITAL LP 767 Fifth Avenue, 47th Floor New York, NY 10153

July 7, 2008

Dear Yahoo! Shareholders:

During the past week I have spoken frequently with Steve Ballmer, CEO of Microsoft. Several of our conversations have lasted as long as an hour. Also, a few of our discussions have taken place while other top executives, such as Kevin Johnson, participated. Our talks centered on the industry in general but, more importantly, on how Yahoo! and Microsoft can do a transaction together. Steve made it abundantly clear that, due to his experiences with Yahoo! during the past several months, he cannot negotiate any transaction with the current board. His logic is simple. If and when a transaction was consummated, Microsoft would be guaranteeing a great deal of capital at closing. However, a transaction could take at least nine months and perhaps longer to obtain regulatory clearance in the U.S., Europe, and elsewhere. During that period, if the current board and management team of Yahoo! mismanage the company (and their recent track record is far from reassuring), Microsoft would be putting its money at risk and a great deal could be lost.

For example, in a transaction to purchase the whole company, a very large amount of capital would be due at closing. Even in an "alternate" transaction, where just the "Search" assets were purchased, large guarantees would have to be made and, again, large sums could be lost if the company was mismanaged. Microsoft perceives this risk may be quite high with the current board and management in place. However, Steve made it clear to me that if a new board were elected, he would be interested in discussing a major transaction with Yahoo!, such as either a transaction to purchase the "Search" function with large financial guarantees or, in the alternative, purchasing the whole company. He stated that Microsoft would be willing to enter into discussion immediately if the new board that has been nominated were elected. While there can be no assurance of a future transaction, as many of you know, I have negotiated successfully a large number of transactions over the past years. If and when elected, I strongly believe that in very short order the new board would, subject to its fiduciary duties, be presenting to shareholders either a purchase offer for the whole company or a very attractive offer to purchase "Search" with large guarantees. I hope to continue to be speaking to Steve over the next few weeks; however, since I do not as yet represent the Yahoo! board, both Steve and I do not wish to get into details over price, or even which of these transactions makes the most sense.

Much has been said about how badly the Yahoo! board has "botched up" negotiations with Microsoft over the past months. There is no need to keep pointing out the mistakes I believe Yahoo! made by not immediately taking a $33 offer made by Microsoft. But one thing is clear -- Jerry Yang and the current board of Yahoo! will not be able to "botch up" a negotiation with Microsoft again, simply because they will not have the opportunity.

Our company is now moving toward a precipice. It is currently losing market share in its "Search" function; our current Board has failed to bring in a talented and experienced CEO to replace Jerry Yang and return Jerry to his role as Chief Yahoo!, and currently it is witnessing a meaningful exodus of talent. It is no secret that Google (which hired a great operator as CEO) continues to dramatically outperform Yahoo!. According to publicly available information, Google's income from operations grew 59% per year over the last two years while Yahoo!'s shrank 21% per year. However, none of the above has caused the Yahoo! board to hesitate in paying themselves $10,000 per week. IT IS TIME FOR A CHANGE.

If elected, I have little doubt that the new board, subject to its fiduciary duties, will do what the current board will not do, i.e.,

-- Immediately start negotiation with Microsoft to sell the whole company or, in the alternative, sell "Search" with large guarantees.

-- Move expeditiously to replace Jerry Yang with a new CEO with operating experience.

Sincerely yours,

CARL C. ICAHN