Intuit's TurboTax printing fees raise users' ire

Intuit's latest TurboTax has only been on the market since Nov. 28, but it has been a rough go for users who are screaming over extra fees.

Here's what's drawing fire:

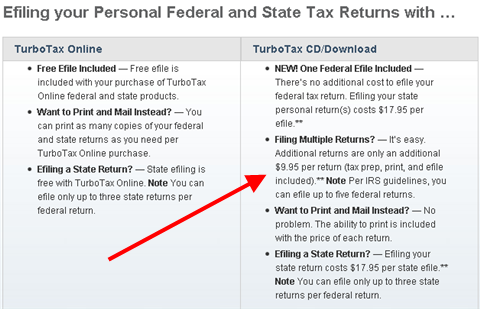

- Intuit included e-file services for free, but raised its price from a year ago. Not everyone will use e-file, but you can argue this move makes some sense.

- Intuit is charging a fee of $9.95 per return, which covers preparation, e-filing and printing, according to a spokeswoman who also noted that Intuit has a moneyback guarantee. The pricing aligns desktop and online TurboTax applications. TurboTax users are evenly split between desktop and online.

- Bottom line: If you print an additional return--prep, print and e-file--it'll cost you $9.95 a pop. The IRS allows you to file up to five federal returns. But since most folks aren't going to file a federal return without a state version these fees can add up.

- TurboTax has multiple flavors (and prices) that confuse users.

Connecting the dots, these additional fees may be part of the reason Intuit executives were confident about their TurboTax sales on its most recent earnings conference call. Last month, Intuit CEO Brad Smith said:

We believe the reason why we are holding our guidance this year on tax is two factors -- one is we know the government will want 140 million tax returns filed regardless of the economy. But secondly, we also appreciate the fact that we are in a category right now that’s growing about four times faster than the next nearest alternative, which is growing faster than pros and tax stores. And given that right now what consumers are looking for is the way to get their taxes done the easiest and the cheapest and to get the maximum refund, we stack up extremely nicely at $65 for one of our mid-tier lies of TurboTax versus $180 for a tax store. So I think all the factors play in our favor, which is why we are holding our guidance for tax despite what is going on in the marketplace.

What Smith didn't say is that printing fees may provide a nice cushion for Intuit. The details are tucked away in what essentially is a footnote when you compare the various flavors of TurboTax.

The wild-card is users and whether they will absorb these printing fees. So far, not so good. Many users are threatening to use H&R Block's TaxCut software, but CNET's Elsa Wenzel notes that it's not clear whether the pricing is that much better once you factor in extras like filing state returns. Update: H&R Block disputes CNET's story.

Here's an Intuit user review from Amazon:

To provide context to this review I should relate that I have seen and worked with the 2008 Turbo Tax program. I am a Beta tester for Intuit, a member of the Turbo Tax Inner Circle, and have been using Turbo Tax since 1997 when Intuit bought out Personal Tax Edge from Parsons Technology. The folks at Turbo Tax Beta Testing sent an e-mail asking testers to "post a review" on places such as this one.

Turbo Tax has always been a great program for doing taxes, even when it has had some annoying idiosyncrasies. I am happy to report that there are a number of improvements in Turbo Tax for 2008, e.g., better printing interface with easier print preview, a dual monitor showing the amount you can expect as a rebate from or amount due for Federal and State taxes, some navigation improvements, etc.

HOWEVER, and this is critical, Intuit has RAISED the price so they can include "free" Federal e-file (whether you want it or not). In addition, they have LIMITED THE NUMBER OF RETURNS TO ONLY ONE, regardless of whether you e-file or just want to print them out and mail them. That means that you can no longer prepare even an information return for your elderly parent, young child, or two returns if you want to file a separate return for your spouse. To prepare and PRINT any returns after the first one, you must pay Intuit $9.95 for every return. This is a dramatic change from past practice when the software license allowed PRINTING up to five returns at no additional cost. It is important to note that printing and mailing additional returns comes at no cost to Intuit. And forcing everyone to pay for "free" e-filing through the product price increase is a scam.

Therefore, regardless of how good this software is, I cannot recommend it based on the unjustifiable and unsubstantiated price increase.

And then there's this one:

Not only did the price go up (though now including federal e-file "at no extra charge", yeah, right), but the number of returns you can do was reduced by a factor of five! Last year's and previous years' software licenses allowed you to do up to five tax returns with the software. Now you can only do one, even if you're just printing returns! You have to pay $10 more for every additional return you print! I do three household returns every year. So for me the price goes up to $80 retail.

To see this, notice the "feature" above: "One federal efile included at no extra charge--receive IRS confirmation and get your refund in as few as 8 days; also includes preparation and printing of one state return", and then check the Intuit web site for what happens when you want to prepare another return.

What's even worse is that the only way to enforce the limit is to require an internet connection to Intuit when you print, even for the first return (otherwise you could just reinstall the software). You'd think they'd learn from the last time when they totally bungled the online licensing, but no. Expect bugs like last time where perfectly legitimate purchases plus bugs prevent you from printing or e-filing at the last minute. Talk about infuriating.

There are two basic pricing models, which is software you buy for a lump sum that you can then use, vs. services, where you pay by the drink. (Imagine paying Microsoft for every document you print from Word. Shh, don't tell them!) Intuit came up with the brilliant idea of charging you both for the software *and* then by the drink for the services. I sure hope that the consumers are too smart to fall for this.

I have been using Turbo Tax for the past eight years. But not this year.

And on Intuit's own community site you can find more of the same:

This will definitely be my last year to use Turbo Tax. The per return fee is absurd. I am going to warn everyone I know that they should not buy Turbo Tax this year due to their scandalous marketing deception. I am glad to see so many people thinking the same way. Intuit has always been a little over confident in their position in the market place. Like IBM and others who got cocky they will find out that people will not tolerate abuse and deception. I do my return and my mother-in-laws. I am not paying another fee to do hers. We will work around it. I will also find a replacement for Quicken. I have had with this company!

Intuit's customer support rep responded with:

We made the decision to include federal e-filing in all TurboTax desktop CD and download products because the majority of TurboTax customers now e-file. Every year, we increase the value of TurboTax by including features and services our customers want and use most. We’ve done this in the past with things like ItsDeductible and audit support. Rather than charge separately, we now include them in the product at an overall lower price than what customers would have otherwise paid separately. That’s true this year. Desktop pricing has changed, but for most of our customers who e-file, these changes actually result in a savings of a few dollars.

We recognize that not every customer will use or value every service we’ve included. But this is a great opportunity to use and benefit from e-filing and other services because they’re now included in TurboTax.

While the majority of TurboTax customers prepare just one return, we understand this is a change for some of you. Another option is to try the TurboTax Online Free Edition which is ideal for simple returns (like your kids or elderly parent or family member) and offers free federal tax preparation, e-filing and printing.

Add it up and Intuit could have a few problems on its hands because its two most profitable quarters ride on the back of TurboTax. The folks that are doing the most complaining are the ones that bought TurboTax right out of the gate. The rest of us haven't even pondered preparing our taxes yet. What happens when the rest of the TurboTax gang discovers this pay per print feature?