Legg Mason takes Yahoo's side vs. Icahn; Yang takes campaign to home page

Updated: Yahoo's argument that billionaire investor Carl Icahn is a short-timer with no clear plan to run the company has won over a key investor: Legg Mason. In addition, Yahoo CEO Jerry Yang is taking the company's campaign to its home page.

In a broadcast to employees today, Yang said the company will be aggregating its own audience to blast Icahn's plan. Here's a partial transcript of Yang's video, which was posted on the company's intranet and filed with the SEC.

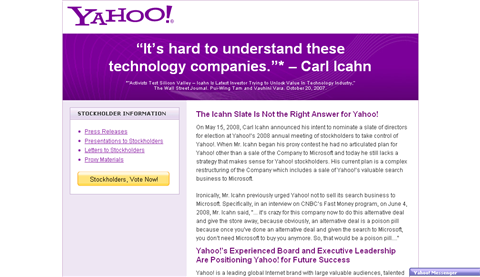

The Board, the senior leadership team, and I have been visiting with stockholders and financial industry analysts to articulate the continuing efforts to maximize the value of Yahoo!. You’ve also probably seen the letters we’ve sent to our stockholders outlining why we believe our current Board can best represent the interests of all stockholders, and that the Icahn/Microsoft agenda threatens to destroy stockholder value. We’ve also increasingly seen stories in the media that reflect an understanding of our position. Today, I’m excited to tell you that we’re launching an advertising campaign online on our homepage as a way to continue to make our case to stockholders. With one of the largest audiences on the Internet, we’re taking full advantage of the power of our network to remind our stockholders why voting for Carl Icahn’s board of directors is a bad choice.

What you're seeing here is that Yahoo is getting much better at communicating its side of the story. So far it's working.

Legg Mason said Friday that it will vote for Yahoo's slate of directors. Legg Mason owns 60.7 million shares, or 4.4 percent of the outstanding shares. However, there is a catch. Legg Mason said Icahn and Yahoo should cut a deal to avoid a proxy fight. In a statement, Legg Mason said:

We have met with representatives of the current Board and management, including founder Jerry Yang, several times. We believe the current Board acted with care and diligence when evaluating Microsoft's offers. We believe the Board is independent and focused on value creation for long-term shareholders.

In general, we believe it is appropriate for large shareholders to have representation on corporate boards if they so desire. Mr. Icahn's slate includes people experienced in technology, advertising, capital markets and governance. We would prefer that the company and Mr. Icahn reach a mutual agreement on the composition of the Board and end this disruptive proxy contest.

Legg Mason also noted that if Microsoft offered a good deal that Yahoo's board would take it.