Intel: Corporate PC, server demand fuels strong second quarter

Intel's second quarter shined as the company's earnings and revenue handily topped estimates. The company also delivered an upbeat outlook for the rest of the year and said the enterprise PC and server upgrade cycle is alive and well.

The chip giant reported net income of $2.9 billion, or 51 cents a share, on revenue of $10.8 billion, up 34 percent from a year ago (statement). Intel was expected to report second quarter earnings of 42 cents a share on revenue of $10.25 billion, according to Thomson Reuters. Intel's strong results came amid multiple concerns about the economy and tech demand.

For the third quarter and 2010, Intel also was upbeat about its prospects. The company said revenue would be $11.6 billion with gross margins of 67 percent. For the year, Intel raised its gross margin outlook to 66 percent, up from 64 percent before. Wall Street was only expecting Intel to report third quarter revenue of $10.9 billion for the third quarter. In fact, Intel's third quarter sales projection is in line for what Wall Street was expecting in the fourth quarter, historically the company's best.

Needless to say, Intel was pretty happy with its results, which indicate it is firing on all cylinders. Intel CEO Paul Otellini said in a statement:

Strong demand from corporate customers for our most advanced microprocessors helped Intel achieve the best quarter in the company's 42-year history.

No matter how you slice the second quarter, Intel's results were stellar. It remains to be seen if the corporate upgrade cycle brings AMD along for the ride or whether Intel's gains mean pain for its smaller rival. AMD reports its results on Thursday. Wall Street expects AMD to report earnings of 7 cents a share on revenue of $1.55 billion.

In a call with analysts today, Otellini said the company's growth continues to "run ahead" of economic growth and credited some of that to growth of the Internet, as well. Asked about growth of the Atom processors in the netbook market, Otellini replied that he didn't see much growth happening there but added that the space to watch for the second half of the year would be digital entertainment products.

Specifically, he noted Google TV products running on Atom, as well as TV sets themselves, set-top boxes and DVD players. That, he said, would be the segment to watch for the holiday season. With that said, non-netbook Atom growth was "significant" this past quarter but it's still a small number. Expect to see non-netbook Atom to "move the needle" early next year with growth and adoption of "tablets and handsets and Google TV kind of products."

He also said he was bullish on Sandy Bridge, the code name for the successor to Nehalem, and that customer feedback on tests of it were so strong that the company has ramped up 32 nanometer production and raised capex guidance.

He was also asked about the growth of tablet PCs and the potential for them to cannibalize the PC market. Otellini said he considers tablets as an "additive category" of computing, just as netbooks were. Like netbooks, which he thinks had the higher potential to cannibalize PCs, tablets are used differently than PCs. Still, he said he remains optimistic about being a part of the tablet market that the beauty of Intel is that it can run a number of operating systems, including Windows, Android, Chrome and versions of Linux.

Among the key comments from Intel CFO Stacy Smith:

- "Our overall business was strong in Q2, particularly in the enterprise segment. The strength of the enterprise market segment led to a richer than expected mix in both server and PC clients. The supply chain continues to be healthy with inventory levels appropriate for the level of demand."

- PC revenue was up 31 percent from a year ago to $7.8 billion, up a bit sequentially.

- Data center revenue was $2.1 billion, up 13 percent from the first quarter and 42 percent from a year ago.

- Atom revenue was $413 million, up 16 percent from the first quarter.

- Intel will raise its capital spending to about $5.2 billion, up from its previous forecast.

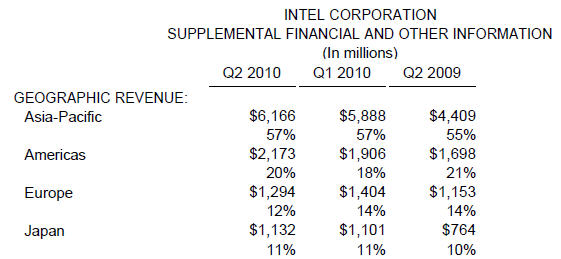

And here's a look at the key charts. Sales by geography:

Sales by division:

Intel shares were up about 7 percent after hours: